CCS AH36 marine plate remains a cost-effective, high-strength shipbuilding steel in 2025, with typical factory prices out of China clustering around USD 500–800 per metric tonne, while Western Europe and North America show higher landed prices often in the USD 800–1,300/tonne band depending on thickness, certification and logistics. Demand-tight markets and regional supply constraints continue to push premiums for certified ship plates and short-lead deliveries.

What we mean by “CCS AH36” and why it matters

When we say “CCS AH36” we refer to AH36 high-strength, low-alloy structural steel plates that are certified to sail under the China Classification Society (CCS) rules. AH36 is part of the shipbuilding H-series (AH/DH/EH/FH) and is widely specified for hull structures, decks, and bulkheads because its chemistry and thermo-mechanical processing produce a balance of yield strength, tensile strength and notch toughness required for marine service. AH36’s mechanical baseline includes a minimum yield of about 355 MPa (for many thickness ranges) and tensile strength typically in the 490–630 MPa window. These mechanical baselines are a practical reason why AH36 is frequently chosen for ocean-going ships, barges and offshore platforms.

Short technical primer — composition, properties and testing

We summarize the engineering essentials you need when specifying AH36:

-

Basic chemistry: Carbon is kept low; manganese and silicon are present at controlled levels; microalloying elements like niobium (Nb), vanadium (V) and titanium (Ti) are commonly used to refine grain and improve toughness. Typical upper limits for carbon hover near 0.18%. Representative microalloy ranges are small (Nb ~0.02–0.05%, V ~0.05–0.10%).

-

Mechanical requirements: Yield (Re) generally ≥ 355 MPa for many thicknesses; tensile (Rm) typically 490–630 MPa depending on gauge and supplier heat-treatment. Minimum elongation and Charpy V-notch energies vary with thickness and the specified test temperature (e.g., L/C positions and impact temperature classes).

-

Weldability and fabrication: AH36 is designed to be weld-friendly. Preheat and controlled heat input are used in thick sections; post-weld treatment is rarely mandatory for standard hull assemblies but is applied for critical details or in low-temperature service. Ultrasonic testing (UT), magnetic particle or dye-penetrant inspection, and Charpy V-notch testing are common QA steps.

-

Classification checks: CCS certification means the mill and product pass classification society inspections and mill test certificates (MTC) consistent with CCS rules; the certificate assures shipyards and owners that the plates meet toughness, chemical and mechanical requirements expected for marine applications.

Typical manufacturing routes and quality controls we rely on

We see two principal production routes in market supply:

-

Thermo-Mechanical Controlled Processing (TMCP): Most modern AH36 plates use TMCP to obtain the fine-grained microstructure that supports toughness at low temperatures while maintaining strength. TMCP grades can meet stricter Charpy energy requirements without excessive alloying.

-

Conventional hot rolling plus controlled cooling: Some producers still use conventional rolling with chemistry adjusted to meet toughness targets; these may be offered at slightly different price/availability points.

On quality control we insist on: mill certificates (3.1/3.2), full traceability heat-to-plate, Charpy V-notch test records at the required temperatures, UT reports, and if needed, third-party inspection (e.g., SGS, BV, DNV) or on-site classification witness testing. Mills certified to produce CCS-classed plates normally maintain these records as standard.

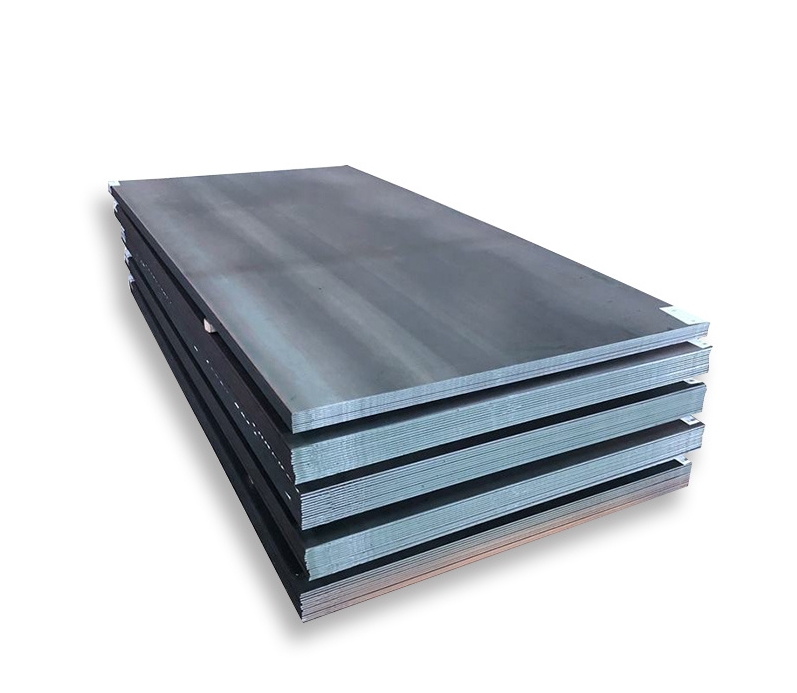

Common thicknesses, sizes and how those affect cost

AH36 plates are supplied across a wide thickness range (6 mm up to 100+ mm) and widths from ~1000 mm to 4800 mm depending on mill capability.

