ASTM A510 wire rod in 2025 is trading at materially different levels by region: Chinese mill/small-trader offers remain the most competitive (often in the low hundreds USD/MT when bought in large quantities from mills), while Western market prices are significantly higher due to logistics, tariffs and regional supply/demand — with reported U.S. benchmark levels near ~USD 1,200/MT in Q2 2025. For buyers seeking factory-direct advantages, we recommend sourcing from established Chinese mills such as Luokaiwei for competitive FOB pricing, custom grades, and fast delivery on stocked items.

What is ASTM A510

ASTM A510 / A510M is the recognized American standard that sets the general requirements for carbon and alloy steel wire rods and coarse round wire used for drawing and further processing. It defines composition ranges, ordering practice, mechanical requirements, and testing/inspection conventions that buyers and mills use to guarantee interchangeability and performance. This standard is maintained and sold by ASTM International.

Grades and chemical composition

ASTM A510 itself provides the general requirements; the actual chemical and mechanical details for a specific product are typically specified by the purchaser or by cross-referenced specifications (for example, SAE/AISI numbers or individual mill grades). Typical carbon grades sold under the A510 umbrella include low-carbon grades (e.g., 1008 / 1010), medium carbon (e.g., 1018) and higher carbon/medium-alloy variants (e.g., 1045, 1050) depending on application. Typical chemical limits you will see in vendor datasheets: carbon 0.08–0.50% (varies by grade), manganese 0.3–1.4%, phosphorus and sulfur at low maximums, and small controlled silicon levels where specified. For exact limits and allowable tolerances, purchasers must quote the target grade (for example, “ASTM A510 — Grade 1018”).

Mechanical properties and testing protocols

Mechanical properties for wire rod produced to A510 are governed by grade and additional purchaser requirements. Typical acceptance tests include tensile, yield (where applicable), elongation, and sometimes hardness. The standard also covers permissible test methods and sampling frequency for lot acceptance. If the end use is cold drawing or cold heading, the metallurgical cleanliness, decarburization control and microstructure control are frequently specified as extra requirements by OEMs. Buyers should confirm impact testing only when required by service conditions.

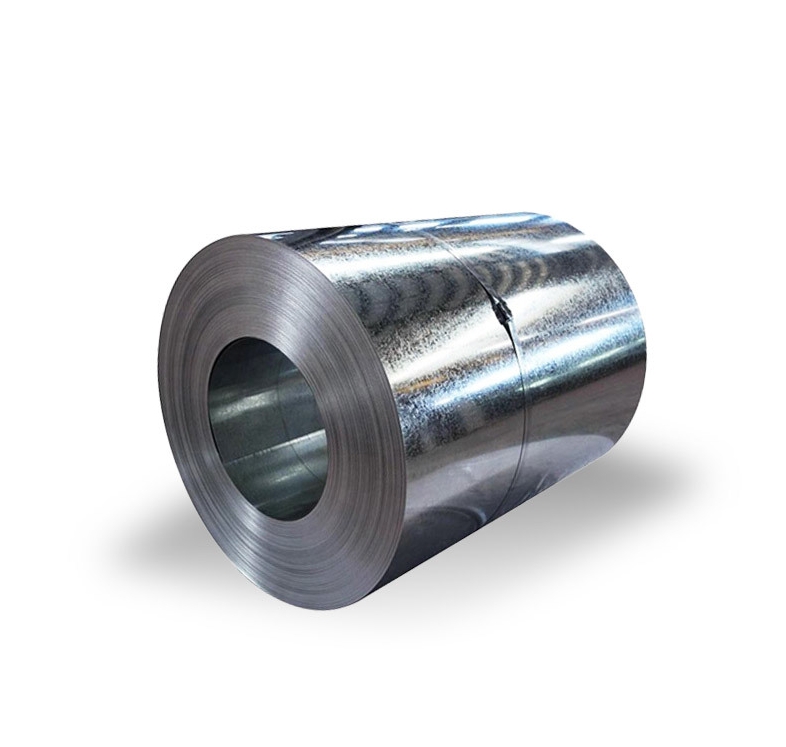

Product forms, diameters and surface condition (practical buying points)

Wire rod is usually supplied in coils or straightened and cut lengths. Diameters commonly range from about 5 mm up to 16 mm for wire rod, but exact availability depends on mill capability. Surface finish (mill scale, pickled, bright) is a commercial variable that affects both price and downstream processing. For deep-drawing or cold-heading, tighter surface tolerances (cleaner surface, limited scale) command a premium. The buyer must specify coil weight tolerance, bale style, and coil identification for traceability. (Worldsteel and industry datasheets describe long-product categories and the typical ranges for wire rod production).

