In 2025 the market for ASTM A1011 hot-rolled sheet is broadly characterized by moderated but regionally divergent prices — U.S. mill/spot HRC has generally hovered around ~$800–$1,000 / metric tonne, Western Europe around $650–$900 / t, while Chinese domestic HRC has traded in the ~¥3,300–¥3,700 / t (≈ $460–$520 / t) band (converting with mid-2025 exchange rates). These differences come from distinct regional cost structures, scrap supply, local demand/stock levels, and trade policy impacts; buyers who lock specs, source volume, and choose the right commercial terms (FOB vs CIF, domestic vs export coil) are best placed to control landed cost.

What ASTM A1011 covers

ASTM A1011/A1011M is the U.S. standard specification that governs hot-rolled sheet and strip in coils and cut lengths — covering commercial steels, drawing steels, structural steels, high-strength low-alloy (HSLA) steels and ultra-high-strength steels in a range of grades and types. If you quote “A1011” to a mill, you must also define the type (e.g., structural, drawing), grade (e.g., 36, 50, 70), finish (P&O, smooth) and thickness — because the standard is a family rather than a single material.

Common A1011 grades and how they affect price

We must be explicit: A1011 is not a single alloy number; price sensitivity is driven by grade and form:

-

Commercial & Structural grades (A36 / Grade 36 etc.) — often lowest price because chemistry is simpler and yields are high.

-

HSLA and higher-strength grades (50, 60, 70) — higher alloying/processing costs and tighter process control increase price.

-

Drawing steels / surface critical grades — extra finishing (pickling, P&O, skinpass) raises cost versus rough coil.

When you request a quote specify grade, thickness, surface finish and whether laminations (P&O) or pickling are required — otherwise suppliers will price at a generic (and usually higher) basis.

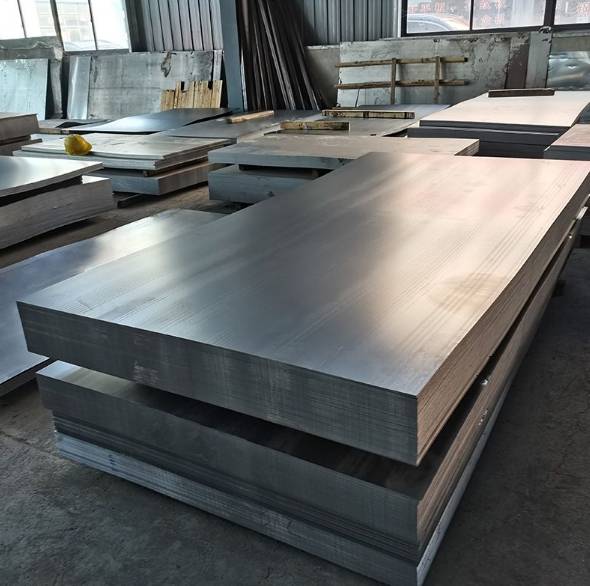

Typical sizes, tolerances, product forms

A1011 material is sold mainly as hot-rolled coil (HRC) or cut-length sheet. Thicknesses commonly range from very light gauge up to ≈6 mm for sheet/strip (A1011 scope), widths depend on mill coil specifications. Surface finish options (plain, P&O) and coil weight (2–25 t typical) influence handling and freight. Always confirm coil weight, as per-coil minimums affect logistics cost.

Mechanical & chemical terms buyers must always set

When you place a purchase order, insist the PO references:

-

Exact ASTM A1011 designation (A1011/A1011M-23 or latest year).

-

Grade & Type (e.g., Structural Grade 50, Type 1).

-

Mechanical limits required (yield, tensile, elongation).

-

Chemical limits for elements that affect weldability and processing (C, Mn, P, S, Si).

-

Test certificate requirement (3.1/3.2 MTC), surface condition, and acceptance tests (UT, eddy current) if needed.

Insisting on an MTC (mill test certificate) and including acceptance criteria in the PO prevents later disputes and avoids hidden rework costs.

How hot-rolling and finishing affect cost

Hot rolling is energy and capital-intensive. Key cost factors:

-

Steelmaking feedstock (scrap, pig iron, DRI) and the scrap cycle — scrap price volatility transmits quickly into HRC.

-

Scale removal & surface treatment (pickling, P&O) add processing time and cost.

