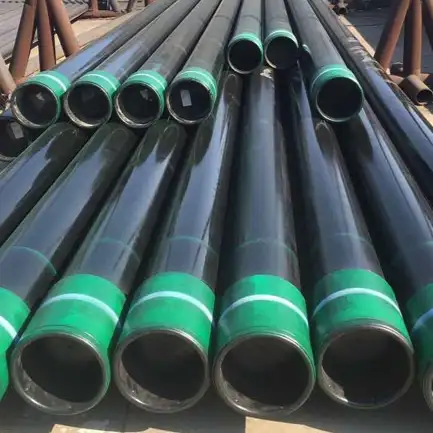

In 2025 the most realistic market band for API 5CT L80 casing and tubing is roughly USD 600–1,500 per metric ton depending on grade variant (L80-1 / L80-9Cr / L80-13Cr), connection type, surface treatment, quantity and certification. China factory/FOB offers the most competitive landed-factory numbers (often in the USD 600–900/ton area for basic L80), while Western markets commonly show higher landed costs because of certification, traceability and shipping premiums.

Quick market summary and 2025 headline drivers

-

Market band in 2025: USD ~600 to 1,500 / metric ton for L80 in typical OCTG offerings; narrow orders and premium alloys push the top end. This reflects supplier quotations, marketplace listings and recent OCTG price outlooks.

-

Short-term drivers for 2025 prices: global steel billet/coil prices, OCTG inventory levels, demand from drilling programs (deep / sour service), and freight/energy costs. Chinese mills’ capacity and fast turnaround keep factory-FOB offers lower; however, PSL/monogram and premium thread types add substantial premium.

What “API 5CT L80” means (concise technical summary)

API Specification 5CT is the industry standard for casing and tubing. L80 is a mid-to-high strength casing grade widely used where corrosion resistance and higher yield are required (including sour service zones when specified as a 9Cr or 13Cr variant). Minimum mechanical targets for generic L80 include yield ≈ 552 MPa and tensile ≥ 655 MPa, but purchaser orders must specify the exact L80 variant and acceptance testing. The API organization published the 11th edition of Spec 5CT and recent addenda that affect licensing and manufacture requirements (effective dates and monogram program updates occurred in 2024–2025).

L80 variants and why they change price

-

L80-1 (Type 1) — basic L80 chemistry; commonly the most economical L80 option.

-

L80-9Cr / L80-13Cr — chromium alloyed variants for enhanced corrosion/CO₂/H₂S resistance and higher wear life; alloying raises raw material cost and often requires distinct heat-treat flows and testing.

-

Connections & upset: BTC, STC, EUE, premium connections or upset ends increase machining, inspection and reject risk — add a premium.

Because 9Cr/13Cr grades contain more alloying elements and demand stricter heat treat and traceability, expect 20–40% price uplift versus Type-1 in comparable lot sizes (exact premium varies). (See supplier listings that separate L80 13Cr offers at higher USD/ton bands.)

How vendors quote OCTG (what the numbers represent)

-

Most common unit: USD per metric ton (FOB factory or FOB port). Purchasers must convert to per-joint, per-foot or per-meter for budgeting.

-

Other price items that change landed cost: thread make-up and thread inspection, coupling stock, anti-corrosion coating, hydrotest, third-party inspection, mill certificates vs API Monogram.

-

PSL / API Monogram / Addenda: Post-2023 API Spec updates and 2024–2025 addenda changed how some grades are licensed and how thread/monogram responsibilities are allocated — requiring purchasers to call out exact documentation needed (API Monogram vs internal QC). Missing or unclear spec items will create downstream price surprises.

2025 global price comparison (illustrative table)

Notes: These ranges are market snapshots compiled from published supplier listings, Chinese domestic reporting and OCTG market outlooks (prices vary by OD, wall, connection, quantity, and shipping terms). Use ranges as planning guidance — get firm quotations for tendering.

| Region / Basis | Typical USD per metric ton (2025, planning band) | Notes |

|---|---|---|

| China — factory / FOB (basic L80 Type-1) | USD 600–900 / t | Strong factory competition; large exporters supply worldwide; sample listings show many offers in this band. |

| India — domestic / FOB | USD 650–1,000 / t | Indian mills and traders publish similar bands; import parity and local forging/heat-treat capacity matter. |

| USA — domestic / distributor landed | USD 900–1,600 / t | Landed stocked product, API monogram and distributor margins push landed cost higher; premiums for quick delivery and certifications. Historical OCTG data shows notable regional premiums. |

| Europe — landed / certified | USD 900–1,500 / t | Small volumes, high regulatory & testing expectations; tends toward the upper half of the band. |

| Middle East (UAE / KSA) — import CIF | USD 800–1,400 / t | Strong local drilling demand, logistics cost, and preference for API-monogram product affect price. |

Interpretation: China keeps the lowest factory FOB numbers because of production scale and integrated supply chains; however, once certificates, premium threads and shipped/cif costs are included, the landed difference narrows. Always ask for price breakdown: base steel, heat treatment, threads, testing, inspection and packaging. Alibabahu-steel.com

Primary cost drivers (detailed)

-

Raw steel billets / scrap & global steel cycle — steel feedstock is the single largest input. Steel price swings quickly change OCTG quotes.

