CCS FH40 is a high-strength, low-alloy shipbuilding steel widely used in heavy-duty hull structure and offshore platforms; typical mechanical requirements call for a minimum yield around 390 MPa and tensile strength in the 510–650 MPa band, with mandatory low-temperature toughness in many applications. In 2025 the market price for high-grade ship plates such as FH40 is materially above commodity hot-rolled coil, with regional FOB prices typically ranging from ~USD 500/ton (China) to USD 1,000+/ton (United States, depending on plate thickness and finish) — detailed comparisons follow below.

What FH40 means under CCS classification

We treat FH40 as a “high-strength hull structural” grade recognized by major classification societies (CCS, ABS, LR, BV, DNV, KR and others). The shorthand FH40 is a family name that defines target mechanical properties, mandated impact energy requirements at low temperature for certain deliveries, and typical compositional windows. FH40 occupies the higher end of the common “AH/DH/EH/FH” families, intended for stronger sections and heavy structural applications.

Because classification societies harmonize many requirements, you will encounter FH40 labeled under different authorities with near-identical mechanical criteria; each certificate (e.g., CCS) documents the applicable delivery condition, mill heat treatments and tests.

Metallurgy and chemical composition

FH40 is a low-alloy steel formulated to achieve strength and toughness simultaneously. Typical maximum and minimum elements reported by experienced mill datasheets include low carbon (to keep weldability) plus controlled manganese, silicon and small amounts of niobium, vanadium or titanium for microalloy strengthening and grain-refinement.

A representative composition window used in supplier technical data:

-

Carbon (C): ≤ 0.16%

-

Manganese (Mn): ~0.90–1.60%

-

Silicon (Si): ≤ 0.50%

-

Phosphorus (P): ≤ 0.025%

-

Sulfur (S): ≤ 0.025%

-

Copper (Cu), Nickel (Ni), Chromium (Cr), Molybdenum (Mo), Vanadium (V), Niobium (Nb), Titanium (Ti) — present in trace to low percentages for property control.

To estimate weldability and crack sensitivity mills commonly compute carbon-equivalent formulas (Ceq or Pcm). For procurement, ask your mill for the measured Ceq (or Pcm) for the specific heat number: that value determines preheat and PWHT requirements. The microalloyed approach (Nb, V, Ti) gives higher strength at lower carbon than plain quenched steels, which helps maintain toughness and weldability.

Mechanical requirements and toughness

FH40 is defined primarily by its minimum yield point and tensile range. Typical acceptance criteria from supplier tables and classification rules:

-

Minimum yield strength (Rp0.2): ≈ 390 MPa (56,500 psi)

-

Tensile strength (ultimate): ~510–650 MPa (74,000–94,500 psi)

-

Elongation: minimum elongation values are specified by thickness and standard condition (common minimums are in the range 18–22% depending on plate thickness).

-

Impact toughness: many FH40 deliveries are required to meet Charpy V-notch energy at low temperatures (e.g., -20°C to -60°C depending on the application and society), with notch energy thresholds set by thickness and the classification society’s rules.

These are baseline minima; purchasers often set higher requirements for cold-service or critical offshore fatigue members.

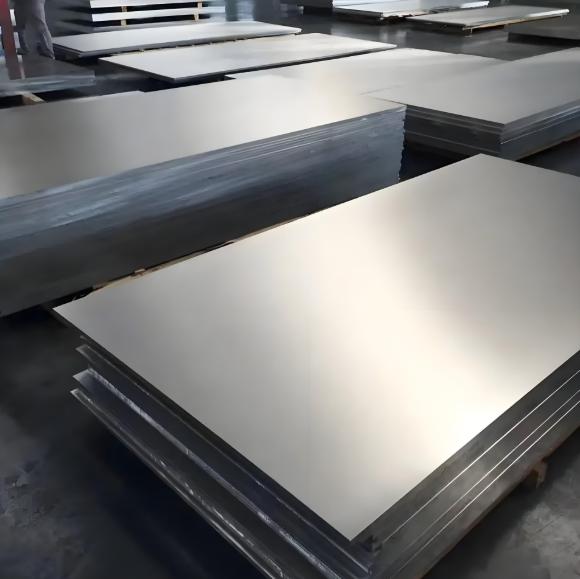

Typical production and delivery conditions

FH40 can be supplied in several delivery conditions:

-

Hot-rolled, normalized (N) — improved toughness and dimensional stability.

-

Quenched & tempered (Q+T or TMCP/controlled rolling) — to reach higher strength/toughness combinations.

-

Thermo-mechanically rolled (TMCP) — common for thick plates to maintain toughness at low temperatures without heavy PWHT.

Thickness ranges commonly offered span from 6 mm to 100+ mm, but practical maximums depend on mill capability and classification society endorsement. Delivery conditions also include surface finish (painted, primed, anti-rust oiled), edge conditioning (squared, bevelled) and required mill test reports (MTRs).