-

Slab/capacity utilization — mills running below optimal load tend to raise prices to cover fixed cost. You can lower per-ton landed cost by accepting strip widths or coil weights that match mill run standards.

Market drivers that shaped 2025 prices

In 2025 the steel market was shaped by a cluster of familiar and new drivers:

-

Scrap availability & pricing (primary raw material for electric-arc furnaces). High scrap pushes HRC up.

-

Regional capacity additions and utilization — OECD and industry reports in 2025 flagged significant planned capacity increases that pressured margins and encouraged mills to stabilize prices via cutbacks or commercial offers.

-

Construction and automotive demand — sector demand swings (residential, infrastructure stimulus) created short-term price pockets.

-

Trade policy & tariffs — in 2025 trade measures in major markets created a divergence between domestic mill lists and world export values.

These drivers make prices sensitive to both macro cycles and local trade policy; that is why a single global price is misleading — buyers must benchmark regionally.

Regional price dynamics: what we observed in mid-2025

Below are representative mid-2025 price markers (useful for benchmarking). Note: reported numbers vary by product definition (domestic ex-mill vs export HRC, full coil vs narrow widths) — always confirm the price basis on the RFQ.

-

United States (spot / mill base): typical HRC reported often in the $800–$1,000 / t range (U.S. domestic list and spot indices showed readings near $830–$980 / t at different points). These reflect domestic mill lists and futures.

-

Western Europe: commonly $650–$900 / t depending on grade and ex-works vs delivered.

-

China (domestic): local HRC spot indexes were around ¥3,300–¥3,700 / t (≈ $460–$520 / t when converted with mid-2025 FX). Chinese domestic prices are often lower on a USD basis but local freight and value-added finishing change landed cost for export buyers.

-

World export benchmark (SteelBenchmarker world export HRC): historically lower than U.S. domestic, used for international trade comparisons (e.g., world export indices near $440 / t on sample mid-2025 snapshots).

Always check whether the quoted number is ex-works, FOB, CIF, or DDP.

Global price comparison (mid-2025 markers)

Table: representative benchmark prices (mid-2025). These are intended as benchmarks only; always confirm the quote basis from your supplier.

| Region / Basis | Representative price (per metric tonne) | Notes / basis |

|---|---|---|

| USA — domestic HRC (spot/mill) | $830–$980 / t | U.S. domestic indices and futures show readings in this band (varies by date & supplier). |

| Western Europe — domestic | $650–$900 / t | Depends on grade, VAT, and delivery zone. |

| China — domestic HRC | ¥3,300–¥3,700 / t (~$460–$520 / t) | Local index readings (CNY) converted at mid-2025 FX (~¥7.18 per USD). |

| World export HRC | ~$440 / t (indicator) | SteelBenchmarker world export figure (snapshot); export basis excludes inland freight. |

| Typical FOB China (coils, common grade) | $480–$620 / t | Added mill packing, export paperwork, and port handling; depends on grade & volume. (Derived from CNY domestic + export premiums / logistic costs). |

How to read this table: the lowest headline number (e.g., China domestic) does not always produce the lowest delivered cost to your plant — freight, duties, inland haul, and finishing matter.

Common commercial terms and how they change price

When you compare RFQs ask suppliers to state clearly:

-

Price basis: EXW / FOB / CFR (CIF) / DDP. A $/t EXW mill price will be much lower than CIF delivered to your port.

-

Incoterm validity: Include port name and currency.

-

Payment terms: L/C at sight vs 30/60/90 days open account — payment terms materially affect pricing.

-

Lead time & coil holding: stock items (in mill warehouse) cost more per tonne but reduce delivery time and demurrage risk. Luokaiwei commonly holds stock SKU options for fast shipment.

Ask for a price break by volume and confirm whether prices include standard mill packaging and MTC.

Procurement tactics to reduce landed cost

We advise buyers to:

-

Standardize on 1–2 grades across projects to increase order volume and obtain better mill pricing.

-

Be explicit in RFQ: grade, thickness, finish, MTC class, mechanical acceptance criteria, coil weight tolerance, and required inspection regime.

-

Request both EXW and CIF quotes to see the true logistics delta.

-

Negotiate a rolling contract (monthly or quarterly) for predictable volumes to secure mill priorities and reduce spot premium.

-

Use local stocking and split shipments if demand is lumpy to cut demurrage and storage fees.

-

Audit sample MTC and perform pre-shipment inspection (PSI) for critical projects.

