In 2025 the landed wholesale price of DX51D-based hot-dip galvanized coil used to make galvanized pipe is generally in the range USD $500–1,150 per metric ton, while finished galvanized pipe prices depend strongly on diameter, wall thickness and finish and typically range from ~USD $3–20 per foot (small diameters, retail) to ~USD $700–1,400 per metric ton for bulk welded/ERW pipe. For project quotations we recommend requesting firm mill or mill-direct offers because local freight, zinc coating weight (Z value), tariffs and steel base-price moves can change the landed number quickly.

What “DX51D” means and why it matters

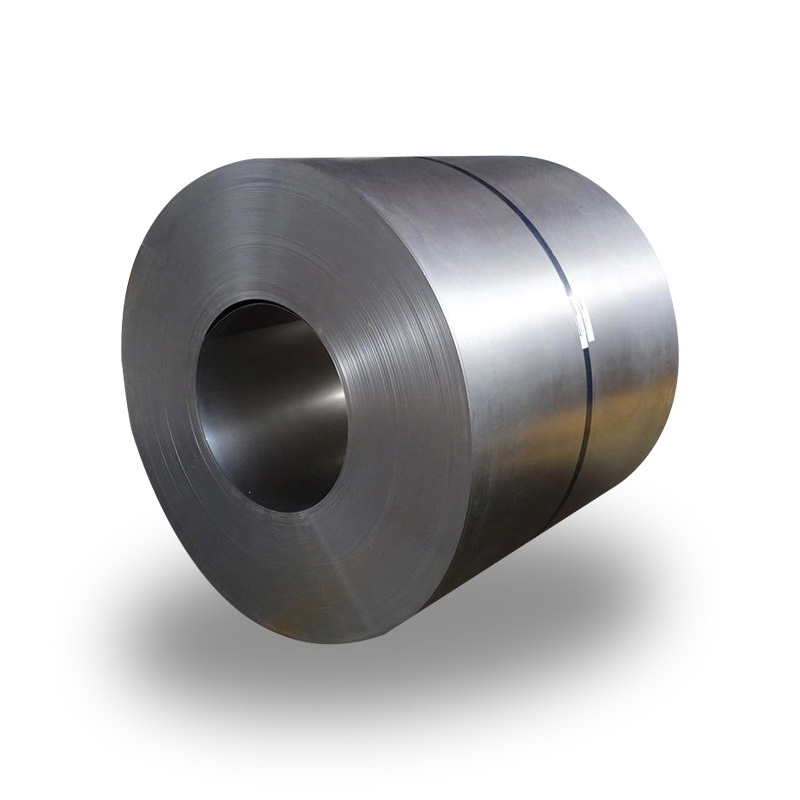

DX51D is a designation in the European EN 10346 family for continuously hot-dip coated low-carbon steels intended for cold forming. The grade identifies basic chemical and mechanical limits (low carbon, good formability) and is commonly supplied with zinc (Z), zinc-iron (ZF), zinc-aluminium (ZA) or other metallic coatings. Choosing DX51D as the substrate tells fabricators that the steel will form well for tubes and pipes and accept the galvanizing process reliably.

Why it matters for pipe buyers: DX51D is optimized for formability and coating adhesion. If you need deep drawing or extra high forming strength, other grades (DX52D, DX53D, etc.) may be used — but for structural and general purpose galvanized pipe, DX51D is a very common choice.

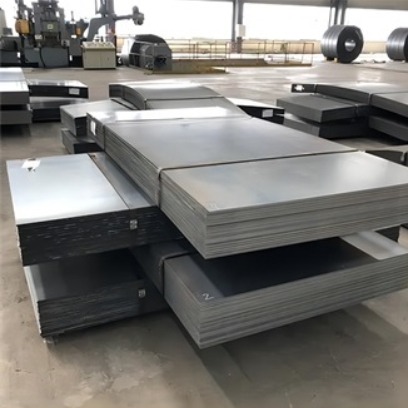

How galvanized pipe is made from DX51D coils

We summarize the common production flow so you know where costs arise:

-

DX51D coil purchase — hot-dipped galvanized coil (HDG) or GI coil is bought in coil form. The coil price and zinc coating weight (e.g., Z275 = 275 g/m² both sides) are primary cost inputs.

