JIS G3101 SS400, SS490 and SS540 plates remain the workhorse structural steels in 2025 — they combine predictable mechanical performance with broad availability — and typical market prices in 2025 vary by region from roughly $380–$760 / tonne in China, $850–$980 / tonne in North America (hot-rolled base), and intermediate ranges in Europe, Japan and South Korea, driven by raw-material swings, regional supply dynamics, and freight/tariff effects.

what JIS G3101 covers

JIS G3101 is the Japanese Industrial Standard for hot-rolled steel plates, sheets and strips for general structural use. The common grades in that standard include SS330, SS400, SS490 and SS540. SS400, SS490 and SS540 are broadly differentiated by their minimum yield / tensile strength ranges and intended structural applications. The standard gives thickness-dependent minimum yield values and tensile ranges that manufacturers must meet.

Key numeric references (minimums shown by grade)

-

SS400: typical minimum yield around 245 MPa for thin sections (values vary with thickness) and tensile strength in the 400–510 MPa band.

-

SS490: higher minimum yield commonly around 285 MPa for thinner plates and tensile strength often in the 490–610 MPa range.

-

SS540: the high-strength member with defined chemical limits (C ≤ 0.30%, Mn ≤ 1.60%) and minimum yield/tensile characteristics that place it distinctly above SS490.

Chemical composition and how it shapes behavior

The SS400/SS490/SS540 family are plain carbon–manganese structural steels. The standard explicitly caps phosphorus and sulfur (P, S) at low levels (typically ≤ 0.05%) to preserve toughness and weldability. SS540 has a formally higher carbon and manganese allowance (e.g., C up to ~0.30% and Mn up to ~1.6%) to reach higher strength without special heat treatment.

What this means in practice:

-

Lower carbon and controlled impurities give SS400 excellent weldability and formability.

-

Higher Mn and C in SS540 raise strength but slightly reduce ductility and weld ease; users often specify preheat / controlled weld procedures for thicker sections.

-

Microstructure in hot-rolled plates is predominantly ferrite + pearlite; strength changes are driven by compositional balance and rolling/air-cooling schedule.

Mechanical properties and thickness effects

JIS gives different minimum yield strengths depending on thickness ranges. For example, thinner plates may carry slightly higher guaranteed yield numbers than thicker plates, because thicker plates are more challenging to process uniformly. Designers must therefore check the mill certificate for the actual thickness class and the tested yields/UTS values.

Practical takeaways:

-

When replacing a foreign grade (e.g., ASTM A36 or EN S275), verify the actual yield and tensile values by thickness rather than assuming a blanket equivalence.

-

Impact toughness (Charpy) requirements are often project-specific; standard mill supply for SS400 may not include guaranteed low-temperature toughness unless requested.

