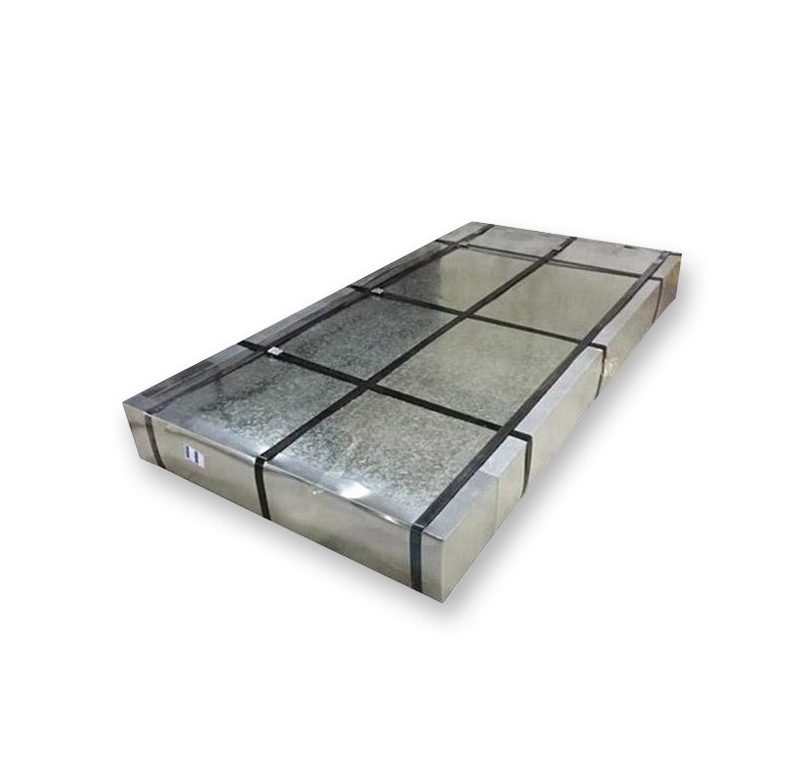

In 2025 the G90 galvanized sheet market shows regional price dispersion driven mainly by zinc (LME) moves, trade policy changes, and local supply dynamics — typical FOB mill ranges observed in H1–mid-2025 run roughly from ~US$480–700/ton (China / SE Asia) up to ~US$1,100–1,350/ton (North America / some European supply) for standard G90 coil/sheet. Buyers who lock volume with reputable mills and who source from factory suppliers in China can still achieve material cost advantages while managing lead-time and logistics risk.

What “G90” means

“G90” is a coating designation for zinc-coated (galvanized) steel that refers to the total zinc weight applied to both faces of the sheet: 0.90 oz/ft² (total both sides) according to common standards (ASTM A653/A653M labels and industry practice). In metric terms this is commonly equated with Z275 (≈275 g/m² total) or roughly ≈21–25 µm per side depending on measurement conventions and process. Always specify units (oz/ft² or g/m²) and whether the number is total or per side.

How G90 is produced — hot-dip vs electro processes

There are two mainstream coil/sheet galvanizing routes:

-

Hot-dip (continuous galvanizing line): steel strip passes through a molten zinc bath and forms iron–zinc alloy layers plus a nominal pure zinc outer layer. Hot-dip yields thicker coatings (G90 and higher) and is typical for building envelopes, roofing, decking and industrial panels.

-

Electro-galvanizing (EG): zinc is electrodeposited from an aqueous bath. EG gives thinner, more uniform coatings and is used when surface finish and tight thickness control matter (automotive inner parts, plated substrates). For G90 thicknesses hot-dip is the usual route.

Process choice affects surface finish, formability after coating, and cost.

Coating thickness, units and quick conversions

Common ways the industry expresses coating weight:

-

oz/ft² (imperial) — G90 = 0.90 oz/ft² (both sides).

-

g/m² (metric) — G90 ≈ 275 g/m² (total both sides) (hence Z275 nomenclature in some standards).

-

µm (microns) — approximate coating thickness per side for G90 is ~18–25 µm per side depending on whether you translate mass to thickness with assumed zinc density and coating morphology. Always accept a tolerance and request mill test certificates (MTCs).

Typical applications and why specifiers pick G90

We see G90 used where improved corrosion life is required vs lighter coatings: roofing deck, exterior cladding, outdoor ductwork, metal decking, cold-formed structural members, and some agricultural applications. G90 is a common minimum where moderate to severe exposure is expected or where long maintenance intervals are desired.

