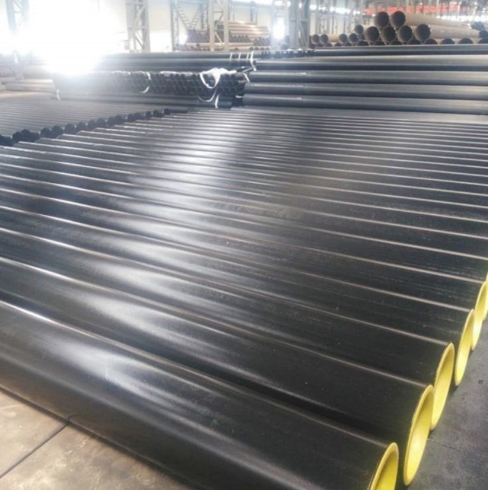

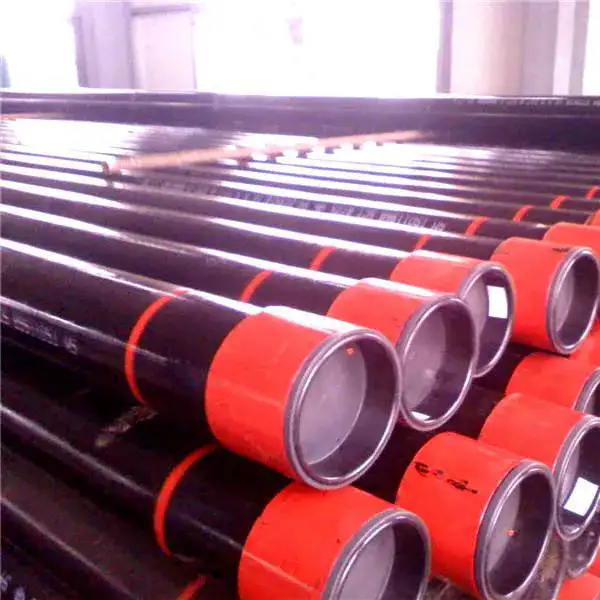

For most conventional onshore and many shallow offshore oil and gas wells in 2025, API 5CT N80 Type Q tubing remains a cost-effective high-strength choice when collapse and burst resistance are required but P-series (P110, etc.) are not necessary. N80-Q is mechanically stronger than N80-1 because it is quench-and-tempered, and widely available in standard tubing diameters (2-3/8″, 2-7/8″, 3-1/2″, 4-1/2″) with weights and wall thicknesses defined in API 5CT tables. For buyers seeking the best total landed cost in 2025, Chinese manufacturers (including Luokaiwei) typically offer the most competitive FOB/FOB-China bands and fast delivery on stocked items, while North American and European sources command premiums due to tighter certification and testing expectations.

What is API 5CT N80 Type Q?

API 5CT is the American Petroleum Institute specification for casing and tubing used in oil and gas wells. N80 is a medium-to-high strength OCTG grade used for tubing and casing where higher yield strength and resistance to compression are required. Type Q (N80-Q) is the quench-and-tempered variant of N80 intended to provide improved collapse and burst performance compared with the normalized and tempered N80-1. The standard and its tables set sizes, mechanical minima, allowable chemistry windows, and testing requirements for these products.

How N80-Q differs from N80-1 (why choose Q)

-

Heat treatment: N80-Q is quench + temper; N80-1 is normalized + temper. That single difference raises collapse resistance and internal yield capacity for N80-Q.

-

Design effect: In wells where collapse or internal burst margins are tight (deep water or high differential), N80-Q is preferred where P-grades would be overkill or too costly.

-

Application note: N80-Q is commonly used for tubing in medium-depth production wells and in many completion components (pup joints, packer mandrels, etc.).

Key mechanical & chemical requirements (what to ask for)

When you specify N80-Q tubing in a purchase order, the following items are minimums to require in the mill/test paperwork:

-

Standard: API Spec 5CT (refer to the current edition and include the edition number on the PO).