Manufacturing, supply forms and mill processing notes

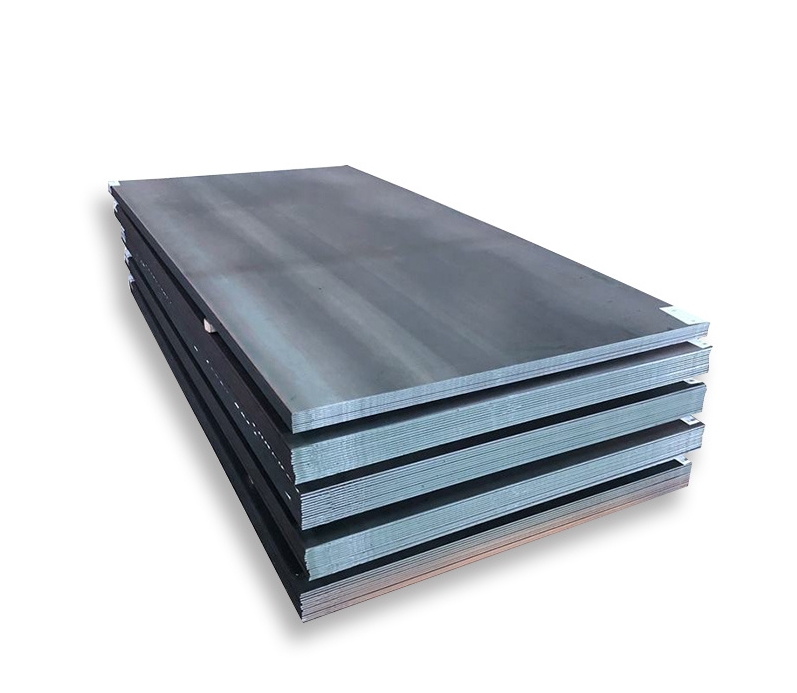

We see these plates typically supplied hot-rolled with surface conditions described as “black” / “as-rolled” and available in broad thickness ranges from a few millimeters to several hundred millimeters (heavy plates). Typical widths range from ~1,500 mm to 4,200 mm; lengths are cut to order.

Processing notes for buyers:

-

Straightness and flatness tolerances are agreed in the order (especially for welded structures).

-

Heat treatment: SS400/SS490/SS540 are designed to meet strength through composition and rolling; further heat treatment is unusual unless specified.

-

Surface protection: Galvanizing, painting or oiling is frequently requested for outdoor or marine use.

Typical applications and selection guidance

These grades appear across common structural use cases:

-

SS400: general building frames, bridges, ship hull fittings, miscellaneous fabricated structures.

-

SS490: heavier structural members, crane rails, harsher load conditions where higher yield is wanted.

-

SS540: where weight reduction combined with higher strength is desired (heavy machinery frames, specialized structural components).

Selection checklist:

-

Confirm thickness-dependent yield on the mill test certificate.

-

Specify impact test conditions if the structure will operate at low temperature.

-

When weldability is critical, prefer SS400 or request welding consumable compatibility statements for SS540.

2025 global price snapshot and comparison

We built this price comparison by sampling public supplier listings, industry commentary and regional price reports from 2024–2025. Prices below are market signals (order-of-magnitude ranges) for hot-rolled carbon structural plate in 2025. Actual contract prices depend on thickness, cut size, surface finish, packaging, shipment terms and order quantity.

| Region / Market | Typical 2025 price per tonne (USD) — SS400/SS490/SS540 (typical range) | Notes / market signal |

|---|---|---|

| China — domestic merchant / mill offers | $380 – $760 / t | Wide seller listing spread on B2B platforms; lower end for high-volume domestic Q235/SS400, higher for heavy/processed plates. |

| India — domestic mills & traders | $440 – $700 / t | Indian domestic mills price close to Chinese levels but logistics & duties create variance. (See regional pricing commentary.) |

| Japan — domestic JIS plates | $700 – $940 / t | Japan’s domestic plates carry JIS certification premiums and local production costs. |

| South Korea | $650 – $900 / t | Exportable, with higher domestic mill price parity versus China. |

| European Union (ex-works) | $760 – $1,050 / t | Premium reflects higher input costs, environmental levies and smaller import windows. |

| United States (HRC/plate base market) | $850 – $980 / t (hot-rolled coil reference ranges; plate premiums apply) | US prices in 2025 showed stabilization but service-center premia remain. |

| Middle East (Dubai, GCC traders) | $560 – $900 / t | Region combines imported Chinese/European material; freight & inventory cycles drive spread. |

Sources: B2B supplier quotes and market commentary (Made-in-China / Alibaba supplier price listings for China; Leeco and IndustrialTube for US market context; Fastmarkets / regional reports for Europe/Japan commentary). These are market signals rather than guaranteed contract levels.

How to read the table

-

The lower bound often represents spot, high-volume, basic hot-rolled plate with minimal processing (black finish).

-

The upper bound includes processed plates (mill-edge, cut-to-size), tighter tolerances, or grades with additional testing/certificates.

2025 market drivers — why prices moved in 2025

Key drivers we identified in 2025:

-

Raw-material (iron ore, coking coal) cycles and scrap availability — swings in these inputs propagated to finished plate prices.

-

Regional supply imbalances: China’s capacity and inventory levels pushed export availability; the U.S. and Europe saw higher per-ton domestic costs.