-

Thin to mid gauges (6–20 mm): These are high-volume and generally cheaper per tonne because of higher mill yields and simpler rolling schedules.

-

Medium-heavy (20–50 mm): Price per tonne can rise moderately due to slower rolling runs, more stringent testing (especially for impact at low temperatures), and lower throughput.

-

Thick plates (>50 mm): These often carry significant premiums for both material and processing and sometimes require specialized mills; lead times lengthen and CE/chemical controls tighten.

Thickness affects both the direct mill price and processing costs (cutting, beveling, extra testing), so project-level budgeting must add an allowance for fabrication and certification work.

Global price picture for 2025 — how we read and use market signals

Steel pricing in 2025 is influenced by scrap and raw-material costs, finished-product demand (shipbuilding/repair schedules), trade policy, freight rates and mill availability. For AH36 specifically, the market shows these characteristics:

-

China (major exporter and local supplier): Competitive factory prices out of Chinese mills and trading houses commonly appear in the USD 500–800/tonne band for standard AH36 plate (depending on thickness, certification and order size). Chinese suppliers remain the most flexible on MOQ and short lead times when the buyer accepts standard MTC and customary packaging.

-

Europe: Landed prices, after tariffs, VAT and inland haulage, frequently appear in the USD 800–1,200/tonne area for certified ship plate. Supply tightness or urgent shipyard demand can push higher.

-

North America: Domestic plate availability and protective measures often keep plate pricing higher than China’s export FOB — reported plate prices for general steel plate in US distribution channels have been in the ~USD 1,000–1,200/tonne vicinity (plate product indices vary by gauge and finish).

-

South & Southeast Asia (India, Vietnam, Korea): Local mills and traders offer a mixed set of prices: domestic-produced AH36 equivalents can be competitive (often USD 550–900/tonne) but certification and mill history matter for shipyards and offshore projects.

Important: prices fluctuate daily. The ranges above reflect observed supplier listings and market indices across 2025; any formal tender should obtain live quotes from multiple vendors and include freight, insurance, duties and testing costs in the landed price.

Global price comparison — typical landed and factory ranges (USD/metric tonne)

| Region / Seller type | Typical price range (USD/tonne) | Notes (thickness, certification, usual lead-time) |

|---|---|---|

| China — mill/trading house (FOB) | $500 – $800 | Standard AH36; 6–20 mm common; CCS/ABS/LR certificates available; MOQ varies. |

| India — domestic mills & traders | $550 – $850 | Competitive local offers; certification parity varies by mill. |

| Vietnam / SE Asia suppliers | $600 – $900 | Mix of local mills and Chinese imports; price sensitive to freight and duties. |

| Europe — mills & distributors (landed) | $800 – $1,200+ | Higher labor and energy costs; certified mill tapes in demand. |

| North America — distributors & steel service centers | $900 – $1,300+ | Domestic plate market price indices and inventory premiums; distribution margins add. |

Notes:

-

Table shows broad ranges; precise quotes depend on thickness, cut-to-length, surface finish, certification witness, packing and shipping terms.

-

Low-volume, urgent orders or bespoke testing requirements generate premiums beyond the shown ranges.

-

The cited ranges combine supplier listings, market-price trackers and distribution price indices seen through 2025.

How specifications and certification affect price

Prices vary more by specification and documentation than by small chemistry differences. Items that add cost:

-

Classification society certificate (CCS, ABS, LR, DNV): Plates with witnessed testing and full CCS/ABS documentation command premiums. Mills that are CCS-approved and which allow class surveyor witness testing may charge more but deliver less risk at the shipyard.

-

Impact testing at lower temperatures: If Charpy V-notch energy is required at -20 °C or -40 °C, especially for thicker plates, the supplier may need TMCP routes or different chemistries, increasing cost.

-

Third-party inspection and additional mechanical tests: On-site QA, extended UT mapping, PMI checks, and extra traceability (heat numbers) add fees.

-

Cutting, beveling and surface treatment: Pre-cut plates or machined edge preparations add to the delivered cost, while “as-rolled” bundles are cheaper.

Logistics, packaging and incoterms

When asking for price, specify clearly:

-

Incoterm (FOB Shanghai, CIF Rotterdam, EXW, CFR): by far one of the largest drivers of a quoted landed cost.

-

Quantity & delivery schedule: Large, repeat orders reduce per-ton freight and processing overhead. Small lots have higher per-ton handling costs.

-

Packing & export docs: Export packaging, fumigation (if wooden crating), and export paperwork costs are usually small per tonne but matter for small orders.

