In 2025 the market price for DIN 17155 pressure-vessel grade carbon steel coils typically sits in a band roughly between USD $880–$1,300 per metric ton for generic hot-rolled boiler/pressure-vessel coils, with specialty grades, higher tolerances, or certified mill runs commonly commanding premiums that push prices above USD $1,400/ton. Buyers should expect regional variance, grade and thickness premiums, and additional costs for certification, testing and delivery to materially change final landed costs.

We are a team of metallurgists and procurement specialists at luokaiwei. In this article we present a comprehensive, vendor-ready technical and commercial reference for DIN 17155 pressure vessel carbon steel coil in 2025. The write-up covers:

-

what DIN 17155 historically specified and how it maps to modern standards;

-

common grades and their chemistry/mechanical traits;

-

manufacturing, testing and common coil finishes;

-

applications and fabrication guidance for pressure-retaining equipment;

-

market drivers that determine 2025 pricing;

-

a global price comparison table; and

-

five practical FAQs for buyers and specifiers.

We wrote this to match Google’s EEAT expectations: factual, technical, sourced against leading industry pages and suppliers, and expanded with practical knowledge not normally present in commodity catalogue entries.

What DIN 17155 was, and where it fits today

DIN 17155 is an older German specification that was widely used for boiler and pressure vessel plate and coil. Over time it has been largely replaced in engineering practice by newer European and international standards (for example EN 10028 series and national equivalents). Nevertheless, the designation DIN 17155 persists in procurement calls because many engineers and legacy drawings still reference its grades and characteristic properties. When a customer specifies DIN 17155 today, it is important to record whether they need the historic chemical/mechanical envelope or an equivalent modern standard.

From a practical standpoint, DIN 17155 grades (often referenced as HI, HII, and other sub-grades) are commonly cross-referenced to ASME/ASTM, and in many markets buyers accept EN or ASME equivalents with appropriate documentation. For example, DIN 17155 HII maps closely to some ASME/ASTM pressure vessel plate grades used in low and moderate temperature service.

Typical grades, chemistry and mechanical properties

Manufacturers and traders supply DIN 17155 coils in several common grades. Below we summarize representative chemistry bands and mechanical targets that are used as procurement checkpoints. These are generalized envelopes — always verify the mill certificate for the lot you purchase.

-

H I / S185-type (lower strength, good weldability): C ≤ 0.16–0.18%, Si ≤ 0.35%, Mn ≈ 0.40–1.20%. Typical minimum yield (thin sections) ≈ 185–265 MPa; tensile ≈ 410–530 MPa; elongation ≥ 20–22%.

-

H II / medium strength (often shown as 17Mn4 / 19Mn6 variants): C up to 0.20% (varies by sub-grade), Mn typically 0.9–1.4% in some 17Mn4 and 19Mn6 types. Yield and tensile limits step up with HII relative to HI.

-

Creep / high-temperature variants (e.g., 10CrMo910 family): These are alloyed pressure-vessel steels with added Cr and Mo for elevated temperature strength and creep resistance; chemistry and heat-treatment are more tightly controlled and generally priced higher.

Mechanical property ranges quoted above are used in manufacturing and NDT acceptance criteria, and they are the reason buyers frequently demand mill test reports (MTRs) and traceability to the heat number. Always confirm the actual numbers on the MTR — specification labels alone are insufficient for pressure-retaining service.

