For most industrial buyers in 2025, AISI/SAE 4130 (chromoly) pipe will cost substantially more than commodity mild-steel pipe because of alloy content, tighter mechanical tolerances, and finishing/heat-treatment steps. Typical finished 4130 mechanical tubing prices today range from a few hundred USD per tonne at some Chinese wholesale listings up to about $8,000–$18,000 per tonne (finished, small-quantity retail tubing) in North American/European retail channels depending on size and processing. Large-volume OEM buys from Chinese mills or contract manufacturers — especially when buying standard lengths with minimal finishing — will get the lowest landed costs. For urgent or certified flight- or pressure-rated material, expect premium pricing and longer lead times.

What is 4130 alloy steel

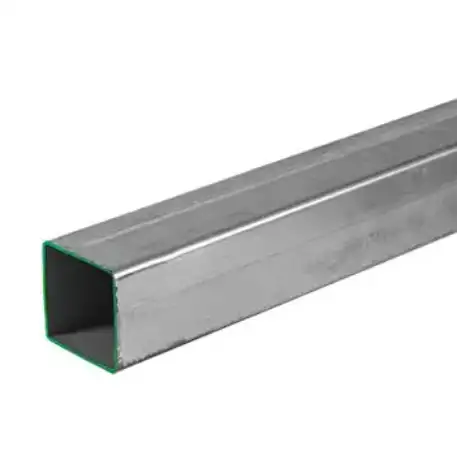

4130 is a chromium-molybdenum low-alloy steel (often called “chromoly”) with nominal chemical composition in the neighborhood of 0.28–0.33% carbon, ~0.8–1.1% chromium, and ~0.15–0.25% molybdenum plus small amounts of Mn, Si and trace elements. That alloy mix gives 4130 higher strength, better hardenability, and superior toughness compared with plain carbon steels of similar carbon content — while still keeping good weldability and reasonable machinability. These attributes make it a mainstay in mechanical tubing, aerospace structures, roll cages, shafts and hydraulic components.

Common standards and specifications that apply to 4130 pipe and tubing

When buying 4130 pipe or mechanical tubing, buyers most commonly reference:

-

ASTM A519 / ASME SA519 — mechanical seamless/cold-finished tubing (covers 4130 and similar grades).

-

ASTM A513 — welded carbon and alloy steel mechanical tubing (used for welded styles).

-

Customer or industry specifications for pressure/vacuum or aerospace use (NADCAP, AMS standards, or AMS/BMS heat-treatment and hardness calls) increase cost.

Always confirm which specification the end-use requires because certifications add inspection, traceability paperwork, and sometimes extra processing — all of which raise the price.

Mechanical properties and heat treatment

Depending on the condition (normalized, annealed, quenched & tempered), 4130 tensile strength and yield vary widely. In normalized or annealed condition it is fairly ductile and easy to machine/weld; after quench and temper it attains high strength and hardness suitable for highly loaded structural parts. These heat-treatment operations (quench oil, temper ovens, stress relief) add processing time, capacity constraints, and QA steps — all directly reflected in unit price. Typical roadmaps and numbers are published in MatWeb / ASM technical data sheets.

Manufacturing routes: how pipe form and finish changes price

Primary manufacturing routes for 4130 pipe / tube:

-

Seamless hot-finished → cold-drawn mechanical tubing (CDS): higher tooling cost, tighter dimensional tolerances, preferred for high-stress/pressure uses.

-

Electric-resistance welded (ERW) or welded + cold-finished: cheaper for larger diameters or where defect tolerance is higher.

-

Precision cold-drawn and honed: premium finishing for hydraulic, bearing, or aerospace applications.

Every additional finishing operation (straightening, cold draw, hardening, honing, non-destructive testing, shot peen, plating) multiplies total cost.

Main cost drivers that make 4130 pipe more expensive than mild steel

When determining price, we separate raw-material and processing drivers:

-

Alloying cost — Cr and Mo content make base ingots/billets slightly more expensive than plain carbon feedstock.

-

Steel mill product mix — quantity of alloyed melt, special chemical controls, and mill scheduling.

-

Processing steps — hot forming, cold finishing, heat treatment, testing, and certification.

-

Dimensional tolerance and straightness — precision tube is priced higher.

-

Inspection & traceability — mill test reports (MTRs), ultrasonic or eddy current testing, and special certifications add cost.

-

Volume, packaging, and logistics — small orders have higher per-unit freight and handling.

-

Currency & macro factors — scrap prices, energy, and freight volatility directly influence prices in 2025.

2025 price snapshot

Below we synthesize publicly available quotes and retail listings observed in 2025 (examples are illustrative, not contractual quotes). There is a wide spread because retail catalogs sell cut pieces, while Chinese mill listings often show bulk-ton prices.

