In 2025 the market for ASTM A871 high-strength, weathering structural plate shows clear regional spreads: typical spot-equivalent HRC/plate prices run roughly $430–$480 / t (FOB China), $600–$650 / t (India spot mid-2025), €540–€610 / t (Western Europe ex-works) and $900–$1,000 / t (U.S. domestic quoted levels) — with ASTM A871 finished plate commonly carrying a small premium over basic HRC because of qualification, testing and weathering alloy additions. These ranges are driven by local mill offers, currency moves, shipping, and trade policy.

1) What ASTM A871 covers?

ASTM A871/A871M is the standard for high-strength, low-alloy structural steel plates that have improved atmospheric corrosion resistance (weathering steel) and are intended mainly for tubular structures and poles. The standard defines grades (commonly Grade 60 and Grade 65), delivery conditions (as-rolled, normalized, or quenched & tempered when required), and chemical/mechanical acceptance criteria used in production and testing. This is the authoritative spec page for quick reference.

2) Why A871 typically costs more than plain carbon plate?

-

Alloy additions. Weathering properties require controlled additions (Cu, Cr, Ni, sometimes Mo or Nb) that raise melt cost.

-

Tight process control. Mills must meet fine-grain practice and specific heat treatments to hit toughness and strength targets; this increases conversion cost.

-

Qualification testing. Charpy impact testing and occasional corrosion index testing add laboratory & inspection costs.

-

Lower volumes (niche end-use). Demand for pole/tubular plate is smaller than general structural plate, so unit overheads are higher.

-

Traceability & certification. Buyers who need mill test certificates, NDT, and traceability pay more.

These items together explain why an A871 plate invoice may be some tens to a few hundred dollars per tonne above a commodity HRC price in a given week.

3) Typical chemical & mechanical grades

ASTM A871 commonly appears in Grade 60 and Grade 65. Key buyer points:

-

Yield / tensile: Grade 60 has minimum yield ~60 ksi, Grade 65 ~65 ksi (imperial notation). These mechanical thresholds influence rolling practice and heat treatment.

-

Chemical variants (Types I–IV): The standard allows several composition types (slight shifts in C, Mn, Si, Cu, Cr, Ni, small microalloy elements). Variants with higher Cu/Ni/Cr to boost weathering cost more.

-

Delivery condition: As-rolled is cheapest; normalized or quenched & tempered increases cost due to additional thermal processing.

Procurement tip: specify grade + type + delivery condition in RFQ to avoid pricing surprises.

4) How plate size, thickness and finish affect price

-

Thickness: heavier plates cost more per tonne for transport but unit price per tonne may be slightly lower for thicker plates due to lower cutting/processing overhead; however plate beyond mill standard widths/lengths often incurs re-rolling or special cutting charges.

-

Widths and cut-to-length: non-standard lengths or heavy edge-trim add per-ton surcharges.

-

Finish & shot-blasting/painting: weathering plates are sometimes supplied bare, but if buyer requests blasted/primed finish that is an additional service.

-

Certification and testing: if purchaser demands extra Charpy positions, PMI, or third-party inspection, expect per-heat test fees.

5) 2025 — Global price snapshot

Method and caveat: the table below synthesizes public price indices for hot-rolled coil (HRC) and mill offers in 2025, then applies a conservative premium to reflect finished ASTM A871 plate qualification and processing. Prices are weekly/spot indicators from price reporting services and mill notices; they should be used for budgeting and negotiation rather than firm contract terms. Sources are cited after the table.

| Region / basis | Representative mid-2025 index (HRC or local flat) | Typical A871 finished plate price (est.) |

|---|---|---|

| China — FOB domestic mill / spot | 3,252 CNY/t HRC index (Aug 13, 2025 reading) | ≈ $430–$480 / t (FOB China after conversion; mill offers often sit in this band for plain grades; finished A871 adds small premium). |

| India — ex-works / domestic | HRC range $600–$650 / t (June 2025 region reports; variable) | ≈ $620–$700 / t (domestic A871 plate typically priced above HRC due to processing & testing). |

| Western Europe — ex-works | HRC offers ~€540–€610 / t (summer 2025 index movements) | ≈ €580–€680 / t (finished A871 plate; depends on local mill and alloy content). |

| United States — domestic mill / spot | Benchmark HRC around $840–$975 / t (index and major mill notices, mid-2025) | ≈ $900–$1,050 / t (finished plate for structural A871; U.S. domestic pricing is higher due to capacity & trade measures). |

| Middle East (UAE / GCC) — local ex-works | Local offers and emirates mill points show rebar/plate in the range $650–$800 / t equivalent | ≈ $700–$850 / t (finished A871 plate depends on local mill or import parity). |

Note: the U.S. domestic band is affected by recent tariff developments and mill base price announcements; China remains lower on a per-ton basis thanks to export pricing and scale, although ocean freight and any anti-dumping duties change landed cost materially.

6) Supply-chain, currency and policy factors shaping prices in 2025

Short items — each a tight paragraph:

-

Tariffs & trade measures. New or increased tariffs on imported steel (announced in 2025) raised U.S. landed costs and caused trade flows to redirect, which put upward pressure on North American domestic indices. Procurement teams should model tariff scenarios into landed cost.

