DIN 17102 EStE315 is a normalized, fine-grain structural steel grade commonly used for automotive structural parts and light-to-medium load fabrication. In 2025 the procurement cost for EStE315-equivalent flat steel is strongly regional: China ex-works/FOB offers (plate/HRC basis) remain among the lowest globally (roughly in the low hundreds USD/tonne), Europe’s spot HRC indices sit in the mid-hundreds USD/tonne, while U.S. structural/finished plate prices are higher due to tariffs, local premiums and fabrication margins. For buyers seeking factory-direct, customizable plate at competitive lead times, we (Luokaiwei) recommend sourcing from established Chinese mills with strict inspection and test plans.

What is DIN 17102 EStE315

DIN 17102 is a German designation system that groups normalized, fine-grain structural steels for welded construction and forming operations. The sub-grade EStE315 (sometimes written EStE 315) denotes a steel with nominal minimum yield/tensile ranges appropriate for automotive structural applications where formability plus moderate strength are required. Commercial suppliers list EStE315 as an automotive/structure plate used for parts that need good ductility and consistent behaviour during stamping and light bending.

Quick technical snapshot (composition and mechanical)

Below is a practical, condensed technical snapshot we use when preparing RFQs or inspection plans:

-

General chemical family: Low-alloy carbon structural steel with tight sulphur/phosphorus controls, small microalloying additions for grain refinement.

-

Key composition features: Very low S and P (improved weldability), small additions of aluminum and sometimes niobium or vanadium for grain control in normalized plates. Exact percentages vary by mill and sub-type (StE / TStE / WStE families).

-

Typical mechanical (nominal ranges): Yield strength often between 235–315 MPa depending on thickness and product form; tensile strength commonly 420–560 MPa for the family of DIN 17102 grades. Actual guaranteed minima appear on mill test certificates.

-

Formability: Good — suitable for stamping, bending and moderate stretch forming within manufacturer recommendations.

-

Weldability: High — low S and P and normalized microstructure give robust weldability with standard procedures.

Note: For contract language always request a mill test certificate (EN 10204 / 3.1 or equivalent) and specify exact guaranteed minima for yield & tensile at the ordered thickness — those values are the basis for acceptance testing.

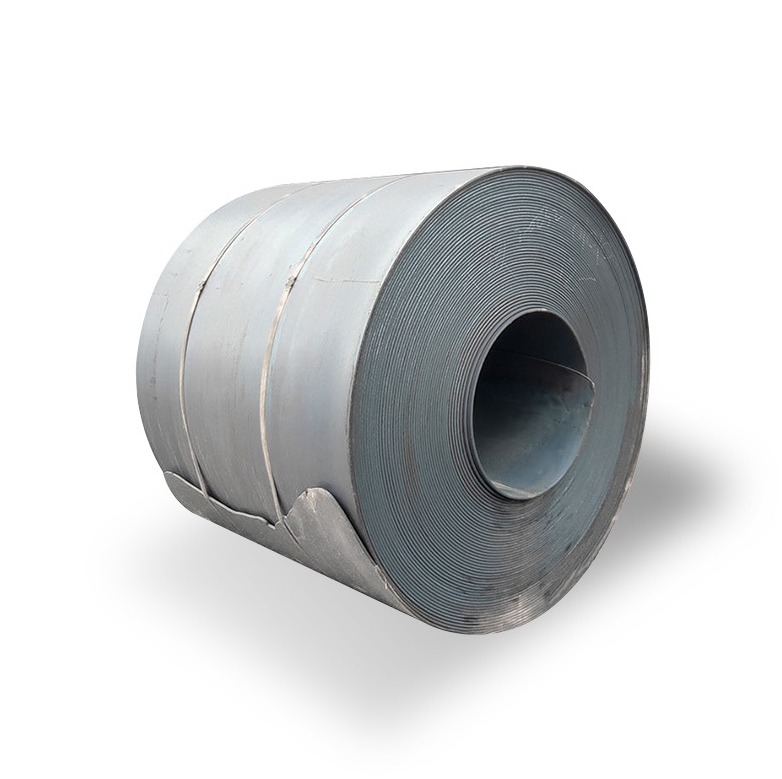

Material forms, dimensions and typical tolerances

EStE315 is sold principally as hot-rolled plate and sometimes as normalized cold-finished plate for thin gauges. Typical commercial ranges we see:

-

Thickness: common 2.5 mm — 200+ mm (automotive parts usually 0.8–6 mm for stampings; heavier structural plate thicker)

-

Width: up to 4020 mm for wide plates; coils / slit widths for thinner stripwork

-

Length: cut to order; standard mill lengths or cut-to-size for blanks

-

Surface: mill scale (for hot-rolled), pickled/shot-blasted or cold-rolled finishes upon request

When sourcing for the automotive industry, tolerances on thickness, flatness, and surface condition must be specified in the RFQ.