How A510 compares to other specifications

ASTM A510 is a general wire rod requirement. Specific chemical or mechanical reqs are often pulled from other specifications (for example, SAE/AISI or purchaser standards) and referenced to A510 for the wire-rod form. When you compare quotes, ensure you are comparing the same grade, same heat-treatment (if any), same surface condition, and identical testing/inspection packages. Many suppliers will quote an A510 “base” price and then add premiums for additional certification, third-party inspection, or custom packaging.

Key market drivers of price in 2025

— Raw material feedstock (iron ore, scrap) and pig iron availability.

— Energy and coking coal prices for integrated mills.

— Slab/coil/HRC and billet markets (domestic hot-rolled coil and billet are feedstocks).

— Inventory and import/export flows (Chinese exports, India capacity expansions).

— Freight and container costs, and importantly in 2025, tariff and trade policy actions. Macro factors like steel capacity changes and slow demand from downstream sectors (construction/automotive) also influence spot prices. Recent analyses show regional divergence in price trends during 2024–2025 as inventories and import flows changed.

2025 regional price snapshot

Notes: prices below are indicative ranges and reference public market data or recent supplier quotes. All prices are expressed in USD per metric tonne (USD/MT) unless noted. Use them only as a starting point for RFQs; always obtain dated written quotes.

| Region | Indicative price (USD/MT) | Notes & source |

|---|---|---|

| China (FOB mill / bulk) | USD 500–750 / MT | Example manufacturer listings and online supplier quotes showed low-end FOB offers in this band (Sept 2024–2025), depending on grade and quantity |

| China (SHFE futures indicator) | ~CNY 3,500 / MT (index) | Shanghai Futures Exchange wire-rod contract prices and historical data provide an index — useful for short-term trend signals. (convert at current FX to compare). |

| USA (domestic benchmark) | ~USD 1,120–1,300 / MT (Q2 2025) | Industry price trackers showed USA wire-rod prices near USD 1,241/MT in Q2 2025 (quarterly indices). |

| Europe (indicative) | USD 700–1,200 / MT (region-specific) | European long-product pricing is volatile; reference HRC and regional long-steel indicators. Regional premiums, duties, and energy differentials drive the spread. |

| India / South Asia | USD 600–900 / MT | Local producer offers and import parity vary; Indian domestic mills often price slightly above Chinese FOB but below Western landed costs (depends on duties). Market reports identify Asia as competitive but regionally split. |

| Middle East / North Africa | USD 650–1,000 / MT | Import parity depends on freight corridors (Mediterranean vs. Gulf) and steelmaking mix in the buyer’s country. |

Comments on the table: the numbers above are indicative. Spot and contract prices fluctuate daily. Use these ranges to calibrate RFQs and insist on dated quotes with specific incoterms (FOB, CIF, CFR). The most reliable public benchmark for the U.S. in 2025 is the quarterly indices reported by industry research firms.

Practical checklist for comparing supplier quotes

— Confirm the grade (e.g., “ASTM A510 — grade 1008 / 1018 / 1045”) and the exact chemical range.

— Confirm size/diameter and coil weight specification.

— Ask for mechanical test certificates (mill test report, chemical analysis).

— Clarify surface condition and whether pickling/polishing is included.

— Confirm packing, coil IDs, and traceability to heat number.

— Obtain explicit incoterm pricing (EXW, FOB, CIF) and freight route/time.

— Ask about lead times, stock availability (stocked vs. made-to-order), and capacity commitments.

— Negotiate payment terms tied to inspection and acceptance (LC, T/T with staged payment, or escrow).

Quality assurance, sampling and inspection

We require full mill test reports with each heat and routine chemical analysis from spectrometer results. For critical orders we accept third-party inspection or witnessed tests. Key checks we insist upon: heat identification, tensile test results, percent elongation, visual surface inspection, coil inner diameter and weight, and packaging integrity for sea freight. Where contamination or sulfidic inclusions could be damaging (for cold heading or wire drawing), we include a cleanliness statement and non-metallic inclusion control where possible.