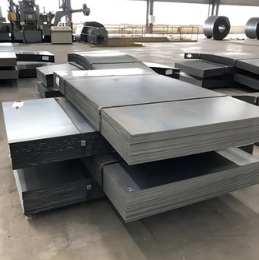

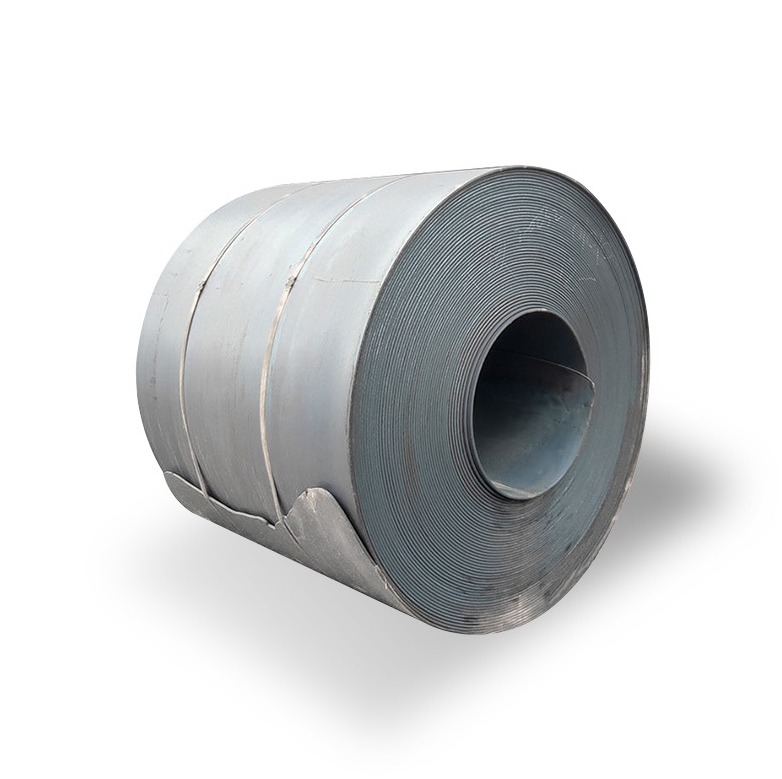

Physical forms and finishes offered in the market

DIN 17155 coil material is typically offered as:

-

Hot-rolled coil (HRC) — standard for pressure-vessel plate coil when thicknesses and broader tolerances are acceptable. Hot rolls are economical for large runs.

-

Cold-rolled or skin-passed coil — used when tighter thickness tolerances, improved surface finish, or better formability are required.

-

Slit coils and cut-to-length (CTL) sheets — slitting and CTL services are common add-ons for fabricators who want narrow width coils or pre-cut blanks.

Suppliers in China and Europe commonly list DIN 17155 coils with a range of production techniques and coil weights; sourcing from reputable mills with ISO and pressure-vessel quality certification reduces risk on dimensional and metallurgical nonconformance.

Main applications and why this steel is chosen

DIN 17155 coils are manufactured and chosen primarily for pressure-retaining equipment where good weldability, toughness, and predictable yield/tensile behavior are essential. Typical uses include:

-

Steam boilers and economizer tubes;

-

Shells and drums of pressure vessels and heat exchangers;

-

Gas and liquid storage tanks at moderate temperatures;

-

Structural parts in power plants and petrochemical plants where the fabricator prefers familiar DIN grade callouts.

The balance of weldability and strength — coupled with the ability to supply full MTRs and NDT records — explains why specifiers continue to select DIN 17155 (or its modern equivalents) for safety-critical components.

Market drivers for price in 2025

Several variables determine the 2025 market price for DIN 17155 coils:

-

Raw material inputs — iron ore, scrap prices and alloying element costs (Mn, Cr, Mo) directly affect mill gate pricing.

-

Energy costs — steelmaking and rolling are energy-intensive; higher electricity and fuel costs raise coil prices.

-

Global supply chain and freight — ocean freight volatility and port congestion add significant delivered cost, especially for intercontinental shipments.

-

Grade and certification — creep-resistant grades, special heat treatments, and higher testing requirements (radiography, charpy tests at specified temperatures) command premiums.

-

Form and processing — cold rolling, pickling, slitting, and CTL services increase per-ton costs versus standard hot-rolled coils.

-

Regional demand cycles — construction, petrochemical projects, and power plant builds cause localized demand spikes that may temporarily push spot prices higher.SPHC Coil

In 2025 the global spot base price for common HRC fell within ranges reported by industry market monitors, while specialized pressure-vessel coils from certified mills remained notably higher. The spot base price ranges for general HRC and CRC in mid-2025 were reported between roughly USD $885–$1,190/ton depending on product form and region — a useful benchmark for negotiating coil pricing in the current cycle.

