Sourcing the right 1/8 36×36 carbon steel plates can be tricky. Buyers in the US, Europe, India, and the Middle East face different challenges: quality standards, price shifts, delivery delays, and supplier trust. The global steel market is vast – for example, worldsteel reports Asia/Oceania alone produced ~1,358 Mt of crude steel in 2024, versus about 106 Mt in North America and 130 Mt in the EU. This means plenty of material exists, but regional differences matter. In this guide, we outline common problems, solutions, and a real-world case study to help you source 1/8 36×36 Carbon Steel Plates confidently.

Understanding the Specs (1/8″ 36×36 Plate)

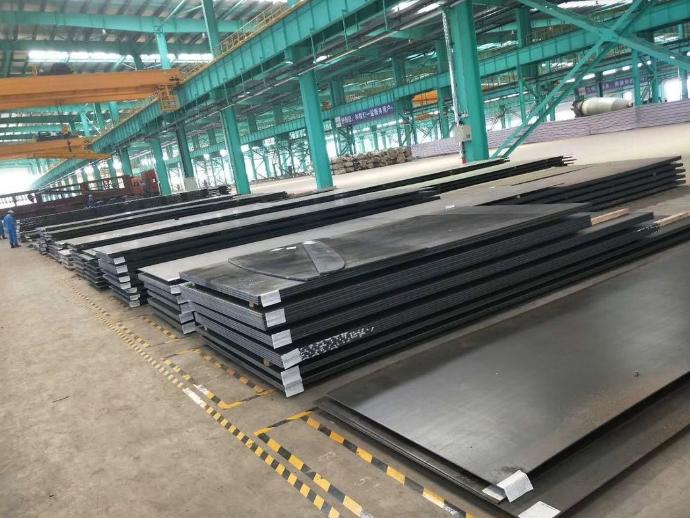

First, be clear on what “1/8 36×36 Carbon Steel Plates” means. This is a hot-rolled carbon steel sheet (about 3.2 mm thick) cut to a 36″×36″ (914×914 mm) size. In practice it’s often called a mild steel plate (common grade ASTM A36) used for structural parts, jigs, or enclosures. The “1/8” (0.125″) thickness is under typical plate thresholds, so suppliers may refer to it as sheet or light plate. Always specify the grade – e.g. “ASTM A36 or EN S275 carbon steel” – to ensure chemistry and strength. Demand is year-round, but price can vary: as of late 2024, US prices were around $1,126/ton while Europe was $929/ton. Use precise terms: say “1/8-inch thick 36×36 carbon steel plate” to avoid confusion.

Quality matters: check that the plate is hot rolled steel if that’s what you need (it will have a scaly surface). Beware vendors calling cold-rolled (coated, thinner sheets) a “plate.” Always ask for a Mill Test Certificate (MTC) confirming the steel meets ASTM A36 or equivalent. A real ASTM source notes: “This specification covers carbon structural steel shapes, plates, and bars… for general structural purposes” In short, you need a structural-grade carbon steel plate, not alloy or stainless steel.

Common Sourcing Challenges

Industrial buyers often face similar sourcing problems:

-

Quality Uncertainty: Suppliers vary widely. Some offer true ASTM A36 plates; others mislabel poor steel. Without inspection, you risk subpar metal.

-

Price Volatility: Global steel prices fluctuate. Tariffs, currency swings, and freight costs affect quotes. For example, an importer in India may pay different rates than a US buyer.

-

Logistics & Lead Time: Plates are heavy and bulky. Long shipping routes (especially offshore) add cost and delay. A long delay can cripple production schedules.

-

Supplier Trust: Unknown vendors (especially overseas) can be scams. Verifying legitimacy is crucial.

These issues can be worse if you only focus on price. Problem: an entry-level buyer might pick the lowest quote from a distant Chinese mill. Consequence: the plates arrive late, warped, or off-spec. Solution: use trusted channels (see below) and always verify certifications.

For example, freight is a key cost driver. As AZoM notes, “if the plate needed by customers is available at a location close to them, receiving the steel plate rapidly and cost-effectively is quite achievable” In other words, ask suppliers “where is this shipping from?” before ordering.

Make sure to adapt these general points to your region. In the US/EU you might lean on local distributors; in India or the Middle East you might find local mills or regional hubs. Below we compare sourcing options and offer a step-by-step guide.

Domestic vs Offshore Sourcing (Comparison Table)

Choosing a domestic (local) supplier versus an offshore one is a key decision. The table below contrasts both:

| Factor | Domestic Supplier | Offshore Supplier |

|---|---|---|

| Lead Time | Shorter (ships by truck/rail) | Longer (ocean freight and customs) |

| Unit Cost | Often higher steel unit price | Lower material price but higher freight |

| Quality Control | Easier inspection (same country, language) | Harder to verify on-site (rely on MTC) |

| Communication | Local language/time zone, quicker response | Time zones differ, potential language gap |

| Minimum Order | Smaller MOQs possible (stock items available) | Usually larger MOQs (to offset shipping) |

| Payment/Currency | Local currency, simpler payment terms | Currency risk, letters of credit common |

Domestic sourcing can reduce risks (shorter lead times, local recourse) but often costs more per ton. Offshore (Asia, Middle East) suppliers may quote ~10–30% lower price, but you must add freight and wait longer. For example, a US buyer might pay a bit more for “Made in USA ASTM A36” plates to avoid import hassles. Use this table to weigh trade-offs in your situation.

