For 2025 the typical market price for ASTM A204 (ASME SA-204) pressure-vessel molybdenum-alloy plates ranges broadly between USD $600–$1,200 per metric ton depending on grade (A/B/C), mill origin, order size, heat treatment, and delivery terms — with most commonly quoted trade prices clustering in the $650–$900/ton band for standard Grade B normalized plates from major Asian mills.

What A204 / SA-204 covers

ASTM A204 / A204M (often referred to in industry by its ASME equivalent SA-204) is the standard for molybdenum-alloy steel plates intended mainly for welded boilers and pressure vessels. The standard defines three grades (A, B, C) with progressively higher tensile strength bands and requires killed steel, specific chemical limits, and mechanical testing (tension, impact where applicable).

Why A204 is chosen for pressure equipment

We recommend A204 when vessels or boiler components must retain strength at elevated temperatures and where weldability and toughness are required. The controlled alloying (notably molybdenum additions) gives higher creep resistance and sustained strength at service temperatures above ordinary carbon steels, while still permitting standard fabrication practices.

Grades, mechanical requirements and what they mean in practice

ASTM lists three grades with these general tensile ranges (translated to common engineering units):

-

Grade A: tensile ~65–85 ksi (≈450–585 MPa).

-

Grade B: tensile ~70–90 ksi (≈485–620 MPa).

-

Grade C: tensile ~75–95 ksi (≈515–655 MPa).

These grades allow engineers to match plate strength to design pressure and temperature. The higher grades typically command higher mill premiums because of tighter chemistry control and often higher heat treatment requirements.

Typical chemical composition

A204 is a molybdenum-bearing low-alloy steel; typical controlled elements include C, Si, Mn, P, S, and small Mo additions. Exact element limits vary by grade and mill practice, but C is kept low (to maintain toughness and weldability) while Mo is added for high-temperature strength. We always request the mill test report (MTR) showing actual analysis for every heat when specifying A204.

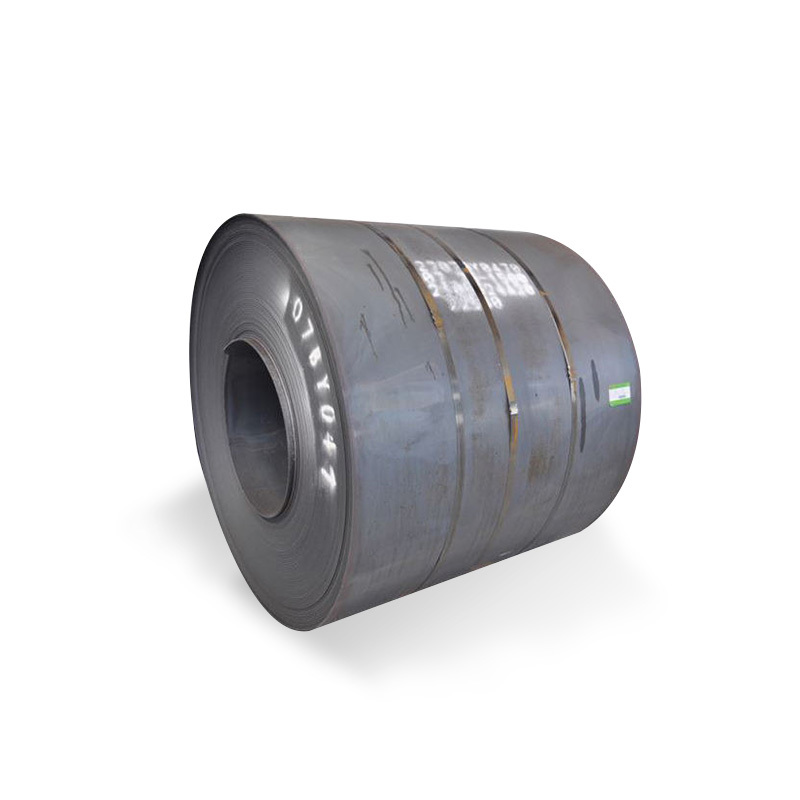

Common product forms, rolling and heat treatment

Plates are supplied hot-rolled and may be delivered in the as-rolled, normalized, or quenched & tempered condition depending on the purchaser’s spec. Thickness ranges from a few millimeters up to several hundred mm (limited by mill capability and property retention). Fabrication shops typically prefer normalized plates for improved uniformity of mechanical properties and easier welding.

