The average 2025 pricing for ASTM A179 carbon steel pipe will hold in the range of $0.80 to $1.20 per pound for Chinese-manufactured standard sizes, $1.50 to $2.00 per pound in North American markets, €1.30 to €1.80 per kilogram in Europe, and $0.75 to $1.10 per pound in India. Market tightness driven by raw‐material costs, global logistics, and environmental policy will keep margins narrow but stable throughout the year.

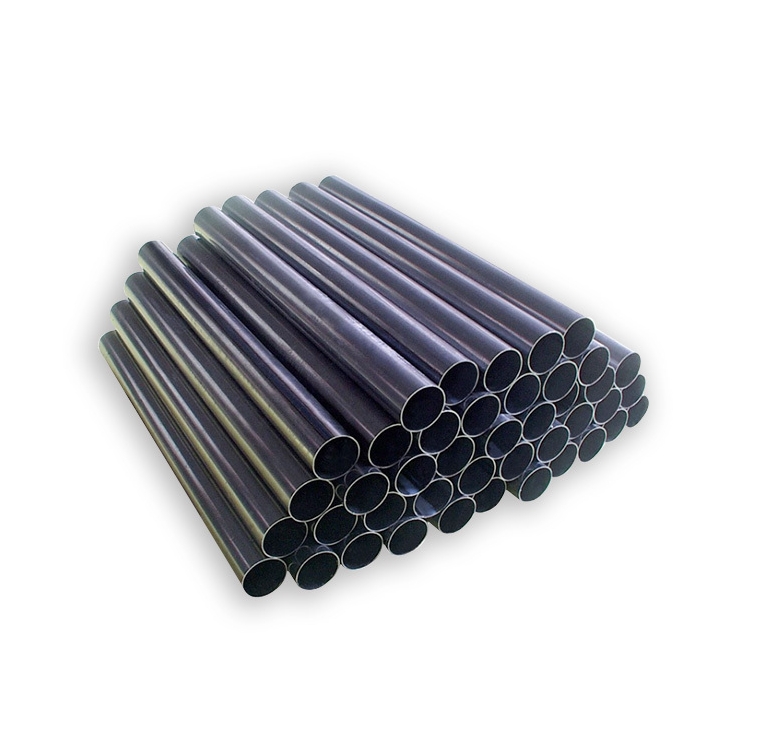

1. Introduction to ASTM A179 Carbon Steel Pipe

We produce seamless, cold‐drawn carbon steel tubing under the ASTM A179 standard with tight dimensional tolerances. Prime usage includes heat exchangers and condensers in power plants, chemical processing, and HVAC. Our Chinese-based Luokaiwei facility offers 100% factory-direct pricing, rapid fulfillment for stocked items, and customized end-finishes.

2. Key Material Characteristics

Carbon content in A179 pipes is limited to 0.30% maximum, ensuring a balance of strength and ductility. Yield strength typically exceeds 205 MPa, tensile strength falls between 415–550 MPa, and elongation is over 30% in a 4D gauge length. This combination provides reliable service under high‐pressure, high‐temperature conditions.

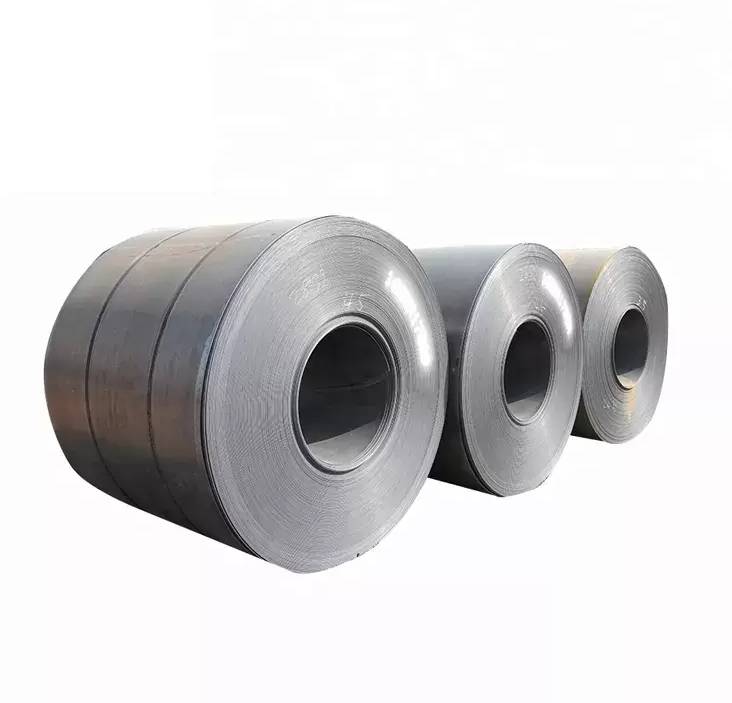

3. Manufacturing and Production Workflow

We utilize a multi‐stage cold‐drawing process beginning with hot‐rolled billets. Precision mandrels shape the tube, then successive drawing stages refine wall thickness. Final annealing relieves internal stresses, followed by ultrasonic inspection to detect subsurface flaws. Each step adheres to ISO 9001-certified quality management protocols.