Step-by-Step Sourcing Guide

To tackle the problem systematically, follow these steps:

-

Define Specifications Clearly. Confirm thickness (1/8″), dimensions (36×36″), grade (e.g. ASTM A36 or EN 10025 S275), and any finish or coating required. List exact tolerances. This avoids confusion.

-

Research Potential Suppliers. Search industry platforms. For North America, use ThomasNet or domestic distributor networks. In Europe, try Europages or local steel stockists. In India, check IndiaMART or SteelAuthority sites. For global options, consider Alibaba/GlobalSources for factories, or specialized portals like SteelOrbis. Verify that listed sellers handle carbon steel plates.

-

Request Quotes & Samples. Send RFQs to multiple vendors (domestic and offshore). Include your spec sheet and ask for: price per plate/ton, lead time, and minimum order quantity. Importantly, request a Mill Test Certificate and, if possible, a small sample piece. Evaluate sample for dimensions and surface. If the supplier can provide an online quote portal (like Leeco Pro for US buyers) that’s even better.

-

Verify Supplier Credentials. Check trust indicators: does the supplier have ISO 9001 certification? How long have they been in business? As AZoM advises, “check ISO 9001, years in business, and customer references” when vetting steel suppliers. For example, a supplier holding ISO or CE marks for steel implies they maintain quality systems. Ask for references or online reviews. For overseas firms, check if they export to your region and confirm their trade licensing.

-

Compare Quotes and Terms. Don’t look at price alone. Include shipping costs, customs duties, and payment terms. Often a low quote offshore might nullify savings once import fees apply. If possible, negotiate with suppliers based on volumes. Also, confirm incoterms (e.g. FOB vs CIF). Reputable suppliers usually handle or arrange freight; clarify this early as shipping can be a major cost factor.

-

Place a Sample or Trial Order. For a first-time offshore order, consider a smaller trial shipment. Inspect that batch closely on arrival: check thickness, flatness, and chemical certification. This step helps catch any mismatch before a full order.

-

Finalize Purchase Order. Once satisfied, issue the official PO. Include all specs and terms: delivery date, total quantity, price, and quality standards. Schedule the shipping and track the order. Ensure you have a plan for unloading and storage (plates can rust if left outside).

By following this guide, you systematically address the “problem” of vague sourcing and implement the “solution” of thorough vetting and planning.

Case Study: Sourcing 1/8 36×36 Plates in Practice

Last year I needed a batch of 1/8-inch 36×36 carbon steel plates for a custom machine frame. Initially, I tried a local metal supplier in my region (Midwest USA). Their price was high, but delivery was fast. To double-check, I also reached out overseas via an online platform to a Chinese mill. Their quote was 20% cheaper, but the lead time was 8 weeks and shipping cost was significant.

I followed my own steps: I asked both vendors for ASTM A36 test certificates. The local supplier had ISO 9001 and 10-year history; the overseas vendor had good reviews online but no formal ISO certificate (although he did provide an inspection report). I ordered one domestic plate first – it fit perfectly and matched the A36 spec. Meanwhile, I arranged a small import trial of 50 plates via the Chinese mill. That shipment took 10 weeks total (including customs), but arrived on time.

In the end, mixing sources worked best. I bought 60% of the order from the domestic distributor (to start production immediately) and 40% from the offshore plant (to save costs in volume). This hybrid approach cut overall cost by about 15% and avoided a single point of failure. Through the process I learned to verify certification and factor in freight early. If I had only chased the lowest price, we would have hit delays.

My experience reinforces the solution steps above: clearly specify ASTM A36 carbon steel sheet requirements, get sample plates, and split orders if needed. It also shows how real buyers (like myself) navigate sourcing – by combining local speed with offshore value, while using data (certs, reviews) to minimize risk.

⚠ Common Mistakes (Warning): Don’t skip verifying specs or quality. Avoid choosing purely by price or ignoring shipping time. Always factor in freight/customs. For example, some buyers make the error of importing “cheap” plates without checking ASTM/EN certificates – those plates can fail strength tests. Always request and review material certificates, and don’t overlook insurance or freight costs which can turn a bargain into a loss.

Sourcing Checklist

-

Define Plate Requirements: Thickness, 36×36″ size, carbon steel grade (ASTM A36 or equivalent), surface finish.

-

Request Certifications: Insist on Mill Test Certificate for each batch. Verify ASTM/EN grade.

-

Vet Suppliers: Check ISO 9001, business years, references. Use reputable platforms (e.g. ThomasNet, IndiaMART).

-

Compare Total Costs: Include unit price, shipping, duties, and lead time.

-

Order Samples: Always test a sample or small lot before full buy.

-

Plan Logistics: Confirm who handles freight and delivery details.

-

Document Agreements: Ensure PO covers specs, quantity, quality, and delivery terms.

-

Maintain Communication: Track the order and stay in touch with the supplier until delivery.

By following these steps and tips, industrial buyers and small businesses can source 1/8 36×36 carbon steel plates more effectively in 2025. The right preparation – clear specs, trusted suppliers, and awareness of regional factors – is the solution to the sourcing problem for steel plate materials.

Sources: Worldsteel reports on 2024 regional steel production; industry pricing analysis; and AZoM sourcing guide insights.