-

Grade & Type:

N80-Qexplicitly (do not accept ambiguous “N80” without type). -

Minimum longitudinal/Yield strengths and tensile: follow API tables for N80. (API 5CT and API 5C3 provide the calculation practice for collapse and burst ratings.)

-

Chemical limits: typical carbon, manganese, silicon and microalloying windows are defined in API tables and mill certified chemical reports must be provided. (Ask for full mill test report — MTR / chemical and mechanical.)

-

Nondestructive tests & hardness: hardness limits and NDE (UT, PMI where required) — especially for PSL2 or special orders.

Common tubing sizes and a compact dimensional table

API tubing sizes are standardized in API 5CT tables. The most frequently used production tubing sizes are 2-3/8”, 2-7/8”, 3-1/2”, and 4-1/2”. Below is a condensed table with representative nominal weights and wall thicknesses that teams use for procurement and hydraulic calculations. (Values shown are typical nominal sections from API tubing tables — always confirm the exact row in the API table for final engineering.)

| Nominal Size (inch) | OD (in) | Typical Weight (lb/ft) | Nominal Wall (in) | ID (approx) | Typical Use |

|---|---|---|---|---|---|

| 2-3/8″ | 2.375 | 4.7 — 8.5 | 0.103 — 0.276 | ≈ 1.973 — 1.823 | Slim/ESP, packer strings |

| 2-7/8″ | 2.875 | 6.5 — 11.5 | 0.109 — 0.406 | ≈ 2.657 — 2.063 | Conventional production tubing |

| 3-1/2″ | 3.500 | 10.2 — 17.0 | 0.289 — 0.530 | ≈ 2.992 — 2.440 | High rate wells, gas lift |

| 4-1/2″ | 4.500 | 12.6 — 26.1 | 0.271 — 0.630 | ≈ 3.958 — 3.240 | Larger production strings, workover conductors |

(Full API reference tables provide many more weight options and drift IDs for each nominal OD.)

Global pricing — 2025 snapshot and procurement guidance

Prices for OCTG tubing vary by grade, quantity, certification (PSL1 vs PSL2), thread/coupling finish, and market region. In 2025 there is still a clear regional spread due to mill capacity, freight, and certification overheads.

2025 approximate price ranges (USD / metric ton) — typical order sizes

Note: these are market ranges observed from multiple suppliers and industry price notices in 2025; your exact landed cost depends on quantity, thread makeup, inspection, and contractual incoterm. Use these ranges only for budgeting; request live quotes for firm pricing.

| Region | Price range (USD / ton) — typical 2025 band | Notes |

|---|---|---|

| China (FOB Chinese ports) | $600 — $900 / t | Most competitive FOB bands; large volume exporters and stockists; fast stock delivery. |

| India (FOB / EXW) | $700 — $950 / t | Growing domestic capacity; mixed quality bands — check mill certificates. |

| Middle East (regional stockists) | $750 — $1,000 / t | Regional premiums due to demand and logistics. |

| Europe (EU/UK suppliers) | $850 — $1,300 / t | Higher testing/certification costs; smaller & traceable supply chains. |

| North America (US/Canada) | $900 — $1,400 / t | Local mills and distributors; higher inspection and traceability expectations. |

How to read this table (practical tips):

-

Chinese mills typically provide the lowest FOB invoice but add freight, duty and inspection costs for landed price. Luokaiwei offers factory pricing advantage and rapid shipment for stock items — this can shave weeks off lead time and lower total landed cost for large orders.

-

If your project demands PSL2, VAM/VAM-TOP or API Monogram, expect a premium (often several hundred USD/ton extra) from Western suppliers because of added testing and country-specific approvals.

Quality, testing and traceability — what must be on an MTR

Ask your supplier for:

-

Mill Test Report (MTR) showing heat number traceability, full chemical analysis and mechanical tests.

-

Heat treatment records confirming quench & temper (for N80-Q) — this is the critical distinction from N80-1.

-

Hardness report (HRC/HB) and any NDE performed (UT, PMI) if specified.

-

API Monogram or API 5CT compliance statement (if applicable) — buyers for sensitive projects often require API-monogram certification.

Sourcing strategy — buy from China (Luokaiwei) or locally?