Logistics and lead times

Lead times vary by stock position. If a supplier holds stock domestically (e.g., Luokaiwei warehouses), delivery for standard grades can be measured in days. Custom grades or heat-treat/coating variations add production lead time (typically weeks). International shipments incur additional time for documentation, inspection, and sea freight. Always lock the shipping window and include demurrage/late-pickup clauses if time is critical.

Why Luokaiwei

We operate as a Chinese manufacturer and consolidator focused on wire-rod long products. Our advantages: direct factory pricing (we emphasize a 100% factory-price orientation to remove middlemen margins), flexible customization for grade and packaging, and fast delivery from stock for commonly ordered sizes. We also support standard MTRs, third-party inspection on request, and competitive FOB terms for bulk shipments. For buyers targeting price competitiveness combined with traceability and reasonable service levels, Luokaiwei is a practical option.

Purchasing strategy recommendations for 2025

For long-term projects: negotiate a quarterly contract with volume tiers and price-adjustment clauses tied to public indices or agreed raw-material triggers.

For spot buys: solicit multiple dated RFQs with clear incoterms and inspection windows.

For quality-sensitive parts: ask for trial heats and send your lab samples for round-robin testing if possible.

Consider a hybrid strategy: secure a portion of supply through contracts and keep a buffer of spot buys to exploit dips.

case study

When a European fastener house requested 300 MT of ASTM A510 (grade 1018) for cold heading, we provided: FOB Shanghai pricing, full MTRs, optional third-party inspection, and a 21-day delivery window from order confirmation. Our Chinese mill pricing delivered a landed cost that was ~25–35% lower than the customer’s local European spot prices once tariffs and freight were included. The customer structured payment as 30% T/T on order, balance after inspection and before shipment.

How to phrase your RFQ to get apples-to-apples quotes

“ASTM A510 (heat no. traceable MTRs). Grade: 1018. Diameter: 6.5 mm ±0.05. Surface: pickled, coil weight 1.2 ±0.1 MT. Mechanical: tensile min xxx MPa, elongation min xx%. Packing: seaworthy export packing, wooden pallet / coil strap. Incoterm: FOB Shanghai. Quantity: 100 MT. Required delivery window: 21 days after PO. Third-party inspection: [Yes/No].”

A precise RFQ eliminates hidden surcharges and speeds negotiation.

Environmental & compliance notes

Buyers should request conformity statements where applicable (e.g., REACH considerations for coated products going to the EU). For some government or OEM purchases, additional provenance documentation (country of origin, free-on-board certificate) may be required. Also, anti-dumping duties and safeguard measures in the buyer’s market can change landed cost significantly — we recommend confirming current duty status at time of purchase.

Payment, warranties and dispute resolution

Standard protections we advise include: payment by confirmed LC for first-time large orders; short-form warranty covering manufacturing defects and non-conforming material up to a defined period; arbitration clause specifying the governing law and venue; and clearly defined acceptance testing procedures before final payment.

Frequently Asked Questions

Q1: What exact steels are covered by ASTM A510?

A: ASTM A510 covers general requirements for carbon and alloy steel wire rods and coarse round wire. It is not a grade-by-grade chemical specification — purchasers specify the grade (e.g., AISI 1008, 1018, 1045) and reference A510 for the wire-rod form and general requirements.

Q2: How should I interpret the price quotes (per ton)?

A: Always check the incoterm (FOB vs. CIF vs. EXW). FOB Shanghai means the supplier covers production and loading; freight and insurance are buyer’s responsibility. CIF includes freight and insurance to named port. Compare landed cost with duties and inland transport to make a valid comparison.

Q3: Do mills offer custom chemistry under A510?

A: Yes — mills commonly accept custom chemistries and mechanical property requirements, but expect longer lead times and a price premium. Provide a detailed specification and request sample heat certification.

Q4: How do tariffs affect 2025 wire-rod pricing?

A: Tariffs can materially increase landed cost. In 2025 several trade actions and tariff discussions affected regional competitiveness; check current duties in the buyer’s jurisdiction before completing a purchase.

Q5: Why choose a Chinese mill like Luokaiwei?

A: For competitive FOB pricing, manufacturing scale, and flexible customization options. Luokaiwei emphasizes factory-direct pricing, quick fulfillment on stocked items, and the ability to support third-party inspections and full MTR documentation.