For 2025 procurement, ASME/ASTM SA-203 Grade D (often referenced as ASTM A203 Grade D or “3.5% Ni pressure-vessel plate”) remains a specialty low-nickel alloy plate used where improved toughness at low temperatures is required. Typical marketplace spot prices observed in mid-2025 for commercial small-lot FOB Chinese mill shipments fall roughly in the USD 600–900 / metric ton band, with larger contract volumes or specific heat-treatment/traceability premiums pushing prices higher. Buyers should expect variability by thickness, surface finish, certification level (MTC II vs. III), and delivery terms.

We manufacture and supply ASME SA-203 Grade D plate for pressure-vessel and cryogenic service. SA-203 is a low-nickel alloy steel family with multiple grades; Grade D is specified where better low-temperature impact resistance is needed compared with plain carbon plates. Its balance of ductility, strength and toughness makes it common for welded vessels, storage tanks and equipment handling low-temperature fluids.

What the designation means

SA-203 / A203 is an ASME/ASTM specification for nickel-alloy steel plates intended primarily for welded pressure vessels. The “Grade D” suffix identifies specific chemistry and mechanical requirements within the A203/SA203 family (grades A, B, D, E, F exist with different Ni levels and toughness requirements). In industry shorthand you will see “SA203 Gr D”, “A203 Gr D” and “3.5% Ni plate” used interchangeably in supplier listings.

Typical chemical composition

We usually quote composition ranges for procurement and MTC (mill test certificates) as follows (examples reflect industry practice; final MTC governs acceptance):

-

Carbon (C): ~0.12–0.20%

-

Manganese (Mn): ~0.50–1.00% (lower bound depends on grade)

-

Silicon (Si): trace to ~0.40%

-

Phosphorus (P), Sulfur (S): kept very low (P ≤ ~0.035%, S ≤ ~0.035%)

-

Nickel (Ni): nominally ~3.5% for Grade D (this is the key alloying addition that improves low-temperature toughness).

Note: suppliers sometimes quote slightly different chemistries depending on whether the plate is supplied normalized, normalized & tempered, or quenched & tempered — check the MTC and heat-treatment record. We always include the exact heat-treatment cycle and chemistry on the certificate for traceability.

Mechanical properties & low-temperature performance

Typical guaranteed properties for SA-203 Grade D (as a practical reference used in procurement and design) are in the region of:

-

Tensile strength (UTS): roughly 450–585 MPa (65–85 ksi)

-

Yield strength (0.2% offset): roughly 255 MPa (37 ksi) minimum

-

Elongation: often 19–26% depending on specimen length and thickness

-

Hardness (Brinell): ~160 HB typical for normalized plate

These values are consistent with published engineering tables for A203 Grade D and are representative for hot-rolled, normalized product. For cryogenic or very low temperature service, impact toughness (Charpy V-notch) requirements and heat treatment (normalized vs quenched & tempered) must be specified to meet project codes.

Heat treatment, fabrication and welding notes

We advise purchasers and fabricators to specify both the desired heat-treatment condition and any welding pre/post-treatment needs up front.

-

As-delivered conditions: hot-rolled normalized, normalized & tempered, or QT (quenched & tempered) are all offered depending on thickness and required low-temperature properties.

-

Welding: SA-203 Grade D welds with common filler metals for low-alloy steels, but welding procedure qualification (PQR/WPS) must account for the nickel content and intended service temperature. Preheat and interpass temperature controls are typical for thicker sections.

-

Post-weld heat treatment (PWHT): may be required by design codes for certain vessel designs; specify if needed.

If your project uses cryogenic temperatures, call out the Charpy-V energy at the required design temperature (e.g., −46 °C, −101 °C) so the mill can deliver plate with the appropriate toughness certification.

Common applications

We supply SA-203 Gr D into segments where both weldability and low-temperature toughness are essential:

-

Cryogenic tanks and piping for liquefied gases (air separation units, LNG terminals, industrial gas storage).

-

Pressure vessels for petrochemical and chemical processing that operate at sub-ambient temperatures.

-

Heat exchangers, cold-box equipment and pressure containment used in low-temperature separation plants.

-

Fabricated equipment where enhanced impact resistance is required compared with plain carbon steel plates.