-

China (wholesale / mill listings): some manufacturers list 4130 tube/pipe in ranges from ~US$500/ton up to US$2,400+/ton depending on size, finish, and minimum order. These low numbers commonly reflect large-volume, unfinished, hot-rolled products or incomplete quotations (no heat-treatment, basic inspection). Use care — extremely low prices may lack required documentation or be for mixed/low-grade stock.

-

Europe / India wholesalers: ranges vary; some brokers list mid-range prices between US$1,200–US$3,000/ton for standard mechanical tubing, depending on lot size and testing level. (regional industrial reports mirror steel feedstock volatility).

-

North American retail/finished tubing: small-quantity retail listings (cut lengths and precision tubing) show per-foot prices that convert to several thousand to ~US$16,000+ per tonne for small lots because retail price is per piece with high service cost. Example retailers (Onlinemetals, Wicks, MK Metal) show per-piece prices that imply high per-ton figures for finished 4130 tubes.

Remember: raw-steel spot prices (hot-rolled coil, scrap, etc.) set the base but finished tubular products include processing and value-add premiums that can be many times the base raw price.

Global price comparison (concise table)

Units: USD / metric tonne. These are indicative ranges observed publicly in 2025 for finished 4130 pipe/tube or comparable offers. Always request an MTR and fully specified quotation.

| Region / Channel | Typical price range (USD / tonne) | Typical order size & notes |

|---|---|---|

| China — large mill / FOB (basic, bulk, unfinished) | $500 – $2,500 | 5–25+ tonne MOQs; prices vary by finish and documentation; very low quotes often exclude heat-treatment and testing. |

| India — merchant/wholesale | $1,000 – $3,000 | Regional supply + domestic logistics; price responsive to scrap and HRC. |

| USA — retail / cut lengths (small qty) | $6,000 – $18,000+ | Per-piece retail for precision chromoly tubes (small orders). Conversion from per-ft retail listings. |

| Europe — distributor (finished & certified) | $3,000 – $9,000 | Includes added inspection, customs, and tighter tolerances. |

| OEM contract (long term, China factory direct like Luokaiwei) | $900 – $2,200 | Best landed unit price when buying direct, large volumes, and accepting standard mill MTRs. (Our typical factory quotes fall here.) |

(Notes: ranges overlap; retail per-piece numbers convert poorly to per-ton because finished tube weight varies by size. Always request full spec: OD, ID, wall thickness, length, condition, MTR, testing, packing, and incoterm.)

Why the quoted ranges are so wide

Three simple truths explain the spread:

-

Unit of sale is critical. A 20 ft finished 1.5″ OD radius-cold-drawn tube sold per piece at a specialty shop includes cutting, inventory, and service margins — much higher per-ton than direct mill FOB.

-

Specification increases cost non-linearly. Add heat treatment, hardness testing, full MTR traceability, NDT, and the price jumps. Aerospace or pressure-vessel specs can double or triple basic mill pricing.

-

Market cycle & feedstock volatility. Scrap, alloy costs (Cr, Mo), energy, and freight cause swings during 2024–2025; the level of processing magnifies those swings.

2025 market drivers affecting 4130 pricing

-

Steel feedstock (scrap, HRC) pricing: rising raw prices lift downstream mills’ offer prices.

-

Alloying element costs: chromium and molybdenum availability & price spikes add unit cost.

-

Energy and furnace capacity: energy costs influence heat treatment throughput and therefore price.

-

Freight & logistic bottlenecks: ocean freight and container availability cause landed-cost variance.

-

Tariffs & trade policy: sudden duties or anti-dumping measures change landed costs overnight.

-

Certification demand (aerospace/defense): buyers needing NADCAP/AMS/qualified mills pay material premiums.

How to request a comparable, apples-to-apples quote

When you ask suppliers for prices, always include:

-

Material grade and exact specification (e.g., AISI 4130 per ASTM A519, normalized, quenched & tempered to X hardness).

-

Dimensions: OD, wall thickness, length tolerance, straightness, and surface finish.

-

Condition: normalized / annealed / quenched & tempered / cold-drawn.

-

Testing & certification: MTRs (EN 10204 3.1/3.2), hardness, U/T, NDT, PMI requirements.

-

Packing and delivery terms: FOB/CIF/DDP, palletizing, special packaging for export.

-

MOQ and lead time: specify urgent vs standard delivery.

-

Payment terms and incoterm.

Always ask suppliers to break down their quote: raw material cost, processing, testing, packaging, and freight. That lets you compare quotes line-by-line.

Buying strategy and negotiation tips

We recommend the following approaches:

-

For volume OEM buys: buy direct from a mill/manufacturer (factory price advantage). We (Luokaiwei) provide factory-direct pricing and can support long-term contracts that stabilize price and lead time.