Primary applications in marine and offshore industries

We place FH40 in areas that demand elevated yield strength plus good low-temperature toughness:

-

Hull plating for large commercial vessels and heavy tonnage hulls

-

Structural members: web frames, longitudinals, deck girders and heavy stiffeners

-

Offshore platforms and substructures where high strength reduces section depth and weight

-

Heavy gear foundations or shipbuilders’ structural components that are subject to impact and cyclic loading

Designers choose FH40 when the project favors thinner sections or lighter structural mass while keeping sufficient fracture-toughness margin.

Fabrication: welding, preheat, post-weld procedures

Weldability is central for FH40 buyers. Because the grade aims for high strength with controlled carbon content and microalloying, many FH40 heats have good weldability, but specific practices matter:

-

Preheat: determine preheat temperature from Pcm/Ceq and base plate thickness. A low Ceq reduces preheat need, but heavy sections may still require controlled preheat.

-

Filler metal: use weld consumables with matching or slightly higher strength and compatible toughness; classification rules may require weld procedure qualification.

-

Interpass temperature: keep interpass temperatures within specified limits to avoid temper embrittlement or grain coarsening.

-

Post-weld heat treatment (PWHT): sometimes required for thick sections or when contractually stipulated. PWHT relaxes residual stresses but can slightly reduce strength; the mill and fabricator must coordinate.

-

NDT: ultrasonic testing (UT) and magnetic particle testing (MPT) are commonly applied to critical welds; radiography (RT) may be specified for keel and critical structural joints.

We always recommend that fabricators hold a copy of the mill MTR, Ceq, and the classification society’s guidance before starting welding.

Corrosion resistance, coatings and fatigue behavior

FH40 is not stainless; corrosion protection is essential in marine environments:

-

Protective systems: zinc-rich primers, epoxy paints and multi-coat systems are standard for hulls and exposed parts.

-

Cathodic protection: in some offshore installations, sacrificial anodes or impressed current systems reduce metal loss.

-

Fatigue: welded detail category and surface condition (bevel quality, toe grinding) control fatigue life. Higher strength steels can be more sensitive to weld toe cracking if welds are poorly detailed, so fatigue-friendly detailing and grinding are important.

Selecting FH40 should always be paired with a corrosion mitigation plan matching the service life and inspection intervals.

Quality control, certificates and testing regimes

Classification societies enforce testing at the mill and on delivery:

-

Mill Test Report (MTR) with chemical analysis, mechanical tests (yield, tensile, elongation), and impact test results keyed to heat numbers.

-

Witnessed tests: buyers or the classification society may witness tensile or impact tests.

-

Non-destructive testing: UT scanning, ultrasonic thickness checks and surface inspection.

-

Certificates: CCS certificate (if purchased under CCS rules) or alternative certificates (ABS, LR, BV, DNV, KR) are often requested on the PO.

We advise specifying the exact certificate format and required tests in the purchase order (MTR level 2/3, impact temperature, delivery condition).

2025 market pricing

Prices for shipbuilding plates depend heavily on base raw material (iron ore, coking coal), mill capacity, trade policy, freight, plate thickness and finishing. In 2025 the wider steel market has seen stabilized but regionally variable prices:

-

China domestic/export ship plate market showed average plate prices near USD 500/ton in mid-2025 for commodity ship plates; higher-grade plate like FH40 will have a premium above this baseline.

-

North American structural plate and fabricated plate prices have been materially higher in 2025 driven by tariffs and domestic mill pricing, with plate indices and merchant prices often exceeding USD 1,000/ton depending on product form and thickness.

-

European plate indices in 2025 were intermediate, commonly in the USD 600–700/ton area for commodity hot-rolled plate, with premium for certified ship grades depending on origin and delivery condition.

Key market drivers for FH40 pricing in 2025:

-

Mill capacity and order book: strong shipbuilding programs tighten allocation for certified plates.

-

Classification certificates: plates delivered with CCS/BV/ABS certificates and additional witnessed testing carry a premium.

-

Thickness and processing: thicker plates and quenched & tempered deliveries cost more.

-

Trade rules and tariffs: import duties or quotas can create large price differentials between regions.

-

Logistics & lead time: urgent orders attract surcharges; container/RO-RO vs bulk shipping for plates changes landed cost.