Advantages of specifying G90:

-

Higher sacrificial reserve of zinc (longer time to first maintenance)

-

Better cut-edge protection compared with G60 or G30

-

Wider acceptance in building codes and contractor procurement lists.

Price matters: think total cost, not just per-ton

When we assess “price” we must think beyond the immediate US$/ton figure. A lower unit price from a distant mill can be offset by:

-

Longer lead times and higher inventory carrying cost

-

Additional freight, duties and inland transport costs

-

Differences in coating uniformity and rework rates (scrap/waste)

-

Warranty and specification risk (non-conforming deliveries)

We recommend buyers compute landed cost (FOB/EXW + freight + duties + handling + local processing) and compare that with local sourcing before making volume decisions.

2025 market snapshot — prices and observed ranges

Market prices for G90 sheet/coil in 2025 are dispersed by region and by product form (coil, cut-to-length sheet, prepainted, etc.). Based on mill offers, trading platforms and market surveys in H1–mid-2025 we observed the following approximate FOB / mill ranges:

-

China (FOB Tianjin / Qingdao): US$480–700 / tonne for standard hot-dip G90 coil (volume & quality dependent).

-

Southeast Asia (Vietnam, Thailand): US$550–800 / tonne (depending on local zinc premium and logistics).

-

India (major mills): US$520–780 / tonne (domestic dynamics and rupee play a role).

-

Europe (ex-works EU / Northwest): US$900–1,200 / tonne (regional mills and tighter environmental / energy costs).

-

North America (FOB mills / SMU observed benchmarks): US$1,100–1,350 / tonne for spot/short-lead material (market surveys in early 2025 show higher regional premiums).

Important: these are indicative ranges observed from public offers, marketplace listings and market surveys in the first half of 2025. Individual quotes will differ by thickness, temper, surface finish, spangle, coil weight, and commercial terms.

Major cost drivers in 2025

Zinc metal (LME base price)

Zinc is the single largest raw-material cost for galvanized steel. LME zinc levels in 2025 moved materially and set the baseline for mill zinc premia. Changes in LME cash and 3-month quotes in H1–2025 correlated with immediate adjustments to vendor pricing. Watch LME zinc for immediate cost signals.

Steel feedstock / scrap

Hot-rolled coil and scrap prices drive the steel substrate cost. When scrap tightens, mills raise coil base prices and galvanizing premiums compound on top.

Energy and gas

Galvanizing lines consume heat and electricity. Energy price volatility — and regional carbon/energy policy — increased the operating costs for European mills in 2025, pushing their ex-works prices higher.

Freight and logistics

Container freight and bulk shipping remain important for interregional sourcing. Shortages of appropriately sized coils for containerization or port congestion can add weeks to lead time and hundreds of dollars/ton to landed cost.

Trade policy & tariffs

New and changing tariffs in 2025 materially altered landed pricing for many importers. Several trade proclamations and Section 232 adjustments influenced duties for steel imports (see official proclamations and CBP guidance). Buyers importing into sensitive markets should re-run landed-cost calculations with current duties.

Mill capacity and order book

Mills that run at high utilization have less spot capacity; tight fabrication schedules lengthen lead times and can create premiums for expedited production.

Supply chain and lead-time issues

In 2025 many buyers reported lead times of 4–12 weeks for standard G90 coils from major mills, with spot shortages for cut lengths and prepainted G90 panels. Smaller orders (under mill MOQ) often incur surcharges. We recommend booking well ahead for large projects and qualifying multiple mill sources.

Quality, tests and acceptance criteria

For specification compliance check:

-

ASTM A653 / EN 10346 / JIS equivalents — ensures base steel grade and coating designation.

-

Coating mass test (mass per area oz/ft² or g/m²) and coating thickness (µm) — request MTC and spot checks.

-

Adhesion (bend) test, cut-edge corrosion checks, and surface finish/visual acceptance.

-

Spangle and passivation if specified (e.g., chromate passivation for improved paintability).

Buying strategies and specification tips

We recommend the following to secure price and quality:

-

Specify the coating metric you mean (G90 = 0.90 oz/ft² total). Avoid ambiguous notation.

-

Use precise tolerances for thickness, flatness and coil weight to reduce surprises.

-

Ask for sample coils and MTCs before signing for large volume.

-

Compare landed cost not just FOB. Include duties, inland trucking, ballast, and handling.

-

Consider mill-level agreements or framework contracts that lock price bands for 3–6 months.