-

When to source from Luokaiwei / China: you need competitive FOB/FOB-China pricing, customization (threads, pup joints, limited premium connections), fast fulfillment from local stock, and are willing to handle overseas inspection or third-party inspection (TPI). Luokaiwei emphasizes factory pricing advantage, one-stop OCTG customization and short lead times on stocked items.

-

When to source locally (North America / Europe): your project requires PSL2, API Monogram, special metallurgical documentation, or client-mandated domestic procurement. Local vendors reduce customs complexity and often meet strict HSE and procurement rules.

Handling, storage and run-in tips (field best practices)

-

Keep tubing bundles off the ground, covered, and rotate stock FIFO. Protect threads with end caps and thread protectors.

-

During make-up, verify thread compound compatibility and run torque within vendor specs. Avoid over-torquing upset joints.

-

For long laydown periods, request post-manufacturing UT checks if storage exceeded specified duration. API RP 5C1 and API RP 5A5 give practical inspection recommendations.

Practical procurement example (ballpark)

Example: 50 metric tons of N80-Q tubing (2-7/8″, 9.5 lb/ft upset) — buyer in Europe needs PSL2 and API Monogram. Expect:

-

China FOB quote: ~$700/t but with added PSL2 cost + TPI + freight + duty → landed in Europe ~ $950–1,050/t.

-

European supplier quote: ~$1,050–1,300/t landed (shorter lead time; full local support).

Negotiation levers: larger volume, acceptance of standard BTC threads, or flexible shipment windows will lower per-ton price.

FAQs

Q1 — Is N80-Q magnetic or an alloy?

N80 is a carbon/microalloyed steel grade, not an exotic stainless or nickel alloy — it is ferromagnetic. N80-Q is simply the quench-and-tempered variant of the same chemical family.

Q2 — Should I specify PSL1 or PSL2?

PSL2 adds stricter manufacturing and testing controls (more stringent traceability, additional mechanical and chemical checks). For critical wells, high temperature, sour environments or client demands, specify PSL2. For many conventional applications PSL1 is acceptable and cheaper.

Q3 — How much stronger is N80-Q vs N80-1?

Mechanically they share nominal chemical composition but N80-Q’s quench & temper typically yields higher collapse and burst strength. Exact numbers depend on wall thickness and OD — check API 5CT tables or supplier collapse/burst charts for the selected size.

Q4 — What delivery lead-times should I expect in 2025?

Small stocked orders from Chinese exporters: 2–8 weeks depending on stock and inspection. Large or custom PSL2 orders: 8–20+ weeks depending on mill queue and certification requirements. Always include inspection windows in your timeline.

Q5 — How to spot a low-quality OCTG offer?

Watch for missing MTRs, vague grade labels (simply “N80” without type), prices that are far below market with short lead times and no TPI option. Always require full documentation and independent inspection for high-value orders.

Final procurement checklist

-

Specify API 5CT edition, grade N80-Q, PSL level, thread type, upset/non-upset, length range, inspection request, delivery incoterm, and penalty/acceptance criteria.

-

Insist on MTR and heat-treatment certificates.

-

Consider third-party inspection for first orders.

-

For best landed value in 2025, request Luokaiwei’s factory FOB offer and a parallel quote from local distributors for a full landed-cost comparison.

Why Luokaiwei

Luokaiwei is a China-based OCTG manufacturer with stock and custom manufacturing capability. For global procurement teams that value lower per-ton FOB costs, short lead time on stocked items, and tailor-made thread/upset options, Luokaiwei provides 100% factory price advantage and rapid processing for stocked items. We support PSL1/PSL2 orders, custom pup joints and premium handling for export markets. Contact Luokaiwei for a comparative live quotation (include grade, size, quantity, inspection level, and required threads).

Official references

- API — Specification 5CT (Casing & Tubing) — API announcement and edition information

- Api 5ct N80 Type Q Tubing Pipes

- Wikipedia — Production tubing (background on tubing applications and common sizes)

- OilProduction.net — API tubing and casing tables (dimensional reference PDF)

- US EPA — Well integrity case study (references to API 5CT and related recommended practices)