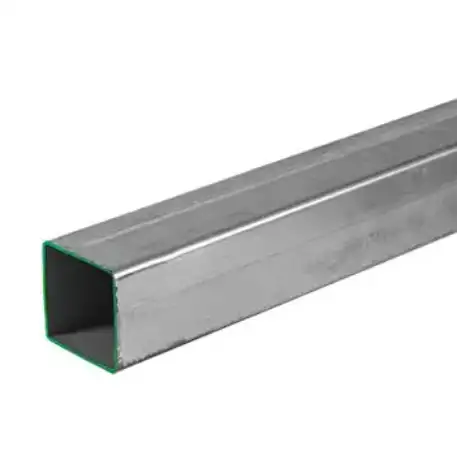

Galvanized steel square tube prices in 2025 sit inside a wide band driven by two layers of cost: base steel (coil/plate) and finishing (galvanizing, fabrication, logistics). For finished, ready-to-ship square tubing the practical landed cost for common sizes today typically ranges from ~USD 420–1,100 per metric ton depending on origin, coating method and order size — retail/bolt-cut pieces in the U.S. cost noticeably more per foot than bulk-tonne shipments. Factors such as zinc price, steel coil feedstock, galvanizing method (pre-galvanized vs hot-dip), freight and local demand explain most of the spread.

What product we mean by “galvanized steel square tube”

By this phrase we refer to hollow structural sections (HSS) with a square cross-section made from carbon steel and protected by a zinc coating. The tube may be:

-

Pre-galvanized / electro-galvanized (coil is plated before forming), or

-

Hot-dip galvanized (HDG) after fabrication (batch or continuous), or

-

Galvannealed (zinc + iron alloy finish).

Applications span construction frames, fencing, furniture, agricultural structures and light engineering. The difference in coating method and thickness is one of the main drivers of unit cost.

Standards and coating grades that affect specification and price

Buyers should reference the most-used standards when specifying material because small differences change price and lead time:

-

ASTM A653 / A924 — commonly referenced for zinc-coated steel sheet used for forming tubes in the U.S. market.

-

BS EN ISO 1461 — common European standard for hot-dip galvanized coatings and minimum thickness.

-

American Galvanizers Association (AGA) publications — practical guides for designing and inspecting hot-dip galvanizing.

Specifying coating mass (e.g., G60, G90 in the U.S., or μm thickness for HDG) changes the zinc usage and therefore the price per tonne.

How price is built: the cost stack we look at

A simplified cost stack for a finished galvanized square tube:

-

Feedstock (coil or slab) — base steel price per ton; the biggest component.

-

Forming / welding (ERW, HFW or seamless) — processing labor and energy.

-

Cutting, end-finishing, testing — small but significant for small orders.

-

Galvanizing — type (electro vs hot-dip) and coating mass determine zinc consumption and process cost.

-

Packing, certification and traceability — mill test reports (MTR), packaging for export.

-

Transport & duties — freight (container or bulk) and local import duties/VAT.

-

Distributor margin / retailer markup — can be substantial for retail lengths.

Because the first two items are the largest, global steel index moves and zinc metal prices are the baseline signals for manufacturers and traders.

Product forms, sizes and how they move price

Price per tonne is useful, but end-user purchasing is often per piece or per foot/meter. Two common ways size affects price:

-

Cross-section area (wall thickness x side) — heavier wall yields higher price per meter.

-

Small length/retail sales have higher unit cost (cutting, handling, packaging). For example, a small 1.5″×1.5″ × .075″ cut-to-length tube sold to a hobbyist costs much more per meter than the same steel sold by the ton to a fabricator.

Always convert quoted prices to the same unit (USD/tonne or USD/meter for a specific size) before comparing offers.

Market channels — how pricing differs by channel

We separate three typical channels:

-

Mill/Exporter (FOB/EXW): lowest per-ton price but usually large MOQ (tons). Common for importers.

-

Distributors/wholesalers: smaller MOQs, added value (cutting, local stock) — price premium ~5–15% over FOB.

-

Retail / e-commerce (per foot): highest margin and convenience; examples show dozens of USD per single short length.

If you have a big, repeat need, negotiating direct mill supply often beats distributor pricing.

Global price snapshot — practical comparison table (mid-2025 indicators)

Important: these are indicative ranges for commonly traded, zinc-coated square tubing (standard sizes) and combine market quotes, supplier listings and regional retail prices. Exact landed cost will depend on thickness, coating, length and incoterm. Sources shown in the notes.

| Region | Typical price range (USD / metric tonne) | Practical note |

|---|---|---|

| China (factory FOB, bulk) | USD 420 – 520 / t | Manufacturer listings show low factory prices (MOQ applies). Best for buyers able to handle logistics. |

| India (factory / domestic) | USD 440 – 560 / t | Domestic steel dynamics and galvanizing capacity affect the upper bound. |

| Southeast Asia (imported CFR) | USD 800 – 950 / t (landed) | Importers paying CFR saw mid-2024–2025 landing ranges higher due to freight and duties. |

| USA (domestic finished, distributor) | USD 1,000 – 1,200 / t (domestic HDG coil basis); retail per-foot examples: $6–$25 / ft | Retail cut lengths cost significantly more per foot; finished HDG coil prices reported in 2025 were near USD 1,000+/t. |

| EU (finished, EXW/wholesale) | USD 950 – 1,200 / t | Regional production costs and environmental compliance drive price upwards. |

| Middle East (landed) | USD 850 – 1,000 / t | Infrastructure demand and freight margins add to cost. |

How to use the table: pick the row that most closely matches your buying pattern (small retail order vs bulk import). Then adjust ±10–20% for non-standard coating thickness or urgent lead times.