-

Freight environment: Ocean freight in 2025 remains volatile; a port-to-port shipping rate can swing landed cost by USD 30–150/ton depending on route and fuel surcharges.

We always recommend requesting total landed price (door-to-door or CIF) rather than raw FOB if the buyer wants an apples-to-apples comparison.

Practical buying checklist we use on tenders

When we evaluate suppliers, we always request and verify:

-

Mill Test Certificate (MTC) 3.1 / 3.2 with heat number traceability.

-

Classification society approval (CCS stamp or witness report) if required by the project.

-

Charpy impact reports at the specified temperatures and positions (L/C).

-

Chemical composition table including Ceq or carbon equivalent if welding or heat-treatment considerations exist.

-

Delivery schedule and incoterm with freight element included if comparison is on CIF terms.

-

Third-party inspection options and sample retention policy.

-

Non-conformance and warranty clauses in the contract.

These items reduce downstream risk even if they increase upfront cost.

Supply-chain strategies to reduce cost and risk

We routinely recommend combinations of these approaches:

-

Framework agreements with fixed annual tonnage to lock better mill schedules and improved pricing.

-

Pooling purchase among sister yards to reach MOQ discounts.

-

Accepting standard mill packaging and longer lead times if immediate delivery is not required.

-

Pre-qualifying two or three mills to maintain competition and avoid single-source disruption.

Procurement decisions must balance unit price against schedule certainty and certification risk.

Environmental and regulatory considerations

Shipbuilding steel production has carbon and energy footprints that increasingly impact buyer choice. European and North American buyers increasingly ask for:

-

Mill CO₂ footprints or EPDs (Environmental Product Declarations) to support ESG reporting.

-

Responsible sourcing statements about scrap feedstock and worker safety practices.

These are becoming commercial differentiators for large owners and tier-1 yards; sometimes mills that can provide EPDs command a premium.

Common mistakes we see in AH36 purchases

-

Comparing FOB mill price only without including freight, duties and QA costs — leads to surprises at arrival.

-

Accepting minimal documentation for critical hull structures — what looks cheaper today can cause rejections at classification inspections.

-

Neglecting thickness-specific requirements — impact energy demands on thick plates can force more expensive metallurgy.

We stress that transparent tender specs and supply-team expertise prevent these pitfalls.

Sample technical specification template

We typically include the following minimum in an AH36 purchase spec:

-

Grade: AH36 — CCS certified.

-

Standard: CCS / ASTM A131 (where requested) — mill certificate per EN 10204/3.1 or equivalent.

-

Thickness: [X mm range].

-

Mechanical: Re min 355 MPa; Rm 490–630 MPa.

-

Impact: Charpy V-notch [x J] at [temperature] for L/C zones as required.

-

Tests: UT 100% or spot UT per class; chemical analysis; PMI on request.

-

Packing: seaworthy, fumigated wood skid or steel bundling.

-

Delivery: CIF [port] or FOB [port] — specify incoterm.

How we price an RFQ internally (transparency)

Our method to produce a competitive, realistic landed price:

-

Base mill price — using current market quotations.

-

Processing and testing premium — impact testing, cutting, beveling, UT.

-

Certification & inspection fee — any classification witness or third-party inspector.

-

Freight & insurance — route-specific.

-

Duties & local handling — estimated for import countries.

-

Buffer / contingency — small percentage to cover exchange rate swings or freight surcharge.

This stepwise approach helps avoid underquoting and preserves margins while remaining transparent for clients.

Frequently Asked Questions

Q1 — Is AH36 the same as ASTM A36?

No. AH36 is a shipbuilding high-strength grade (H-series) with higher required toughness and yield (typically Re ≥ 355 MPa). ASTM A36 is a general structural steel with lower strength and different qualification tests. AH36 is specifically tailored and certified for marine use.

Q2 — Can I substitute Q345B or local equivalents for AH36?

Technically some structural steels (like Q345 series) have overlapping strength, but they may not meet class society toughness or certification requirements. For classed ship hulls or offshore work, you should use plates with explicit shipbuilding grade certification (AH/DH/EH families) or obtain class acceptance.

Q3 — What’s the single biggest driver of price variance?

Certification and testing expectations (class society witness, Charpy at lower temperatures, third-party inspection) combined with freight/incoterm selection. Two identical plates with different documentation packages can have materially different landed prices.

Q4 — How long does delivery usually take for certified AH36?

Typical mill lead times for standard thicknesses range from 2–6 weeks if plates are in stock; custom thicknesses, thick plates, or plates requiring additional tests can extend to 8–12+ weeks. Shipping and customs add transit time. Always confirm lead-times with the mill for firm planning.

Q5 — How should I evaluate an overseas quote?

Compare landed prices (CIF or DDP) rather than raw FOB; insist on mill test certificates and, if required, classification witness records; confirm logistics, insurance and local duties to avoid hidden costs. Where risk is high, request sample tests or third-party inspection.