Typical applications

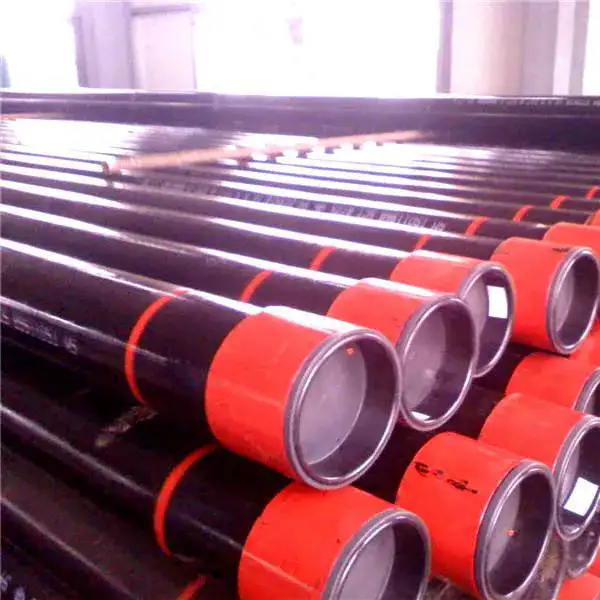

A204 plates are widely used for reactors, heat exchangers, separators, boilers and steam drums, high-temperature pressure vessels in petrochemical plants, and parts of hydrocarbon processing equipment where elevated temperature strength and weldability are essential. Supply chains in oil & gas and power generation are the largest consumers.

2025 global price snapshot

Steel plate pricing changes rapidly due to scrap/iron ore, alloying-element costs (Mo is a key driver), freight, and trade flows. Below is a practical, market-level comparison we compiled from current trade listings and distributor quotes in 2025. These figures are indicative price bands (FOB mill or ex-works unless noted) and should be used for budgeting or RFQ benchmarking only.

| Region / Typical source | Common quoted range (USD / metric ton) | Notes |

|---|---|---|

| China (large mills / trading platforms) | $600 – $900 / t | Competitive export quotes from Chinese mills and trading platforms; price depends on order volume, plate thickness, and heat treatment. |

| India (stockists / mills) | $650 – $800 / t | Indian suppliers frequently quote Grade B in this band; lead times vary. |

| Global B2B marketplaces (small lots, trading) | $700 – $1,000 / t | Platforms such as Alibaba / Made-in-China show broad ranges reflecting seller diversity and lot sizes. |

| Europe (distributors / small suppliers) | $900 – $1,400 / t | Higher domestic cost base and certifications can push European prices up; import parity pricing varies. (market observation) |

| USA (mill / distributor quotes) | quoted by CWT or per-ton; typical equivalent: $700 – $1,200 / t | US market often expresses plate in CWT (hundredweight). Use conversion: CWT × 20 = $/ton. That practice influences how distributors quote and how buyers compare. |

How to read these bands: lower end usually represents bulk orders of standard Grade B, basic finish, direct mill shipments from Asia. Upper end reflects small orders, tight delivery, additional testing (NDT, impact), specialty heat treatment, or certified mills in high-cost regions.

Key market evidence: multiple exporters and stockists currently list A204 Grade B in roughly the $600–$900/ton window for standard sizes; spot availability and freight add to final landed cost.

What drives price differences

We separate drivers into raw-material, product, and commercial categories:

-

Alloying element costs: molybdenum price swings directly affect A204 pricing because Mo is a relatively costly alloying metal.

-

Steelmaking route and mill capabilities: mills using vacuum degassing, controlled rolling, or special heat treatment may charge premiums for the improved properties.

-

Grade and mechanical finish: Grade C or quenched & tempered products typically cost more than Grade B normalized material.

-

Thickness and plate size: very thick plates may be priced per plate/heat rather than simple per-ton rates because production yields differ.

-

Quantity and contract terms: LTL shipments and small lots carry large per-ton premiums; long-term contracts lower unit price.

-

Freight, duties, and inspections: landed cost depends heavily on shipping routes, insurance, import duties, and third-party inspection requirements.

-

Certification and testing: NDT, impact testing at low temperatures, NACE or other special certifications raise price.

Sourcing strategy — how we (luokaiwei) specify and procure to control cost and risk

When we prepare an RFQ, we always specify:

-

Exact ASTM/ASME standard (A204 / A204M / SA-204) and the required grade.

-

Required heat treatment (normalized, tempered, etc.).

-

Dimensional tolerances and flatness if applicable.

-

All tests and certifications: MTRs (EN 10204 3.1/3.2 equivalents), chemical & mechanical reports, UT or RT if required.

-

Welding procedure expectations and PWHT needs, if the plate is part of a welded assembly.

-

Acceptance criteria for surface condition and any machining allowances.

We find that precise, strict RFQs reduce cost surprise during inspection and acceptance. Asking for a single extra mechanical test after receipt often costs many multiples of the savings you thought you had in the lowest bid.

Quality assurance, inspection and common buyer traps

For pressure-containing parts the following QA items are non-negotiable:

-

Mill Test Report (MTR) showing heat number traceability and full chemical/mechanical data.

-

Non-Destructive Tests (NDT) — UT/RT where required by code.

-

Impact testing for service at low temperature if design dictates.

-

Hardness checks where specified.

-

Third-party inspection for large or critical orders.

Common traps: accepting MTRs without verified heat numbers, assuming “grade B” is identical across mills (it is not), or failing to include weld heat treatment instructions in the purchase order.