-

Slitting & forming — coil is slit to strip width for ERW or formed for seaming. Material utilization matters.

-

Welding (ERW) or seam welding — ERW welding adds equipment and QA costs; thicker walls and larger OD increase cost.

-

Post-processing — galvanizing after forming (hot-dip galvanizing) or precoated coils (GI): additional costs if pipe is post-galvanized or touch-up is required.

-

Inspection, packing and logistics — banding, anti-corrosion wrapping, and freight to buyer’s port/warehouse.

Each step adds margin and handling cost, so finished pipe per-ton price will typically be higher than raw coil price. Where the galvanizing step is done (coil vs pipe) also shifts price and lead time.

Key technical specs that drive price

Small changes in these parameters produce relatively large price swings:

-

Coating weight (Z-value): cataloged as Z60, Z100, Z275 etc. Heavier coatings cost more (more zinc), and for coastal projects buyers often specify higher Z to extend life.

-

Thickness (base steel): 0.5 mm vs 3.0 mm changes raw-material cost and forming/welding complexity.

-

Outer diameter & wall schedule: larger OD & heavier schedule = more steel per meter = higher price.

-

Surface finish and spangle: zero-spangle and passivation treatments add small premium for aesthetic or forming needs.

-

Standards & testing: EN/ASTM certification, third-party inspection and mill test reports increase cost but reduce commercial risk.

-

Quantity and packaging: MOQ and palletization affect effective price per unit.

When you compare quotations, always normalize to price per metric ton and price per meter (for the pipe size) — both metrics are used in trade.

Global price drivers in 2025

The main macro drivers in 2025 were:

-

Steel mill base price (hot-rolled coil, cold-rolled coil) — base sheet/coil prices rose in late-2024 and into 2025, driven by demand recovery in some regions and constrained supply in others. Market trackers showed HDG/CRC price bands in the $1,070–1,140/ton area in early 2025.

-

Zinc metal price — zinc is cyclical; higher zinc means higher galvanizing cost per tonne.

-

Freight & container cost — ocean freight volatility affects landed price for importers; inland trucking adds local variability.

-

Trade policy & duties — anti-dumping duties or quotas change landed cost by jurisdiction.

-

Local demand for pipe — construction booms or infrastructure projects in a region can tighten supply and lift local prices.

Because these drivers move independently, regional spreads exist and global sourcing can save money — provided you manage logistics, delivery risk and QC.

Typical 2025 price ranges — raw coil vs finished pipe

Notes: the figures below are representative ranges observed in 1H–2H 2025. Final contract prices depend on zinc coating, thickness, delivery term and volume. Sources shown in the right column. Prices are approximate and expressed in USD/metric ton for bulk; where retail or per-meter prices are typical we add per-meter or per-foot conversions.

| Region / product | Typical 2025 price (bulk, USD/ton) | Retail/finished guidance | Representative source |

|---|---|---|---|

| China — DX51D GI coil (factory / trading offers) | USD $450–850 / ton | Small batch coil offers as low as $500/ton on domestic B2B marketplaces; 1–50 ton MOQs affect unit cost. | Supplier listings and marketplaces. |

| Europe — HDG coil (market) | USD $1,000–1,200 / ton | Finished ERW galvanized pipe (bulk) ~ USD $800–1,400/ton depending on size & coating. | Market reports (industrial tubing & European mills). |

| USA — HDG / finished pipe | USD $1,000–1,200 / ton (coil-equivalent) | Retail galvanized pipe often sold per foot: ~USD $3–22 / foot depending on size and schedule; bulk users see $800–1,300/ton. | U.S. distributors & market intelligence. |

| India — finished GI pipe (domestic brands) | ~USD $600–1,000 / ton (local) | Small diameters sold per meter: INR 75–350/meter (2025 variability). Local mill lists from Jindal/Tata. | |

| Export, FOB China (DX51D pipe, bulk) | USD $700–1,050 / ton | Typical mid-range export price for welded GI pipe with Z275. Depends on order size & shipping. | China export listings and supplier quotes. |