-

Alloy content (Cr for 9Cr/13Cr) — chromium and other alloying elements raise melt cost and require controlled heat treatment.

-

Heat treatment & testing — tempering/normalized cycles and hardness checks, CK-NDE, hydrostatic tests, PMI add cost. API 5CT addenda tighten these requirements.

-

Threading & coupling — machining to BTC or premium makes each joint more expensive; higher reject rates increase per-unit cost.

-

Certification & traceability — API Monogram, third-party inspection and mill paperwork increase price but reduce procurement risk.

-

Logistics, freight & tariffs — distance from mill to jobsite and shipping congestion / fuel surcharges add volatile costs.

Why buy from Chinese suppliers like Luokaiwei (practical procurement view)

-

Factory price advantage: integrated mills and high production volumes allow competitive FOB pricing. Sample market listings consistently show Chinese factory quotes in the low end of the 2025 band.

-

Customization & stock: Luokaiwei offers custom sizes, thread types and short-lead inventory for standard spec items — useful for projects that need quick turnarounds.

-

Document control & export experience: good Chinese OCTG exporters provide full mill certs, heat-treatment records and third-party inspection packages; ask for API Monogram status if necessary.

-

Cost-saving tactics when sourcing from China: request a price split (steel + processing + testing + packaging + freight), negotiate MOQ tiers, and request factory acceptance testing photos / NDT reports before shipment.

Practical note: If you require API Monogram or operator-specific QRS compliance (e.g., IOGP S-735 overlays), call that out up front — those orders will carry a premium and different lead times.

QC, inspection and documentation checklist (what to require in PO)

-

Complete mill test certificates (chemical + mechanical).

-

Heat-treatment records, hardness maps (especially for 9Cr/13Cr).

-

Hydrostatic test certificates and NDT (UT/MT) reports.

-

Thread gauge test certificates and connection acceptance documentation.

-

API Monogram (if required) and third-party inspection report (e.g., SGS, Intertek) or operator inspector sign-off.

-

Traceability per joint (heat number → joint).

Specifying these reduces surprises during acceptance.

Sample landed price calculation (worked example)

Scenario: 5″ (127 mm) L80 Type-1 casing, 10 tons FOB China quoted at USD 700/ton, CIF USA port adds freight & insurance USD 80/ton, inland transport & duty adds USD 120/ton, threading & coupling/processing adds USD 80/ton, third-party inspection USD 15/ton.

-

Base FOB: 700.00

-

Freight & insurance: 80.00

-

Duty / inland: 120.00

-

Processing (threads/couplings): 80.00

-

Inspection & docs: 15.00

Landed / metric ton = USD 995.00

If joint weight ~150 kg, per joint ≈ USD 149.25. This is an illustration — real numbers depend on the OD/WT, thread type, and local taxes. Use the supplier breakdown to check assumptions.

Best procurement practices for 2025 OCTG tenders

-

Tender by detailed specification (L80 variant, thread type, units, testing, packing, certificates). Generic “supply L80” causes bid variability.

-

Require explicit price splits (steel, processing, testing, packaging, freight) in the quote.

-

Ask for lot-by-lot or joint-level traceability.

-

If time-sensitive, accept stocked (surplus) OCTG but insist on full inspection and paper trail.

-

Validate supplier API license / monogram capability if you need monogrammed product.

FAQs

Q1: Is the factory price the same as the landed price?

No — factory (FOB) is only the mill price. Landed cost includes freight, insurance, customs/duty, inland haulage, processing and inspection. Always convert to landed cost for apples-to-apples comparison.

Q2: How much more does L80-13Cr cost vs L80 Type-1?

Expect a material and processing premium; ballpark +20–40% depending on chromium content, heat treatment, and demand. Request vendor chemistry sheets and separate alloy cost line items.

Q3: Do I always need API Monogram product?

Not always, but many operators require API Monogram certification as part of procurement QRs. If the operator/insurer or oil company specifies monogram, include it in the PO to avoid rejections.

Q4: What payment & incoterms shorten lead time?

Larger deposits, LC at sight and FOB with factory stock typically shorten lead times. For fastest delivery, buy from suppliers with inventory and ask for pre-inspected cargo.

Q5: Will steel price drops in mills always translate to cheaper OCTG?

Not immediately. OCTG manufacturing involves lead times, existing inventory and heat-treat capacity constraints; the pass-through depends on stock position and order size. Market reports advise monitoring both billet and OCTG spot availability.

How Luokaiwei (China) can help your 2025 tender

-

Factory pricing: Luokaiwei sources and manufactures OCTG with competitive mill integration to lower FOB.

-

Customization: we support special threads, upset ends, and 9Cr/13Cr chemistry per purchase order.

-

Fast stock delivery: standard L80 sizes kept in inventory for quick turnaround; small-lot support.

-

Documentation: full MTC, heat-treatment reports, NDT and third-party QC available on request.

If you want, Luokaiwei can produce a free pricing breakdown for a specified OD/WT/connection and provide sample test documentation for pre-qualification.

Limitations, caveats & next steps

-

The table and bands above are planning estimates based on supplier listings and market reports; OCTG pricing is very sensitive to OD/WT, thread type, quantity and certification. For procurement, obtain firm quotations with the full breakdown and update freight/insurance figures at the time of tender.