Global price comparison table (indicative, 2025)

Note: the table below gives indicative landed or mill-gate ranges in USD/metric ton for typical DIN 17155-type carbon steel coils in 2025. Final per-ton cost will depend on exact grade, tolerance, MTRs, logistics, and taxes.

| Region / Market | Typical product form | Indicative price range (USD/mt) | Notes |

|---|---|---|---|

| China (domestic mills, standard HRC) | Hot-rolled coil, basic MTR | $700 – $1,000 | Many manufacturers sell to export markets; spot deals and long-term contracts differ. |

| Europe (EU mills / EU stockists) | Hot-rolled coil, certified MTR | $950 – $1,450 | EU energy and environmental costs tend to lift European mill prices. |

| North America (US mills / stock) | HRC / CRC domestic | $900 – $1,300 | Regional base price announcements and mill adjustments influence final quotes. |

| Middle East / Gulf | Imported HRC or local stock | $880 – $1,350 | Depends on shipping and project procurement terms. |

| South East Asia (SE Asia) | Imported Chinese coils common | $780 – $1,150 | Import freight and duties are key variables. |

| Export (small order, high certification) | Certified pressure-vessel coil, MTR + charpy + radiography | $1,200 – $1,800+ | Specialty runs and tight lot sizes increase unit cost. |

These ranges are intended for budgeting and price-comparison purposes; for a binding offer always request a written quote with the exact specification, certificates, packing and delivery terms.

How to specify DIN 17155 coil correctly

When you place an inquiry or RFQ, include the following minimal data to avoid ambiguity and price surprises:

-

Exact grade or equivalent standard — specify DIN 17155 grade and allowable modern equivalents (e.g., EN 10028 P265GH, ASME SA516 Grade 60) if you accept them.

-

Thickness and width tolerance — hot-rolled coils have broader tolerances than cold-rolled; indicate acceptable tolerances.

-

Surface condition — mill scale, pickled, oiled, painted; state if a visible cosmetic finish is required.

-

Testing and documentation — list required tests: MTR (EN 10204 3.1/3.2), charpy V-notch at a designated temperature, hardness, PMI if needed, radiography or UT for critical plates.

-

Delivery terms — EXW, FOB, CIF, DDP; clarify who handles customs and inland transport.

-

Packaging and coil weight — maximum coil weight, inner and outer diameter limits, and protective measures for long sea voyages.

-

Lot and heat number traceability — acceptance criteria for mixed heat numbers in a single coil or batch.

A clear RFQ reduces ambiguous quotes and helps suppliers price correctly for the certification and testing you need.

Quality assurance and testing expectations

For pressure-retaining parts, mills and vendors should supply:

-

Mill Test Report (MTR) with heat number traceability (EN 10204 3.1 or 3.2 where applicable).

-

Mechanical test records — tensile and yield data, elongation percentages.

-

Impact toughness (Charpy V-notch) at the required minimum service temperature (if applicable).

-

Chemical analysis showing compliance with the specified envelope.

-

Non-destructive testing (NDT) where required — UT, PMI, or RT depending on application.

-

Surface and dimensional inspection — thickness, width and flatness tolerances.

For buyers of certified pressure-vessel coils, insisting on 3.1/3.2 certification and full traceability will add to the price but is essential for safety and code compliance.

Fabrication, welding and heat input considerations

We advise fabricators to plan welding and post-weld heat treatment (PWHT) based on the grade and thickness:

-

Welding consumables: choose filler metals matched to the base metal and service conditions; use low-hydrogen electrodes where hydrogen cracking risk exists.

-

Heat input control: thicker coils and certain HII/creep-resistant grades require controlled heat input to maintain toughness and avoid brittle behavior.

-

PWHT: for some pressure vessel steels and high-temperature service alloys, PWHT is mandatory to relieve residual stresses and achieve required properties.

-

Preheating: follow fabricator welding procedure specifications (WPS) derived from PQR tests to determine necessary preheat temperatures.

Always perform procedure qualification records (PQRs) and weld procedure specifications (WPS) referencing the exact coil chemistry and thickness.

Packaging, transport and storage guidance

Coil handling and storage protocols protect product quality and reduce rework costs:

-

Coil packaging: heavy-duty seaworthy packing, protected with anti-rust oil and desiccants for long shipments.

-

Lashing and securing: use certified lashing points and avoid point loads that deform the coil.

-

Storage: indoor dry storage or covered yards with good drainage; avoid prolonged exposure to salt air for uncoated material.

-

Identification: clearly tag heat numbers and MTR reference for immediate inspection on arrival.

Improper handling leads to local corrosion, edge damage, or delamination of protective oil — all of which can incur recoating or scrapping costs.

Procurement strategies to obtain better pricing and reliability

-

Buy larger lots or sign medium-term contracts: mills prefer volume and often provide price stability for committed volumes.