Interpretation: China factory prices for DX51D coils and pipe are frequently lower in nominal USD/ton because Chinese suppliers sell direct from factory with lower freight to Chinese ports and variable (often lower) margins. European and U.S. finished prices commonly reflect higher labour, QA, certification and distribution costs. Use these bands only for early budgeting and always get updated quotations.

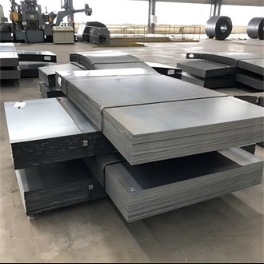

China: factory advantage & Luokaiwei’s offer

We operate manufacturing in China (Luokaiwei). There are structural reasons China often offers the lowest factory price:

-

Large integrated mills and local supply chains keep coil costs competitive.

-

Mills and trading factories can supply small to large MOQ with fast stocking programs.

-

Exporters offer EXW or FOB that cut out domestic distributor margins.

About Luokaiwei (what we emphasize for buyers): we offer mill-sourced DX51D-based galvanized pipe with these selling points: 100% factory-price advantage (no middleman), customization (OD, wall thickness, Z value), stock items for immediate dispatch (for standard diameters), and optional third-party testing / MTRs. For international buyers we provide FOB, CIF and DDP options and can handle documentation, packing and sea freight.

Europe & UK snapshot

European producers and buyers prioritize certified supply chains and traceability under EN 10346 and EN pipe standards. End users requesting EN compliance and high coating classes often pay a premium. Markets in 2025 saw higher HDG coil base values than some Asian suppliers, and inland logistics (truck, rail) plus local wages push finished pipe prices up relative to offshore imports. For structural projects where standards, warranty and short supply chains matter, buyers often accept the premium.

USA snapshot — retail vs wholesale

In the U.S., galvanized pipe is commonly stocked by distributors and sold by the foot for plumbing/construction retail or by metric ton for larger fabrications. Distributor pricing includes cutting, threading and local delivery fees, which explains the wide per-foot retail band. For industrial purchases, buyers rely on mill test reports, material certificates and often preference domestic mills to avoid anti-dumping exposure. Market trackers in early 2025 showed coil/HDG price bands in the $1,000+ /ton range.

India & South Asia snapshot

India maintains substantial domestic GI pipe production (Jindal, Tata and regional mills). Quoted retail/meter prices tend to be lower in INR terms for small diameters, but conversion to USD/ton depends on local taxation, GST, and logistics. Indian mills publish price lists (per meter/ per kg) which are useful for quick domestic tendering.

How to read quotations — buyer checklist

When comparing quotes, make sure each quote clearly states the following:

-

Material grade: DX51D (or DX51D+Z, +ZF, etc.) and the standard (EN 10346).

-

Zinc coating weight or designation (e.g., Z275 = 275 g/m² both sides)

-

Dimensions — OD, wall thickness (mm), length (m) or coil width/thickness

-

Quantity and packaging — coil weight or pipe length per bundle

-

Terms — EXW, FOB, CIF or DDP (incoterm) — ensure freight and insurance allocation is clear

-

Lead time and inspection — third-party inspection, mill test reports and warranty period

-

Payment terms — L/C, T/T, etc.

We always suggest normalizing quotes into USD/metric ton delivered and USD per meter for each exact pipe size to compare apples to apples.

Quality, testing and standards to request

Minimum checks to insist on:

-

Material certificate (MTR / EN 10204 3.1 or 2.2) — chemical and mechanical results.

-

Coating test — confirm zinc weight (g/m²) and uniformity.