Manufacturing route & heat treatment

The strength/ductility balance of EStE315 is typically achieved by:

-

Controlled rolling and normalization — the steel is hot-rolled with microalloying additions then normalized (air cooling) to produce a fine grain ferrite-pearlite matrix with predictable mechanical behaviour.

-

Thermomechanical processing in some mills (TStE variants) for better low-temperature toughness and tighter property control.

We always ask suppliers to provide the heat treatment code and proof of cooling cycle when toughness or forming at low temperatures is critical.

Automotive applications & forming behaviour

EStE315’s balanced ductility and strength make it suitable for:

-

Structural stampings (inner sills, brackets, cross-members for light vehicles)

-

Welded assemblies that require consistent shrinkage behaviour

-

Components where mild strengthening after forming is acceptable

Practical notes from our shop floor experience: holdback for springback and trimming tolerances, and confirm strain-hardening behaviour on representative coupons before mass production tooling.

Welding, joining & assembly notes

Welding of EStE315 is straightforward with standard consumables for low-alloy carbon steels. Recommendations:

-

Pre- and post-weld heat treatment typically not required for thin automotive gauges, but thicker weldments should be evaluated for HAZ toughness.

-

Use low hydrogen electrodes or MIG wires matched to base metal chemistry.

-

Always request CBMT (co-based microstructure testing) or HAZ hardness checks for welded sections that are load critical.

Surface treatments & corrosion protection

For automotive end-use, EStE315 is normally treated after forming:

-

Phosphating + e-coating (ED) for corrosion protection prior to painting

-

Hot-dip galvanizing or continuous galvanizing (for external panels) — check allowable deformation limits after coating

-

Mechanical surface preparation (shot or grit blasting) is common for welded assemblies destined for paint lines

Specify coating adhesion and bend tests in your technical delivery conditions if downstream processing is critical.

Quality control, certifications & approvals

For automotive supply chains you should require:

-

Mill Test Certificate (EN 10204 3.1) showing chemical and mechanical results.

-

Third-party inspection certificates (BV, ABS, DNV, TUV etc.) where applicable. Several Chinese mills list common approvals — always verify with the issuing body.

-

Traceability from melt to MTC and unique heat/coil/plate IDs.

-

Non-destructive tests: UT for full-thickness plate, surface crack detection where required.

Global price comparison 2025

Below is a practical snapshot of representative market levels in mid-2025. These numbers are indicative and intended for budgetary comparisons; final quotes should be requested with delivery terms (FOB, CIF, EXW, delivered, fabricated) and quantity.

| Region / Basis | Representative price (USD / metric tonne) | Notes |

|---|---|---|

| China — ex-works / FOB (commercial HRC / plate basis) | ~ $400 – $550 / t | China plate / HRC export indices and steelbenchmarker show low hundreds USD/ton for bulk commercial grades; Chinese mills offer competitive factory pricing. |

| Europe — spot HRC composite (Argus / market indices) | ~ $540 – $600 / t | European HRC / plate quotes trade higher than China but lower than U.S. fabrication costs; regional premiums and VAT vary. |

| United States — structural plate / fabricated pricing | ~ $2,300 – $2,800 / t | Structural and finished plate pricing reported by RSMeans/Gordian reflect domestic premiums, tariffs and high fabrication costs; U.S. structural project prices significantly higher in 2025. |

Important context and caveats (we emphasise these):

-

These numbers mix raw HRC/plate commodity indices and finished/ structural plate pricing streams — they are not direct like-for-like product replacements. HRC/coil/plate commodity prices differ from fully processed, certified automotive plate with specific finish and testing. Use them as a directional comparison only.

-

Tariffs, transport, customs and quality extras (pkging, testing, MTC 3.1) materially change landed costs. See the cost drivers section below.

Primary cost drivers and market factors (2025)

Key drivers that explain the price spread between regions:

-

Raw material costs: iron ore and scrap swings feed directly into HRC prices. Iron ore futures and spot flows rose in recent months, putting upward pressure on mills.

-

Energy and electricity costs: plate production is energy intensive; regional power prices change mill offers.

-

Trade policy & tariffs: U.S. import measures and other protective actions in 2025 materially elevated domestic finished plate prices compared with Chinese FOB levels.

-

Freight and logistics: container/RO-RO capacity and port congestion influence CIF/CFR landed costs, sometimes adding hundreds USD/ton for distant markets.

-

Quality, testing & fabrication premium: certified, traceable plate for automotive uses attracts a premium over commodity plate.

-

Order quantity & repeat business: long-term contracts and large volumes substantially lower per-ton pricing from mills.