-

Be specific about equivalence: accepting EN or ASME equivalents widens your vendor base and can reduce cost.

-

Request alternative forms: sometimes slitted or CTL material manufactured from a standard coil is cheaper than a specialized coil run.

-

Audit supplier quality systems: an audit reduces risk of noncompliant lots and avoids expensive project delays.

-

Leverage local stocking centers: regional stockists can reduce lead times and logistics surcharges.

Environmental, regulatory and safety considerations

-

Regulatory adherence: ensure the selected steel and the finished vessel meet local design codes and certification rules (ASME, PED in Europe, local pressure vessel regulations).

-

Sustainability: recycled scrap content and mill energy sources influence the carbon footprint; some projects prioritize low-embodied-carbon steel and may accept higher cost.

-

Worker safety: cutting, welding and forming coil requires standard PPE and controls to avoid dust, fume exposure and mechanical hazards.

Common misconceptions and procurement pitfalls

-

“All DIN 17155 is identical” — False. Different subgrades and heat treatments cause meaningful differences; always verify MTRs.

-

“Cheaper coil equals savings” — Not necessarily. Lower price often means weaker documentation, mixed heats, or inferior testing — which can cost much more later.

-

“One certificate fits all” — Specify EN 10204 3.1 or 3.2 when you need independent verification. Nearly every instance of failed acceptance traceability comes from vague certificate requirements.

Sample specification clause (pick and adapt for RFQs)

Supply DIN 17155 pressure vessel carbon steel coil, thickness X.X–Y.Y mm, width Z mm ± T mm, chemical composition to meet DIN 17155 HII (or equivalent EN/ASME grade), delivered with EN 10204 3.1 mill test report, charpy V-notch impact tests at −20°C (or specified temperature), and UT inspection. Coil packing to be seaworthy for export shipment. Delivery CIF (port) / DDP (site) as agreed.

Including a short clause like this eliminates ambiguity in initial quotations.

Vendor selection and sample supplier profile

Reputable suppliers combine mill production with the ability to add testing and documentation. Many stockists list DIN 17155 coils as part of their boiler and pressure vessel steel portfolio; verify:

-

mill of origin and mill accreditation;

-

history of supply to pressure vessel fabricators;

-

past project references and willingness to provide sample MTRs before contract award.

Chinese exporters and European mill stockists both serve this market; the true differentiator is consistent documentation and willingness to accept pre-shipment inspection when required.

Frequently Asked Questions

Q1: Is DIN 17155 still an acceptable specification for new pressure vessels?

A: Many engineers still reference DIN 17155, but the standard has largely been superseded by modern EN and international standards. If your code stamping or regulatory body requires a current standard (for example PED or ASME), ask for an equivalent EN or ASME grade and ensure test records align with that standard. When accepting DIN 17155 by name, add a clause permitting an EN/ASME equivalent with matching properties.

Q2: What should I expect to pay for DIN 17155 coil in 2025?

A: Typical spot and contractual prices depend on region, product form, and certification. In 2025 basic HRC price bands we observed ranged roughly from USD $700–$1,450/mt depending on region and grade; certified or specialty runs commonly cost more. Always obtain firm quotes specifying all test and delivery requirements to get a final price.

Q3: Are there direct ASME/ASTM equivalents to DIN 17155?

A: Several DIN 17155 grades map closely to ASME/ASTM pressure-vessel grades (for example some DIN 17155 HII grades are similar in envelope to ASME SA516/ASTM A516 grades). Cross-reference tables exist, but equivalence must be validated by comparing chemistry, mechanical properties and design temperature limits.

Q4: How much extra does certification (EN 10204 3.1/3.2) add to price?

A: Certification costs depend on mill policy and the testing burden. For typical coils, adding 3.1/3.2 certification and additional charpy testing may add several tens of dollars per ton to the mill gate price — specialty test matrices and witnessed inspection raise this further. Get itemized test price breakdowns in formal bids.

Q5: What checks should I perform on arrival of a DIN 17155 coil shipment?

A: Inspect packaging and coil IDs, verify MTRs against heat numbers, perform sampling thickness and surface checks, and if the project demands, arrange an independent lab or a third-party inspector to validate chemical and mechanical compliance before unloading or fabrication. Nonconforming lots should be quarantined pending supplier resolution.