-

Dimensional checks — OD, wall thickness tolerance.

-

Weld integrity & non-destructive testing for welded pipe (if critical).

-

Visual & packaging inspection before shipment.

The governing standard for continuous hot-dip metallic coated strip is EN 10346 (DX51D), and buyers should reference it in their purchase orders. Request manufacturers provide the relevant clause confirmations.

Lead times, stock & Luokaiwei’s customization capacity

Typical lead times (2025 landscape):

-

Stock items (standard OD & schedules) — shipped within 7–21 days from our factory stocks.

-

Custom sizes & special coating weights — 4–10 weeks (depending on mill scheduling and galvanizing line).

-

Large volume long runs — 6–12+ weeks when mills require batching and production slots.

At Luokaiwei we maintain a rotating stock of standard welded galvanized pipes and coils to shorten delivery for urgent orders. We also provide JIT packing and staged shipments for large projects.

Practical procurement strategies to control cost and risk

-

Buy coils instead of finished pipe when you have local forming capacity. Coil tends to be cheaper per tonne; forming domestically can save money if labour and equipment exist.

-

Lock zinc / steel price with short term agreements for multi-shipment projects to reduce volatility.

-

Specify allowable tolerances and acceptance tests to avoid disputes on arrival.

-

Split shipments to reduce storage carrying cost and to inspect small initial lots.

-

Work with a factory that offers third-party inspection so certification concerns don’t add delta-price later.

Five common misunderstandings and how to avoid them

-

“Price per foot equals price per ton” — it does not; smaller diameters have higher fabrication overhead per ton. Normalize.

-

“All ‘galvanized’ is the same” — coating weight and process (pre-galvanized coil vs post-galvanized pipe) change life expectancy and cost.

-

“Cheapest EXW from overseas is best” — hidden customs, duties, inland delivery and warranty management often negate nominal savings.

-

“DX51D is only for light use” — DX51D is a versatile forming grade used widely in structural and general pipe; match grade to forming and load needs.

-

“Price lists are fixed” — steel and zinc markets move; use price clauses for multi-shipment contracts.

FAQs

Q1 — What is the expected lifespan of DX51D galvanized pipe?

A: Lifespan depends on coating weight (Z value), environment and maintenance. In rural/indoor environments Z275 or higher with proper installation often lasts multiple decades. For coastal or industrial sites specify heavier coatings and periodic inspection.

Q2 — Should I buy pre-galvanized coil or pipe that’s post-galvanized?

A: Pre-galvanized coil (GI) offers consistent factory coating for forming; post-galvanized pipe gives deeper coating on weld seams but adds process cost. Choice depends on required coating uniformity and project tolerance.

Q3 — How do I convert coil price to pipe price?

A: Estimate using the steel mass per meter for your pipe size, add forming/welding cost, coating or touch-up cost, plus packing and freight. For rough budgeting add 15–40% margin to coil cost to approximate finished pipe price (varies significantly by region and size).

Q4 — Does DX51D meet ASTM standards?

A: DX51D is a European EN grade (EN 10346). ASTM grades use different nomenclature; many fabricators accept DX51D material for dimensions and properties but check mechanical/chemical limits against the applicable ASTM requirement for your application.

Q5 — How do I ensure consistent quality from an overseas supplier?

A: Require manufacturer MTRs (EN 10204), third-party inspection (SGS, BV), pre-shipment photos and sample testing. We at Luokaiwei offer sample packs, MTRs and welcome third-party inspection on request.

Practical next steps if you’re buying

-

Specify exact pipe size(s), wall thickness, coating weight (Z) and standard (EN/ASTM).

-

Ask for MTO: price per ton, price per meter for each size, MOQ, lead time and incoterm.

-

Request MTRs and confirm inspection scope.

-

Compare at least three quotes normalized to USD/ton landed and USD/meter for each size.

-

If you like, send your RFQ to us (Luokaiwei) — we will provide factory pricing, available stock options and customization services.