-

For certified or small lots: use a reputable distributor who holds inventory, but expect a retail premium.

-

For prototypes: specify annealed condition (cheaper) initially, then refine to heat-treated production specs.

-

Bundle orders (same OD, different lengths) to amortize tooling and cutting cost.

-

Ask for alternative finishes (e.g., normalized vs quenched) — sometimes normalized will meet performance needs at lower cost.

-

Request sample MTRs and reference part numbers to validate supplier capability before placing a bulk order.

We emphasize that Luokaiwei offers: 100% factory pricing for many stock items, customization services (cut-to-length, special heat treatment), and rapid dispatch for stocked items — which helps lower landed procurement cost and lead time risk.

Example cost breakdown

Example item: 1″ OD × 0.120″ wall × 6 m (about 20 ft) 4130 cold-drawn, normalized tubing, small batch (qty: 100 pieces).

Approximate cost components for a North American buyer using factory-direct China supply (FOB Qingdao):

-

Mill base material & alloy premium: $600–$1,200 / tonne (portion allocated)

-

Cold drawing / straightening / cutting / packing: $300–$700 / tonne

-

Heat treatment (if requested) & QA: $200–$800 / tonne

-

Inspection / MTR / paperwork: $50–$200 / tonne

-

Ocean freight & insurance (FOB → CIF/landed): varies — $100–$500 / tonne depending on route.

-

Distributor/agent margin (if used): 5–25% on top.

Net result (factory FOB basis) for the above example often falls into the $900–$2,200 / tonne bracket for factory direct, but small orders or retail purchases in the USA will be substantially higher after cutting, handling and retailer margin. These numbers are directional — verify with firm quotations.

Quality and certification premiums: what adds

Expect to pay extra for formal certification:

-

Full traceability (3.1/3.2 MTR): adds lab time & paperwork.

-

NDT (UT/eddy/RT): required for pressure systems or safety-critical parts.

-

Heat-treatment records and controlled furnace cycles: necessary for aerospace – higher cost.

-

Material or process audits (e.g., supplier qualifications / NADCAP): large premium.

Unless you absolutely need these, avoid requesting every inspection step — but never compromise on what your application requires.

Logistics, storage and lead time impacts

-

Short lead times usually cost more because mills prioritize longer contracts.

-

Stocked items at local distributors are expensive but immediate.

-

Consolidated ocean shipments reduce per-unit freight dramatically for larger volumes.

-

Customs delays and documentation errors increase landed cost quickly — always pre-clear paperwork requirements.

Luokaiwei can provide consolidated shipments and experienced export documentation to help reduce delays.

Frequently Asked Questions

Q1 — Is 4130 the same as 4140 / 41xx steels?

Short answer: 4130 is part of the 41xx family (chromium-molybdenum steels). 4140 has slightly different chemistry (higher carbon and often higher strength) and behaves differently under heat treatment. Specify the exact grade required.

Q2 — Can 4130 pipe be welded easily?

Yes — 4130 is generally weldable in its annealed/normalized condition, but post-weld heat treatment may be needed for high-strength applications to avoid cracking. Discuss welding procedure specifications (WPS) with your fabricator.

Q3 — How much more will quenched & tempered 4130 cost vs annealed?

Quench & temper adds furnace time, QA and handling, so expect a 20–60% premium over annealed/normalized supply — more if strict hardness or certification is required. Actual premium varies by region and batch size.

Q4 — Is buying cheap Chinese 4130 risky?

Not necessarily — many reputable mills in China produce to ASTM and EN standards. The risk comes with vague quotes: low prices that omit MTRs, testing, or correct spec. Always request a complete specification, sample MTR and, if possible, a third-party inspection.

Q5 — How do I reduce cost without sacrificing performance?

Options: increase order quantity, accept standard mill conditions (normalized rather than fully heat-treated), request minimal required testing, or consolidate orders to reduce freight. Long-term contracts with a factory partner (like Luokaiwei) can yield the best per-unit economics.

How Luokaiwei can help

We are a China-based OEM and supplier of 4130 pipe and tubing. Our capabilities include custom OD/wall/length production, heat treatment, MTRs and export packing. For buyers who can commit to reasonable MOQs, we offer 100% factory price advantage, flexible customization, and fast delivery on stocked items. Contact us with your full spec and we will return a clear, itemized quote and MTR sample.

Practical next steps for a buyer

-

Prepare a detailed RFQ that lists spec, testing, and delivery expectations.

-

Ask for itemized pricing (raw material, processing, testing, packing, freight).

-

Request sample MTR and photos of similar shipments.

-

Compare at least three suppliers (one local distributor, one regional mill, one China factory).

-

If the part is safety-critical, consider 3rd-party inspection or lab testing.