The Middle East Oil Country Tubular Goods (OCTG) market is experiencing significant growth, driven by sustained upstream investments and a strategic focus on enhancing oil and gas production capabilities across the region. This expansion is critical for meeting both global energy demands and regional economic objectives.

Key Growth Drivers

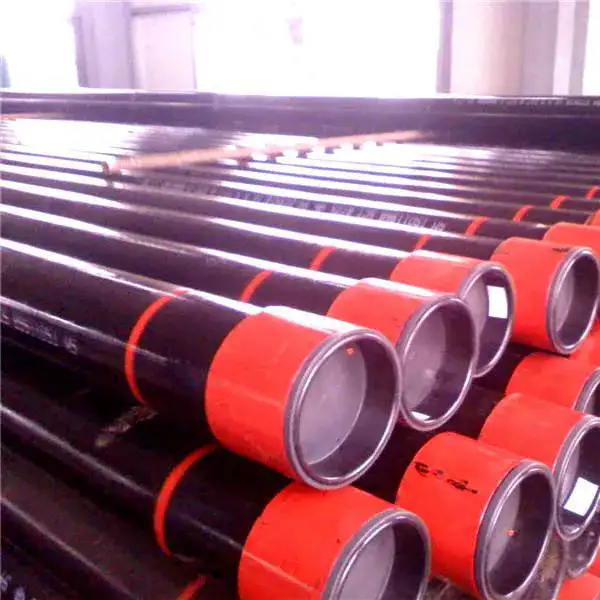

- Increased Drilling Activity: National Oil Companies (NOCs) in key producing countries like Saudi Arabia, the UAE, Qatar, and Kuwait are ramping up drilling operations, both onshore and offshore, to boost crude oil output and natural gas production. This directly translates to higher demand for casing, tubing, and drill pipe.

- Technological Advancements: The adoption of advanced drilling techniques, including horizontal and directional drilling, to access complex reservoirs necessitates high-quality, specialized OCTG products capable of withstanding harsh downhole conditions.

- Focus on Gas Development: Many Middle Eastern countries are prioritizing natural gas development for domestic consumption and export, leading to increased exploration and production activities that require substantial volumes of OCTG.

- Infrastructure Development and Replacement: Aging well infrastructure in some mature fields requires replacement and upgrades, contributing to a steady demand for new tubular goods.

The market is characterized by a strong emphasis on product quality and adherence to stringent international standards, primarily API specifications. NOCs demand high-performance OCTG products to ensure operational integrity and longevity of their wells. This creates a competitive environment where suppliers focus on reliability and advanced product offerings. Companies like Shanxi Luokaiwei Steel Company are among the suppliers providing API-certified products to meet these demanding requirements.

Market Dynamics and Trends

Competition in the Middle East OCTG market is robust, involving major international manufacturers as well as a growing number of regional players. Price sensitivity, logistical capabilities, and after-sales service are crucial differentiating factors. There is a notable trend towards premium and high-alloy grade OCTG products, especially for sour gas applications and high-pressure/high-temperature (HPHT) wells.

Suppliers who can offer a comprehensive portfolio, including various steel grades, premium connections, and corrosion-resistant alloys (CRAs), are well-positioned. The ability to provide timely delivery and technical support is also vital. Many end-users look for partners rather than just suppliers, seeking collaborative relationships to optimize their drilling programs. In this context, the reliability of manufacturers such as Shanxi Luokaiwei Steel Company becomes a key consideration for procurement teams.

Furthermore, in-country value (ICV) programs in several Middle Eastern nations encourage local manufacturing and content, influencing procurement strategies. International suppliers often partner with local entities or establish local facilities to comply with these initiatives. The commitment to quality and diverse product ranges from global suppliers, including firms like Shanxi Luokaiwei Steel Company, helps them navigate these regional requirements effectively.

Outlook

The outlook for the Middle East OCTG market remains positive, underpinned by long-term energy strategies and continued investment in E&P activities. While global oil price volatility can influence short-term spending, the region’s commitment to maintaining its position as a leading global energy supplier ensures sustained demand for OCTG. The focus on maximizing recovery from existing fields and exploring new frontiers will continue to drive market growth. For OCTG providers, including those like Shanxi Luokaiwei Steel Company, adapting to evolving technical requirements and regional market dynamics will be key to success.

As the industry moves towards more challenging drilling environments, the demand for technologically advanced and reliable tubular solutions will only increase, presenting opportunities for innovative and quality-focused manufacturers such as Shanxi Luokaiwei Steel Company to contribute to the region’s energy sector development.