How we (Luokaiwei) supply EStE315 — services & advantages

We are a Chinese manufacturer with an emphasis on factory-direct supply for structural and automotive steels. When you buy from us you get:

-

100% factory pricing advantage — we coordinate direct mill supply and consolidated shipments to lower unit cost.

-

Customization services: cut-to-length, slitting, surface treatments (pickling, shot-blast), pre-paint/coil coating on request.

-

Fast delivery for stock items: we hold common thicknesses in stock; for high-volume repeat buys we prioritise allocation and short lead times.

-

Quality control: MTCs (EN 10204 3.1), full traceability, UT/MT on request, and third-party inspection for critical orders.

-

Support for OEM workflows: we provide sample blanks, runs for stamping trials and technical support for forming & weld parameters.

If you want, we can prepare a tailored RFQ template and a sample inspection plan that matches Tier-1 automotive requirements.

Purchasing checklist and RFQ template

When preparing an RFQ include the following minimums:

-

Standard & grade: DIN 17102, EStE315 (or equivalent EN/ISO designation if you prefer).

-

Thickness, width, length and tolerances required (e.g., ±0.2 mm).

-

Heat treatment/processing statement (normalized/certified).

-

Mechanical guarantees: Yield (MPa), Tensile (MPa), Elongation (%), Impact (if required) and test temperatures.

-

Chemical limits: maximum S, P, and exact alloying limits.

-

MTC standard: EN 10204 3.1 (or 3.2 if specified).

-

NDT requirements: UT, surface MT, ultrasonic for full length if needed.

-

Surface condition & packaging: pickled, oiled, coated, or as-rolled.

-

Certificates & approvals: list any required third-party approvals (TUV, ABS, etc.).

-

Delivery terms & incoterm: EXW / FOB / CIF and required destination port.

Use this checklist to standardise quotations and compare apples-to-apples.

Sustainability, recycling & regulatory considerations

-

Recycling: Steel is highly recyclable; choosing scrap-friendly steelmaking suppliers improves life-cycle carbon metrics.

-

Carbon intensity: ask mills for their steel CO₂ intensity (kg CO₂ / t) or EPDs when carbon footprint matters. European buyers increasingly require low-carbon or “green” steel declarations.

-

Regulatory: ensure compliance with REACH/substance restrictions if plated/coated products will enter EU automotive supply chains.

Case notes & quick selection guide

-

For high-volume stampings where cost is critical but basic strength suffices → choose EStE315 from high-quality Chinese mills with consistent MTCs and pre-production samples.

-

For safety-critical welded structural parts needing low-temperature toughness → request a thermomechanically processed variant (TStE) or higher certainty in impact testing.

-

For corrosion-exposed components → specify coating route (galvanizing or pre-paint) and test bend/adhesion on coated coupons.

Frequently Asked Questions

Q1: Is EStE315 the same as StE315 or StE355?

A1: They are related families inside DIN 17102. EStE315 is a specific normalized fine-grain grade; StE315 indicates the StE family; StE355 is a higher strength grade. Always confirm the exact standard designation in your PO and the guaranteed minima on the MTC.

Q2: What certificates should I insist on for automotive supply?

A2: Require EN 10204 3.1 mill test certificates at minimum, plus third-party inspection if the part is safety-critical. Ask for full chemical & mechanical results traceable to the heat number.

Q3: Can EStE315 be hot-dip galvanized after forming?

A3: Yes, but the suitability depends on forming strain and coating ductility. For heavy deformation, discuss post-coat vs pre-coat options and run bend/adhesion tests. Specify Galvanizing acceptance criteria in the technical spec.

Q4: Why are U.S. structural plate prices higher than Chinese FOB?

A4: In 2025 domestic U.S. prices reflect tariffs, local production premiums, higher fabrication costs and tight domestic demand; this pushes finished structural plate well above raw HRC/plate export indices. That divergence is reported in market updates for 2025.

Q5: How do I compare quotes from different countries fairly?

A5: Compare landed cost (price + freight + duties + testing + packaging) for the exact product specification and incoterm. Also align on inspection, MTC level and whether additional finishing (pickle, shot blast, coating) is included.

Final practical recommendations

-

If your priority is lowest unit cost with consistent quality, request a factory-direct offer from an established Chinese mill and insist on EN 10204 3.1 MTCs, UT inspection and a small sample run for forming tests. We (Luokaiwei) can arrange that end-to-end.

-

If you need short-lead, certified, low-carbon steel for European OEMs, compare local European suppliers for lower logistic time and ask for EPD/CO₂ intensity reports.

-

Always evaluate landed cost not just ex-works price; account for duties (2025 trade policy is volatile), logistics, and QA costs.