-

Trade measures, freight and logistics — tariffs, customs timings and ocean freight spikes changed landed costs and created regional premiums.

-

End-market demand (construction, shipbuilding, heavy equipment) which varied by country.

-

Environmental and energy costs in EU/Japan — carbon constraints and higher energy costs raised ex-works plate prices in those areas.

Practical procurement recommendations

We recommend the following in a tender / RFQ for JIS G3101 SS400/SS490/SS540 plates:

-

Specify JIS G3101 by edition (e.g., JIS G3101:20XX) and exact grade. Ask the mill to cite the clause coverage in the test certificate.

-

Request mill test certificates (MTC) with chemical and mechanical test records and thickness class referenced.

-

Define acceptance tests: UT for laminations, Charpy V-notch at specified temperature if required, tensile for the sample plate.

-

Supply condition & packing: specify tolerances, surface protection (oiled or painted), and packaging for export.

-

MOQ & lead time: larger lots bring better per-ton pricing; build freight and duty into landed cost.

-

Ask for equivalents only after verifying the thickness-dependent mechanical targets — a direct substitution by name (e.g., ASTM A36) is risky without MTC comparison.

Quality control checklist (technical acceptance)

When goods arrive, our inspection routine includes:

-

Visual check for mill stamps and heat numbers.

-

Cross-reference MTC chemistry and yield/tensile to the stamped heat no.

-

Dimensional and flatness checks against the purchase spec.

-

NDT: ultrasonic scan for laminations on heavy plates (recommended for >20 mm).

-

Welding trials or weldability certificates for SS540 where higher carbon/manganese are present.

Equivalents and substitutions

Common approximate equivalents (use cautiously — always confirm mechanicals by thickness):

-

SS400 ≈ ASTM A36 / GB Q235 / EN S275JR (close in typical structural performance).

-

SS490 ≈ ASTM A572 Gr50 / higher strength European steels (check yield vs. thickness).

-

SS540 has fewer direct low-cost global equivalents because it targets higher yields within JIS; consult the mill for similar A572/A572 Gr 60 equivalents and validate samples.

Sustainability, recycling and life-cycle notes

Steel plate is highly recyclable. Buying decisions that factor in recycled content, mill energy footprint, and coating longevity can improve total life-cycle cost. European mills’ higher costs often reflect stricter environmental controls; that can be an explicit buyer preference for green procurement.

Common pitfalls and how we mitigate them

-

Pitfall: Assuming grade names map one-to-one across standards.

Mitigation: Require MTC and compare numeric mechanicals. -

Pitfall: Quoting spot sample prices as contract prices.

Mitigation: Publish price ranges, label them, and require RFQ to confirm final bids. -

Pitfall: Missing thickness-dependent requirements.

Mitigation: Include thickness range explicitly in purchase order and acceptance criteria.

FAQs

1) Are SS400 and ASTM A36 interchangeable?

They are often treated as equivalents in low-demand structural applications, but they are not identical. You must compare the actual yield and tensile values by thickness on the MTC before declaring interchangeability.

2) Why does SS540 cost more than SS400?

SS540 has higher specified strength and composition limits (higher C and Mn allowances), plus it requires stricter mill testing and possibly more careful rolling — those factors usually translate to a premium.

3) What thicknesses are commonly stocked?

Hot-rolled plates commonly range from a few millimeters up to several hundred millimeters; standard merchant widths are ~1.5–4.2 m. Confirm the mill’s available widths and minimum cut lengths before finalizing an order.

4) Should I require Charpy tests?

If structures operate at low temperature or in impact-sensitive service, yes — specify Charpy V-notch parameters (temperature and energy) in the contract. The standard supply may not include low-temperature impact guarantees.

5) How do I convert quoted price per CWT to price per tonne?

U.S. suppliers often quote price per CWT (100 lb). To convert: $/CWT × 20 = $/short ton (2,000 lb). To get metric tonne pricing, further convert as needed (1 metric tonne ≈ 2,204.62 lb). Check the seller’s unit and confirm the basis before contract.