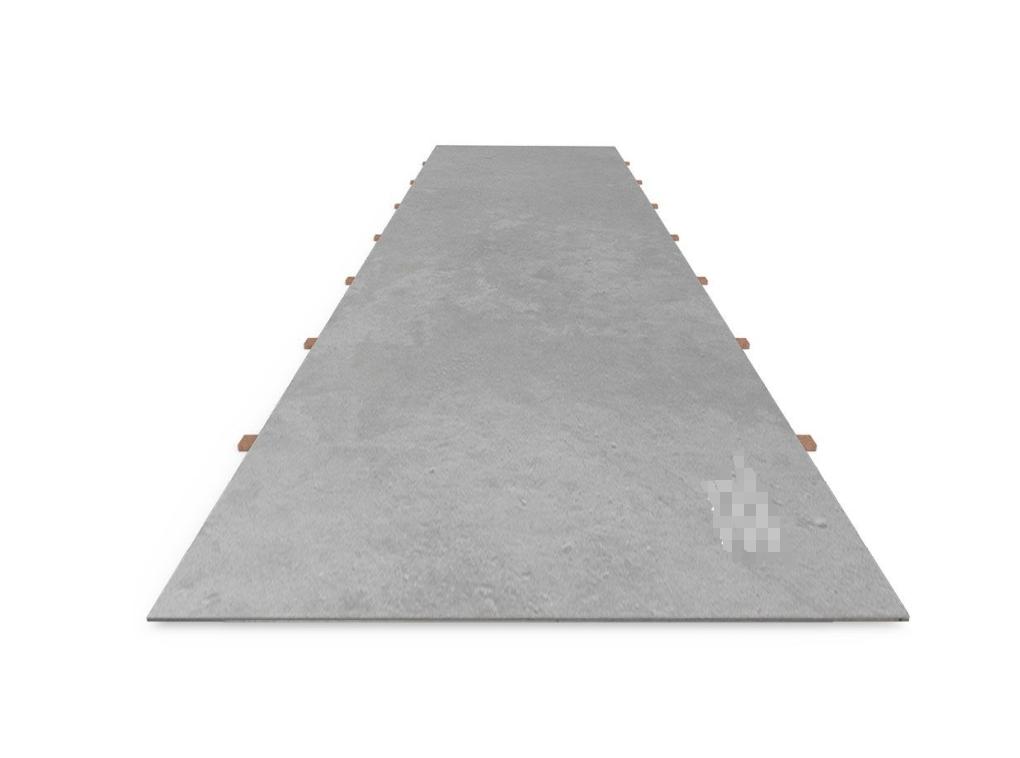

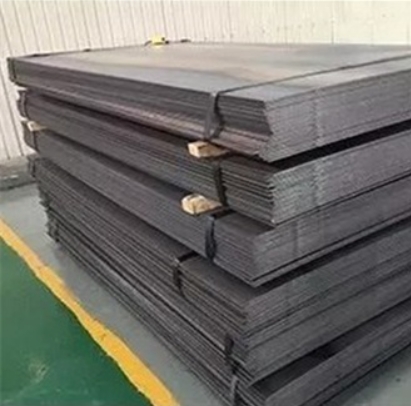

Dimensions, tolerances and surface options

We offer SA-203 Grade D in common plate ranges. Typical practical ranges in the marketplace:

-

Thickness: 6 mm up to 150 mm (many mills produce up to ~300 mm but standard commercial range often quoted 6–150 mm).

-

Width: 1,500–4,200 mm (standard mill widths; cut-to-size options available).

-

Length: up to 12,000–18,000 mm depending on mill and stock availability.

-

Surface finishes: hot-rolled mill scale, shot-blasted, pickled, or ground depending on buyer preference.

Always confirm deviation tolerances with the mill and ask for dimensional certificates if tight geometries are part of your design.

Quality control, testing and documentation

We follow standard NDT and testing practices for pressure-vessel plate supply:

-

Mill Test Certificate (MTC) to EN 10204 Type 3.1 or equivalent, showing chemistry and mechanicals.

-

Impact testing (Charpy V-notch) at the temperature(s) specified by the purchaser or applicable code.

-

Ultrasonic or radiographic testing if requested or required by the design code.

-

Corrosion and surface inspection, dimensional check, packaging record and heat/lot traceability.

For projects governed by ASME Section VIII, PED, or other jurisdictional codes, we can supply additional third-party inspection or witnessed testing on request.

Price analysis — market behavior in 2025

Price is the area that changes fastest. The numbers below reflect market observations of supplier listings, small-lot FOB quotes and marketplace listings in 2025; they are intended as indicative procurement references rather than firm offers.

-

Observed small-lot FOB China ranges (mid-2025): USD 600–900 / metric ton for standard hot-rolled, normalized SA-203 Grade D plate. Lower end corresponds to larger lots or lower traceability (basic MTC) and common thicknesses. Higher end is seen for short lead times, high-traceability MTCs, and special heat-treat/finish.

-

Spot seller examples: Some online supplier listings show FOB offers around USD 699–799 / MT, while other factory pages list higher ranges depending on MOQ and shipping terms. Heavy plate, thicker gauges, or plates requiring quenched & tempered finishes attract premiums.

-

Regional and contractual variances: European and North American sourced plates usually carry a premium versus Chinese mill FOB due to production costs, certification and logistical margins. Conversely, large long-term contracts may secure discounts under committed tonnage.

Key drivers of price in 2025:

-

Nickel metal price movements and alloy premia (nickel content increases raw material cost vs plain carbon A516/A36 plates).

-

Energy and mill operating rates in major steelmaking regions.

-

Order size, sheet sizes and required documentation level (MTC Type 3.1, third-party witness).