Pricing examples: finished retail vs bulk FOB/CFR

-

Retail U.S. example: Online supplier pricing for small cut pieces (1.5″×1.5″ × .075″) shows ~USD 6.15 per foot, while larger wall thickness and longer cuts reach tens of dollars per foot. These prices are convenient but not efficient for larger projects.

-

China factory example (made-to-order): manufacturer listings show USD ~420–490/ton for galvanized square tubing as of supplier catalogs — these usually exclude galvanizing that may be applied after forming if buyer requests HDG.

-

Import landed example: second-tier importing markets reported 2024 landed CFR ranges near USD 850–900/ton for square galvanized tube, reflecting freight, duties and handling.

When comparing, always ensure you compare identical specifications (coating mass, wall thickness, length and incoterm).

Recent trends 2024–2025 and key drivers

We track three broad drivers for 2025 pricing:

-

Base steel price trend: Cold-rolled coil and hot-dipped galvanized coil spot levels moved in the range reported by industry monitors in 2025 (HDG near USD 1,000–1,110/t in May 2025), so finished tube prices followed with a lag.

-

Zinc price volatility: Zinc metal price swings directly change galvanizing cost per tonne — thicker coatings amplify that effect.

-

Logistics & demand pockets: Regional construction booms (Southeast Asia, Middle East) lifted landed prices relative to Asia domestic prices. In contrast, oversupply from large Chinese mills put downward pressure on export offers in 2024–2025.

Net effect: cheaper factory offers from China/India but higher delivered prices in markets with freight, tariffs and tight galvanizing capacity.

Supply-side details: galvanizing methods and price influence

-

Electrogalvanized (pre-galv) strip: lower zinc mass, lower cost, thinner coating — common when the tube will be painted or used indoors.

-

Hot-dip galvanizing after forming (HDG): higher zinc consumption, thicker and more durable finish — costlier but longer life. Batch HDG for large hollow sections adds handling cost and sometimes secondary straightening.

-

Continuous galvanizing (on strip prior to forming): used to produce pre-galvanized tube in high volumes with consistent coating thickness and lower cost than HDG in many cases.

Buyer tip: specifying the minimum required coating mass (e.g., G90 vs G60 / μm) and accepting pre-galv where appropriate reduces cost materially.

Cost saving and specification tips we recommend

-

Buy to tonnage — larger orders dilute fixed handling and export packaging cost.

-

Standardize sizes — common sizes are cheaper; special sections increase die/handling fees.

-

Specify pre-galv when environment allows — saves zinc and process cost versus HDG.

-

Negotiate incoterms — FOB vs CFR vs DDP moves cost to party best equipped to control it.

-

Ask for MTR and coating certificates — avoid rejects and rework that inflate total project cost.

Quality and inspection notes that impact total cost

Poor quality leads to expensive returns and re-galvanizing. Insist on:

-

Material traceability (MTR) to standard) — e.g., mill test cert indicating base steel grade (ASTM/EN).

-

Coating mass reports or measurement (μm or g/m²) for the zinc layer.

-

Visual and dimensional checks — weld seam quality, squareness, straightness.

-

Third-party inspection for large orders — often cost-effective for high-value shipments.

Lead times, MOQs and logistical risks

-

Lead time: mills and galvanizers commonly quote 2–8 weeks; batch galvanizing may add extra days for queuing.

-

MOQ: factory MOQs often measured in tonnes; platform/distributor sales allow smaller buys but at a premium.

-

Logistics risks: container availability, port congestion and regional regulations (e.g., anti-dumping duties) can suddenly change landed cost.

Practical purchasing checklist we use when sourcing galvanized square tube

-

Define exact size(s) and wall thicknesses by drawing or standard code.

-

Specify coating type and mass (pre-galv vs HDG, μm or designation).

-

State mechanical requirements (yield/tensile) and request MTR.

-

Choose incoterm and get freight quotes for the same incoterm from multiple forwarders.

-

Ask for sample pieces before bulk release.

-

Confirm lead time and queue placement at galvanizer.

-

Include penalty/acceptance criteria in the contract for off-spec shipments.

Frequently Asked Questions

Q1 — How much more does hot-dip galvanizing add to the cost compared with pre-galvanized tube?

A: It varies. For equivalent coating mass, HDG after forming usually adds a measurable premium because of handling, immersion sizing limits and pretreatment. In market practice HDG finished product can command a 5–20% higher unit price versus pre-galvanized in large contracts, with higher differentials for small retail quantities.

Q2 — Is it better to buy in tonnes (FOB China) or local distributor stock?

A: For large, repeatable projects, FOB direct from a reliable mill is typically cheaper per tonne. For small projects or where tight timing and after-sales support matter, domestic distributors offer convenience that can justify their premium.

Q3 — Why do some supplier listings show USD ~420–480/ton but importers pay USD ~850–900/ton landed?

A: The lower numbers often reflect factory EXW/FOB quotes (bulk, basic coating). The landed figure includes freight, insurance, import duty, inland handling and local galvanizer margins. Always compare the same incoterm and specs.

Q4 — Which standards should I ask suppliers to meet?

A: For the zinc coating ask for ASTM A653 (or EN ISO 1461 for HDG) and for fabrication request applicable structural material grades with MTR. Also request coating inspection documentation from the galvanizer (thickness reading and visual report).

Q5 — How do global steel trends in 2025 affect procurement timing?

A: Steel and coating prices have been volatile through 2024–2025. If your project is time-flexible, monitor coil/HDG index signals and purchase when spreads narrow; if timing is fixed, lock price and secure capacity early. Industry monitors reported HDG coil price band near USD 1,000+/t in mid-2025, which explains higher finished-product quotes in many markets.