Global price comparison (FOB / approximate ranges, 2025)

Below is a practical, buyer-oriented comparison for standard uncoated shipbuilding plate (note: FH40 requires a premium over commodity plate; presented ranges are indicative and for budgeting — final quotes depend on thickness, certificate, quantity and delivery terms):

| Region / Typical Port (FOB) | Typical 2025 price range (USD / metric ton) | Notes |

|---|---|---|

| China (Qingdao / FOB) | USD 450 – 560 / t | China ship plate averages around USD ~500/t mid-2025; FH40 premium above commodity baseline. |

| India (ex-works / FOB) | USD 560 – 700 / t | Indian plate prices varied; some reports showed ~USD 641/t in June 2025 for plate categories. |

| Europe (North Sea / Mediterranean FOB) | USD 600 – 800 / t | European hot-rolled plate indices averaged in the USD 600+ band in mid-2025; certified ship plate costs more. |

| South Korea / Japan (Pusan / Yokohama FOB) | USD 650 – 900 / t (estimate) | Local mills and import patterns produce variation; marine grades often attract a premium. (Estimate from regional mill price behavior.) |

| United States (Gulf / FOB mill) | USD 1,000 – 1,300 / t | U.S. plate and fabricated plate prices tracked near or above USD 1,000/t in mid-2025 due to domestic pricing dynamics and tariffs. |

How to read this table: numbers are indicative FOB levels for standard hot-rolled plate in 2025. For FH40 delivered with CCS (or other class) certificates, specify delivery condition, thickness, and witnessed tests: expect a 5–20% premium on top of the baseline ranges depending on those variables and order quantity.

How we price FH40 at the factory — practical components

When we produce a formal quotation for FH40 we itemize:

-

Base metal cost — raw material + mill processing (dependent on thickness and condition: HR / N / TMCP / Q+T).

-

Testing & certification — cost to perform and witness mechanical and impact tests, hard-copy MTRs and classification paperwork.

-

Surface & edge prep — shot-blast, oiling, prime or painted finish; beveling and plate marking.

-

Packing & shipping — skid packaging, outturn inspection, containerization or bulk vessel loading.

-

Logistics & insurance — freight to the named FOB port, inland transport to port, insurance during transit if requested.

-

MOQ & discounts — smaller lots cost more per ton; larger lots reduce the unit price.

-

Lead time surcharges — urgent delivery or out-of-line production schedules carry surcharges.

To make quotes comparable, always specify Incoterms (FOB, CFR, CIF), delivery port, plate dimensions, certificates required and QA witness requirements.

Procurement and logistics checklist (what buyers must specify)

We recommend buyers include the following in the PO to avoid ambiguity:

-

Exact grade: CCS FH40 (or FH40 under a named society)

-

Delivery condition: HR / Normalized / TMCP / Quenched & Tempered

-

Thickness and tolerances; width/length ranges and tolerances

-

Impact test temperature and number of specimens per heat/lot

-

Required classification certificate (CCS / ABS / LR / BV / DNV etc.) and witness options

-

MTR level and sample size (e.g., one MTR per heat or per plate bundle)

-

Surface protection: oiled, primed, painted, blasted or raw

-

Packing requirements and special marking or traceability needs

-

Payment terms, Incoterm, and required delivery window

Completeness here reduces change orders, re-testing and unexpected premium charges.

Environmental, regulatory and carbon-cost considerations

Shipbuilders and oil & gas project owners increasingly demand information on embodied carbon and recycled content. For FH40 we can provide:

-

CO₂-eq per tonne estimates from the mill (if the mill calculates cradle-to-gate emissions).

-

Alloy traceability and scrap content information.

-

Compliance checks for local environmental rules or EU carbon border adjustment implications (CBAM). European buyers may face additional compliance costs when importing.

For large projects we recommend asking suppliers for an emissions statement and any mill energy-intensity or renewables usage disclosures; these items are becoming part of award criteria.

FAQs

Q1 — How different is FH40 from FH36 or FH32?

FH40 targets higher yield and tensile levels than FH36 or FH32; that strength increase allows lighter sections but requires stricter control of toughness and heat treatment. For identical thickness and delivery condition, FH40 will be more expensive.

Q2 — Do I always need impact tests at -60°C for FH40?

Not always; the required impact temperature depends on the classification society rules and the intended service temperature. Some FH40 deliveries call for Charpy testing at -20°C or lower; critical Arctic/ice or offshore installations may specify -60°C. Confirm the impact temperature and specimen count at the PO stage.

Q3 — Can FH40 be welded with standard E8018-type electrodes or modern flux-cored wires?

Yes, but choose consumables with mechanical properties equal to or slightly higher than the base metal and with verified low-temperature toughness. Preheat and interpass controls should match the mill’s Ceq and the thickness.

Q4 — How much extra should I budget above commodity plate price?

Expect a 5–20% premium over commodity hot-rolled plate baseline, depending on quantity, mill certificate, thickness, and heat treatment. FH40’s premium reflects both alloying/processing and extra testing/certification requirements.

Q5 — What increases lead time most for FH40 orders?

Thickness selection (very thick plates), special heat-treatment (Q+T) and witnessed classification tests lengthen lead time. Also, production queues at specialized mills and logistics congestion can add weeks. Plan with realistic buffers or accept a price premium for priority production.