-

Lead time and shipping terms (FOB vs CIF vs DDP).

Global price comparison (indicative table — mid-2025)

| Region / Source (indicative) | Price USD / MT (approx.) | Basis | Notes |

|---|---|---|---|

| Chinese FOB – small lot listings (online suppliers) | $600–$800 | FOB China ports | Typical small MOQ offers for hot-rolled normalized plate. |

| Chinese factory direct (larger MOQ) | $550–$700 | FOB / CNF | Lower price possible for long contracts / large volumes. |

| Global trading houses (short delivery) | $750–$1,200 | CIF/Delivered | Includes handling, documentation and trade margins. |

| Western mills / branded suppliers | $1,000+ | Ex-works / DDP | Premium for local certification, mill reputation and short lead times. |

| Spot premium for QT / special Charpy acceptance | +$100–$300 / MT | — | Extra processing and testing drive this premium. |

Table note: These numbers are pulled from a cross-section of online listings and supplier pages in 2025 and are indicative only. Always request a firm pro-forma with exact terms, MTC level and lead time.

How we price and quote (what to give us)

To give a fast, accurate quotation we need:

-

Grade & standard: SA-203 Grade D (A203 Grade D) — specify ASME/ASTM acceptance.

-

Heat treatment: delivered normalized / normalized & tempered / quenched & tempered.

-

Thickness / width / length: exact sizes or plate cutting schedule.

-

Mechanical & impact certificate requirements: required Charpy temperature and specimen size, and MTC type (2.1 / 3.1).

-

Quantity & delivery term: MT quantity, FOB/CIF/DDP location, preferred shipping window.

-

Acceptance tests: any NDT, third-party inspection or code-specific witness requirements.

We price on the basis that the buyer supplies full spec and delivery term. Short lead times or special finish requirements will add to cost.

Logistics, packaging & lead times

-

Standard packaging: bundled with steel straps, anti-rust coating and seaworthy wooden crating where needed for container shipping.

-

Lead times: depend on stock vs mill production. In-stock small lots may ship in 2–6 weeks; made-to-order large lots and special heat-treatment parts may take 8–16 weeks. (Always confirm at RFQ stage.)

-

Export documents: we provide commercial invoice, packing list, bill of lading, and MTCs. Additional documents such as SGS inspection certificates or laser scanning reports can be arranged at an extra cost.

Procurement tips

We recommend buyers:

-

Bundle orders by thickness/plate family to reduce cutting loss and freight per ton.

-

Specify clear acceptance criteria (temperatures for Charpy, MTC type) to avoid re-work and premium claims.

-

Compare delivered cost (DDP) rather than just FOB to measure true landed expense.

-

Ask for heat traceability (heat/lot numbers) and witness options if the project is safety-critical.

-

Factor alloy premium: remember nickel content creates an alloy premium vs plain carbon alternatives — but in many cryogenic applications it’s required for safety.

Environmental & safety considerations

SA-203 Grade D plate production involves standard steelmaking energy and emissions profiles. From a user standpoint:

-

Handling precautions: mill scale dust control during cutting, and typical PPE for welding (fume extraction).

-

Recycling: steel plates are recyclable at end of life; nickel content has secondary value.

-

Regulatory: ensure the supply chain meets local environmental and import regulations for chemicals and packaging materials.

FAQs

Q1 — What is the key difference between SA-203 Grade D and plain carbon plates such as A516?

A1 — The primary difference is alloy content and toughness. SA-203 Grade D contains nominal nickel (~3.5%) and has mechanical/impact properties tailored for low-temperature service, whereas A516 is a carbon-manganese pressure-vessel plate designed for ambient or higher temperatures and lacks the same low-temperature toughness margin.

Q2 — Can SA-203 Grade D be used at cryogenic temperatures?

A2 — Yes, Grade D is commonly chosen for sub-ambient and cryogenic applications, but you must specify the required Charpy V-notch energy at the design temperature so the mill can deliver an appropriate heat-treat condition and toughness certification.

Q3 — How much more does SA-203 Grade D cost versus A516?

A3 — Pricing varies by market and time. In 2025 we observed SA-203 Grade D generally priced at a premium versus A516 because of the nickel content and testing requirements; indicative SA-203 ranges around USD 600–900/MT FOB were noted in marketplace listings for small lots (A516 prices tend to be lower on a per-ton basis). For a precise comparison provide the same delivery and certificate levels to each supplier.

Q4 — What certificates should I require for critical pressure-vessel work?

A4 — Ask for an MTC (EN 10204 Type 3.1 or equivalent), documented Charpy V-notch results at the design temperature, heat/lot traceability, and any code-specified records (ASME Section VIII acceptance, third-party witness if required).

Q5 — How do thickness and heat treatment affect price and lead time?

A5 — Thicker plates and QT (quenched & tempered) conditions add cost and extend lead times due to additional processing and lower mill throughput. Thin, common sizes in mill stock can ship faster and cheaper; customized thicknesses or strict impact requirements increase both lead time and price.