-

Chinese output & domestic demand. China’s domestic property slowdown and capacity adjustments have created erratic export pressure and price volatility; cheap Chinese cargoes continue to challenge third-country markets.

-

Currency moves. Exchange-rate swings (e.g., CNY ↔ USD) matter for FOB/FOB-converted quotes. In August 2025 1 CNY ≈ $0.139 (≈7.18 CNY per USD) which materially changes USD-reported Chinese prices week-to-week. Always check the FX date used in any RFQ.

-

Freight & fuel. Ocean freight and booking tightness can add $20–$80/t to delivered prices depending on route and container vs. bulk ship. Surcharges and port congestion remain risks.

-

Input costs. Iron ore and coke prices are volatile. When raw material indexes climb quickly, mills lift offers within days. Price reporting services (SteelBenchmarker / MEPS / CRU) capture this near-real time.

7) Practical sourcing checklist

-

Specify full ASTM call-out: “ASTM A871/A871M, Grade 65, Type II (or chosen Type), normalized” — no ambiguity.

-

Demand mill test certs (MTC) + Charpy positions required and indicate acceptance levels.

-

Ask for FOB and CIF breakdowns with freight, insurance, and any local duties separated.

-

Request lead-time and available stock list (mill stock/ready slabs reduce lead time).

-

Compare landed cost, not just FOB — include tariffs, inland trucking and port fees in buyer’s model.

-

Use a short test order (1–2 truckloads) before long contracts when testing a new mill/supplier.

8) Why consider Luokaiwei (practical vendor notes for buyers)

-

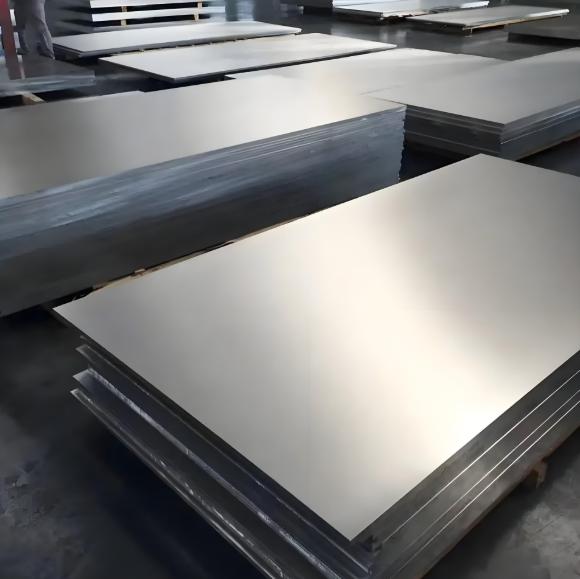

Factory pricing advantage: A Chinese mill like Luokaiwei typically offers factory (ex-works) prices that are lower than many western mills because of scale and lower conversion cost. That can be decisive for large structural programs.

-

Custom services: Luokaiwei supports custom plate sizes, special edge trimming, and expedited cut-to-length from stock for fast delivery on standard grades.

-

Inventory and delivery: For stocked items (common thicknesses / grades) Chinese mills often dispatch faster from inventory than international lead-time on new production—helpful for urgent projects.

-

Certification & export experience: Established exporters can supply full MTCs, test reports, and handle export packing/inspection to meet international buyer needs.

Buyer practical note: always request pre-shipment inspection and sample Charpy reports if weathering performance is critical.

9) Sample commercial terms and realistic delivery expectations

-

Payment terms: typical is 30% T/T deposit, 70% against copy of B/L, or LC at sight for first orders. Negotiate Net terms after established trade.

-

Lead times: from stock — 2–6 weeks door-to-dock (depending on destination). From production — 6–12 weeks depending on mill backlog, thickness and heat treatment requirements.

-

Packing: export standard wooden crates or bundle blocking + steel strapping; heavy plates require lashings and dunnage for sea freight.

-

Quality inspection: third-party inspection (BV, SGS, Intertek) is common; include in RFQ if needed.

10) FAQs

Q1 — Is ASTM A871 the same as Corten?

No. “Corten” is a trade name historically used for certain weathering steels; ASTM A871 is the formal standard that covers high-strength weathering steel plates for structural use. Some A871 compositions overlap with common weathering steels used under other names, but always call the ASTM spec in contracts.

Q2 — How much premium should I budget for A871 versus plain HRC?

Expect a conservative premium of $20–$120 / t over a commodity HRC number for finished A871 plate depending on alloy content, testing intensity and post-rolling treatments. Use the table earlier in this article for regional landed proxies.

Q3 — Can you get A871 plate galvanized?

Yes, plates can be hot-dip galvanized, but galvanizing changes surface appearance and may alter intended weathering behaviour; if atmospheric corrosion resistance through patina formation is the goal, consult the design engineer before galvanizing.

Q4 — Which tests should I insist on?

Minimum: chemical analysis per heat, tensile test, yield & elongation, Charpy V-notch (temperature specified), and full MTC. For critical projects add PMI and NDT where required.

Q5 — How should I compare supplier quotes?

Compare landed cost per tonne, not just FOB. Break out: mill price, processing premium, test & inspection fees, packing, freight, insurance, duties, and inland delivery. Ask suppliers for serial number references and recent MTC samples to verify capability.