-

Prequalify secondary operations (cutting, slitting, prepaint) to avoid rework delays.

-

For coastal/marine projects consider thicker coatings (e.g., G120/G180) or duplex systems (galvanizing + paint).

Luokaiwei — how we position ourselves as a supplier

We are Luokaiwei, a China-based manufacturer and global supplier of galvanized coils and cut-to-length sheet. From our perspective:

-

We offer factory prices and can supply competitive FOB Tianjin/Qingdao pricing for standard G90 coil.

-

We support custom thickness, slit width, and surface finish, plus small batch and large volume orders.

-

Where customers have urgent needs, stock items are available for fast dispatch; customized runs are scheduled with predictable lead times.

-

For global buyers we provide transparent quantity discounts, MTCs and inspection options (third-party inspection before shipment) so you control quality and compliance.

-

Working directly with a mill like ours removes extra distributor margins and helps buyers reduce landed cost when logistics are optimized.

If you’d like, we can prepare a sample-based quotation for your exact thickness, temper and delivery port.

Global price comparison table

| Region (typical port / term) | Indicative range (US$/ton) | Notes / drivers |

|---|---|---|

| China (FOB Tianjin / Qingdao) | $480 – $700 | Wide range: dependent on mill, order volume, thickness and zinc premia. |

| Southeast Asia (FOB Vietnam / Thailand) | $550 – $800 | Local premiums and freight to certain export ports. |

| India (ex-works) | $520 – $780 | Domestic demand and currency effects. |

| Europe (ex-works EU / NW Europe) | $900 – $1,200 | Higher energy and environmental costs; slower capacity response. |

| North America (FOB) | $1,100 – $1,350 | SMU benchmarks show elevated regional levels and premiums in early 2025. |

| Middle East (CIF / regional supply) | $700 – $950 | Dependent on regional mills and import parity. |

| South America (Brazil ex-works / CIF) | $800 – $1,050 | Transport and tariff factors matter. |

Table notes: These are indicative and reflect observations from public mill offers, trading platforms and market surveys in the first half of 2025. For a precise RFQ comparison we must match thickness (e.g., 0.5 mm vs 1.2 mm), temper, coil weight and finish (spangle, passivation).

FAQs

Q1 — Is G90 always the best choice for outdoor projects?

No. G90 offers a stronger sacrificial zinc reserve than G60, but the correct choice depends on exposure class. For severe marine environments, a thicker coating (G120/G210) or a duplex system (galvanize + specialised paint) may be more cost effective over the asset life. Use a corrosion map or a zinc coating life predictor to estimate time-to-first-maintenance.

Q2 — How much does zinc price movement affect final G90 price?

Significantly. Zinc can be the single largest variable in galvanizing cost. When LME zinc moves sharply, mills typically adjust their zinc premium and pass that change through into coil prices within weeks. Monitor LME zinc and mill spreads for hedging or contract timing.

Q3 — Can I use G90 for roofing and cladding?

Yes. G90 is commonly specified for roofing systems and exterior cladding where moderate durability is required. Confirm forming, bending and post-paint compatibility with the supplier, and request samples for finish acceptance.

Q4 — How should I write the specification to avoid misunderstandings?

Write both coating mass and standard: e.g., “ASTM A653 / A653M, coating designation G90 (0.90 oz/ft² total, approx. Z275), hot-dip galvanized, coil width XX mm, thickness XX mm, spangle minimal, supply MTC and adhesion test report.” This avoids ambiguous shorthand.

Q5 — Is sourcing from China still cost effective in 2025 given tariffs and freight?

Often yes — but it depends on destination and tariff exposure. For markets with new or higher tariffs, landed cost may erode the factory price advantage. We recommend requesting a landed cost breakdown (FOB + freight + duties + local handling + inventory cost) from potential suppliers before awarding large contracts.

Practical checklist for buyers

-

State standard and coating unit explicitly (G90 = 0.90 oz/ft² total).

-

Ask for MTC (chemical & coating mass) and third-party inspection if value is large.

-

Compare landed cost, not just FOB.

-

Consider multi-mill prequalification to reduce single-source risk.

-

For coastal projects, raise coating class or specify duplex protection.

Closing remarks

We aim to give purchasing and engineering teams a transparent snapshot of G90 galvanized sheet pricing in 2025 and the practical levers available to manage cost and risk. If you want, we can prepare a custom RFQ template and a landed cost model based on your target port, target thicknesses, and annual tonnage so you can compare Luokaiwei FOB offers versus local alternatives.