4. ASTM A179 Standard Specifications

ASTM A179/A179M mandates:

-

Chemical composition limits for C, Mn, P, S, Si.

-

Mechanical properties including tensile, yield, elongation.

-

Dimensional tolerances on outside diameter and wall thickness.

-

Non‐destructive testing by hydrostatic or ultrasonic methods.

-

Marking and certification traceable to mill test reports.

We comply with both inch-pound and metric requirements within A179M.

5. Drivers of 2025 Price Trends

5.1 Raw-Material Costs

Iron ore, scrap steel, and alloying agents remain the most volatile inputs. We lock in volume contracts with integrated mills to mitigate spike risk.

5.2 Energy and Fuel

Electricity and natural gas impact annealing ovens and drawing mills. Efficiency upgrades at our plant help contain overhead.

5.3 Logistics and Freight

Container shortages and port congestion continue mildly pressing freight rates. Our proximity to major Chinese ports shortens lead times.

5.4 Environmental Regulation

Emissions standards in China and abroad impose incremental compliance costs; we invest in low-emission furnaces and wastewater treatment to stay ahead.

6. Global Price Comparison 2025

| Region | Price Unit | 2025 Range | Currency |

|---|---|---|---|

| China | per pound | 0.80 – 1.20 | USD |

| United States | per pound | 1.50 – 2.00 | USD |

| Europe | per kilogram | 1.30 – 1.80 | EUR |

| India | per pound | 0.75 – 1.10 | USD |

7. Regional Market Analyses

7.1 China

Domestic capacity growth keeps prices competitive. We undercut typical mill quotes by offering factory-direct rates.

7.2 North America

Higher labor and environmental costs push U.S. prices upward; import duties may apply. We support CIF and DDP shipments with full compliance documentation.

7.3 Europe

Stringent REACH regulations and energy costs sustain premium pricing. Our European customers benefit from bonded warehouse stock in Rotterdam.

7.4 India

Low production costs yield the most aggressive offers, though quality consistency can vary. Luokaiwei performs third-party audits to guarantee specification adherence.

8. Luokaiwei’s Competitive Strengths

-

Factory Pricing: Zero middlemen; savings passed directly to you.

-

Custom Solutions: Wall‐thickness adjustments, custom end finishes, and special packaging.

-

Fast Delivery: In-stock items ship within 7–10 days; custom runs within 30–45 days.

-

Quality Assurance: Full MTRs, PPAP for automotive, and 100% ultrasonic testing.

9. Quality Control and Testing Protocols

Our in-house lab performs:

-

Chemical analysis via spectrometry.

-

Mechanical testing on tensile and hardness machines.

-

Non-destructive inspection including eddy current and ultrasonic up to Level II per ASNT.

This ensures every tube meets API, ASTM, and ISO standards.

10. Typical Applications

-

Power Generation: Boiler tubes in fossil‐fuel and nuclear plants.

-

Process Industries: Heat‐exchanger tubes in refineries and petrochemical units.

-

HVAC Systems: Condenser and chiller tubes.

-

Oil & Gas: Low‐pressure process piping.

11. Technical Compliance and Certifications

We maintain:

-

ASTM A179/A179M certification.

-

ISO 9001 quality management system.

-

PED compliance for pressure equipment in Europe.

-

ASME B31.1/B31.3 guidelines for process and power piping.

-

RoHS and REACH environmental conformity.

12. Sustainability and Environmental Responsibility

Our continuous-casting scrap return loop reduces waste. We deploy closed-loop cooling in drawing mills to limit water consumption. All emissions controls exceed local requirements.

13. Procurement Best Practices

-

Plan Ahead: Lock in pricing 2–3 months before need.

-

Specify Testing: Request witness testing or 100% inspection if critical.

-

Order in Bulk: Larger batch sizes reduce per‐unit shipping costs.

-

Negotiate Terms: We offer extended payment options for strategic partners.

14. Outlook for 2026 and Beyond

Given stable raw-material outlook and rising demand in renewable energy sectors, we project moderate price growth (~3–5% annually). Early engagement secures best delivery windows.

Frequently Asked Questions

1. What factors most influence A179 pipe pricing?

Raw-material costs, energy rates, logistics, and regulatory compliance jointly drive final quotes.

2. Can Luokaiwei supply custom wall thicknesses?

Yes, we offer thicknesses from 0.035 in. up to 0.250 in. with tolerances per ASTM A179.

3. What quality documentation is provided?

Full Mill Test Reports (MTRs), third-party inspection certificates, and non-destructive test records accompany every shipment.

4. Are there minimum order quantities?

Standard MOQ is one full production coil (~2 tons), though stocked tube lengths can be ordered smaller.

5. How long is typical lead time for standard sizes?

For stocked inventory, 7–10 days; custom orders range from 30–45 days after approval.