Welding, fabrication, and post-weld heat treatment considerations

A204 has good weldability when carbon and impurity levels are controlled, but we always plan weld procedures and PWHT before procurement. For thicker plates and higher grades:

-

Preheat may be necessary depending on thickness and joint design.

-

PWHT is commonly required for pressure vessels to relieve residual stresses and to meet creep/rupture design criteria.

-

Matching filler metals and proper procedure qualification (PQR/WPS) are essential for ASME code compliance.

Corrosion behavior and protective measures

A204 is not a corrosion-resistant alloy like stainless steels. For corrosive media we recommend design protections: internal linings, claddings, correlated alloy selection, or coatings. For many petrochemical environments, material selection must consider temperature, pressure, and corrosive species jointly — it is not enough to select a plate only by mechanical strength.

Practical tender checklist

-

Standard and grade (A204 / SA-204, Grade B, etc.)

-

Plate dimensions and tolerances (thickness × width × length)

-

Heat treatment: condition required (normalized / Q&T / AR)

-

Tests: mechanical (tensile), impact (if needed), hardness, NDT (UT/RT), PWHT records

-

Documentation: MTR 3.1/3.2, mill heat number traceability, test certificates

-

Packaging and marking requirements

-

Delivery terms (Incoterms), lead time, third-party inspection plan

Market signals we watch in 2025

We keep an eye on:

-

Molybdenum futures and spot prices (Mo is a key alloy element).

-

Scrap and iron ore price trends that shift base carbon-steel pricing.

-

Global freight rates and port congestion.

-

Trade policy or anti-dumping duties that can alter landed costs regionally.

When Mo spikes, expect A204 premiums to widen quickly.

Two worked purchase examples

Example A — Large contract (500 t), standard Grade B, China mill, FOB Shanghai: expect lower band pricing near $620–$700/t for normalized plates with basic MTRs (no extra impact testing). Freight and duties add to landed cost.

Example B — Small lot (5–10 t), European certified supplier, Grade B inclusive of NDT and 3.2 MTR: expect toward $1,000–$1,300/t delivered to European yard, because of documentation, small lot handling, and certification overhead.

How to compare quotes properly

-

Convert all quotes to the same unit (USD / metric ton) and the same conditions (FOB vs CIF vs DDP).

-

Check whether the price includes MTR grade 3.1/3.2 and whether NDT or impact tests are included.

-

Verify delivery time and whether any escrows or performance bonds are requested.

-

Verify whether the supplier is a mill, stockist, or trading house — mills can be cheaper but may require larger minimums.

Sustainability and recycled content considerations

Some buyers now require declarations of scrap content or greenhouse gas intensity of production. If your procurement policy includes embodied carbon targets, request supplier disclosures and project-level emissions data early in the RFQ phase.

Short annotated bibliography of practical reference documents we rely on

-

ASTM A204 / A204M — the governing specification for plate chemistry and mechanical bands. Use it as the authoritative basis for any purchase order.

-

Mill datasheets and distributor product pages for dimensional availability and standard finishes (typical examples are shown by leading suppliers and distributors).

Global price comparison

Below is a compact price table for quick budgeting. These are indicative ranges (USD / metric ton) in 2025:

| Source type | Indicative 2025 band (USD / t) |

|---|---|

| Chinese mill export quotes / trading platforms | 600 – 900. |

| Indian stockists / suppliers | 650 – 800. |

| Global B2B listings / small lot traders | 700 – 1,000. |

| Distributor (Europe / US, small lots, certified) | 900 – 1,400. (market observation) |

FAQs

Q1 — What is the best grade of A204 for boilers running at ~400°C?

We typically choose Grade B for a balance of elevated-temperature strength and weldability; Grade C is chosen for higher strength needs. Confirm design code temperature limits and creep life before finalizing grade.

Q2 — Do A204 plates need PWHT?

PWHT depends on thickness, joint design, and applicable code. For many pressure vessel welds and thicker sections, PWHT is required to meet toughness and stress-relief criteria — specify it in the purchase order and welding procedure.

Q3 — How much does adding impact testing add to the price?

Impact testing increases cost through extra lab work and potential heat rejections; for small lots it may add several percentage points to unit price. Negotiate inclusion in long-term contracts to control per-unit premium.

Q4 — Are the prices I see on marketplaces like Alibaba or Made-in-China reliable?

They provide indicative spot prices and seller quotes; use them for budgetary planning but verify mill certifications, test records, and incoterms with the seller. Market listings often show a broad band reflecting lot sizes and seller types.

Q5 — How do I convert US distributor quotes given per CWT to USD/ton?

US distributors frequently quote steel by CWT (hundredweight). Multiply the quoted $/CWT by 20 to convert to $/short-ton (2,000 lb). For metric ton conversion, ensure whether short-ton vs metric; it’s safer to ask the seller to provide USD per metric ton.