These actions often reduce the total cost of ownership more than squeezing the unit price alone.

Why choose Luokaiwei (what we offer)

At Luokaiwei we combine China mill access with B2B logistics expertise. In plain terms:

-

Factory pricing advantage — as a manufacturer / vendor with factory ties we can offer 100% factory-price competitiveness on many A1011 product lines (mill direct or mill-approved sourcing).

-

Fast stock delivery — we maintain a rotating stock of common A1011 coils and cut sheets for rapid shipment; stock SKUs qualify for expedited EXW/FOB handling.

-

Customization — we support cut-to-length, slitting, special coil weights, and custom stamping/packaging as required.

-

Support for documentation — 3.1/3.2 MTCs, SGS/third-party inspection on request, and export paperwork for CIF/FOB shipments.

-

Export experience — we routinely quote FOB Qingdao/Shanghai and handle logistics to major consuming regions; we advise on duties, inward processing and optimal incoterms for your jurisdiction.

If you need a Delta analysis (EXW vs CIF vs delivered), we can generate a comparative landed cost sheet for your port and required grade.

Logistics, lead times & stock recommendations

Typical lead times:

-

Stock coils (in China): ready for shipment in 1–14 days depending on packing and port queue.

-

Mill orders (custom thickness/grade): 4–8 weeks typical for production slots; premium for rush.

-

Export transit: East Asia → Europe/North America takes 20–35 days sea freight depending on routing and port rotations.

Advice: for critical projects request buffer stock and arrange partial shipments; for smaller buyers, aggregated purchases (via a trusted supplier like Luokaiwei) reduce per-ton freight and MOQ friction.

Sustainability, certification & technical checks

Buyers increasingly request:

-

MTC (mill test certificate): 3.1 attestation or 3.2 inspector certificate depending on PO.

-

CO₂ / ESG disclosures: mills now supply cradle-to-gate CO₂ intensity on request (useful for tenders requiring embodied carbon reporting).

-

Third-party inspection: visual, thickness, UT testing for critical structural applications.

Luokaiwei can coordinate third-party inspection and provide certified documentation before shipment.

Practical sample calculation (how buyers convert indices to landed price)

Example approach (simplified):

-

Take domestic ex-mill» price (e.g., China ¥3,466 / t).

-

Add mill packing & export premium (USD 20–40 / t).

-

Add port handling & shipping (varies; East Asia→Europe sea freight + terminal handling ≈ USD 80–160 / t depending on rates and season).

-

Add import duty & VAT (if applicable).

-

Add inland haul and last-mile handling.

This method shows why a lower domestic index does not always give the lowest CIF/DDP landed cost.

FAQs

Q1 — What is the best price basis to request on an RFQ?

A1 — Always request EXW, FOB and CIF/DDP quotes for the same SKU so you can see the logistics delta. If you have local import experience, FOB lets you control shipping and insurance; if not, CIF or DDP simplifies procurement but increases unit price.

Q2 — Are A1011 and A36 the same?

A2 — No. A36 is a single structural grade commonly used in plate/structural steel. A1011 is a broader sheet/strip specification covering multiple types and grades (including structural grades similar to A36). Always specify the exact grade and mechanical requirements.

Q3 — How much does surface finish affect price?

A3 — Surface finish can add tens of dollars per tonne (pickling, P&O, skinpass). Drawing steels and surface-critical strips cost more than rough coil. Get explicit finish requirements in the RFQ.

Q4 — What documents should I insist on in the PO?

A4 — Reference the ASTM A1011 year, grade, type, exact mechanical and chemical acceptance criteria, required MTC class (3.1/3.2), pack standards and inspection rights (PSI), plus Incoterm and port. This minimizes ambiguity and exposure to claims.

Q5 — How can Luokaiwei help reduce lead time?

A5 — We offer stock coils for many common A1011 SKUs, slitting and cut-to-length services in China, and coordinated export bookings — which can cut delivery from typical production lead time down to days for stocked items.

Closing practical checklist for purchasers

When evaluating quotes, check that each supplier provides:

-

Price basis and currency.

-

Exact ASTM A1011 designation and grade.

-

Coil weight tolerance and packing description.

-

MTC and inspection options.

-

Lead time, validity period, and payment terms.

If you’d like, we can prepare a side-by-side landed cost worksheet (EXW vs FOB vs CIF delivered to your port) — tell us cargo port and annual tonnage and we’ll run the numbers.