High carbon steel, a material with a carbon content exceeding 0.60%, is prized for its superior strength and hardness, making it suitable for applications requiring high wear resistance. As of 2025, prices for high carbon steel are fluctuating between $0.80 and $1.30 per pound, with the cost driven by factors like production processes, demand in key sectors like automotive and industrial manufacturing, and raw material costs. At Luokaiwei. We commitment to 100% factory prices and comprehensive customization support positions them as a strong partner in the global steel market.

Understanding High Carbon Steel: Properties and Applications

High carbon steel distinguishes itself by its relatively higher carbon content, typically ranging from 0.60% to 1.5% by weight. This elevated carbon percentage is critical because it significantly enhances the material’s hardness, tensile strength, and wear resistance after appropriate heat treatment. It allows the steel to form a harder martensitic structure, making it ideal for applications that demand high durability and the ability to withstand abrasive forces or maintain a sharp edge.

We see high carbon steel in many critical components across various industries. Common applications include:

- Tools: Hammers, chisels, wrenches, drill bits, and various hand tools.

- Cutting Implements: Knives, saw blades, surgical tools.

- Springs: Automotive springs, industrial springs, musical instrument wire (e.g., piano wire).

- Railway Components: Rails, wheels.

- Machinery Parts: Gears, shafts, axles, bearings, and heavy-duty wear plates where resistance to abrasion is crucial.

While its superior hardness is a major advantage, it’s also important to acknowledge its trade-offs: high carbon steel generally exhibits lower ductility and reduced weldability compared to low or medium carbon steels. Understanding these characteristics helps us appreciate why specific grades command different prices.

Critical Factors Shaping High Carbon Steel Prices in 2025

The price of high carbon steel is not static; it’s a reflection of complex global market dynamics. As we project into 2025, several key factors will continue to exert influence:

1. Raw Material Costs: The Foundation of Production

The cost of producing steel is directly tied to the prices of its primary inputs.

- Iron Ore: The essential ingredient. Its price is subject to global mining output, demand from major steel-producing nations, and geopolitical stability in key mining regions.

- Coking Coal: A vital component for blast furnace steelmaking. Environmental regulations, mining capacities, and global energy market trends all impact its cost.

- Scrap Steel: Increasingly important, especially for electric arc furnace (EAF) production, which relies heavily on recycled steel. The availability of scrap and global recycling rates directly affect its price.

- Alloying Elements: High carbon steels often include other elements like manganese, chromium, vanadium, and molybdenum to achieve specific properties. The supply and demand for these elements on the global market will influence the final steel price.

2. Energy Costs: Powering the Mills

Steel production is highly energy-intensive. The cost of electricity, natural gas, and other fuels for heating and processing remains a significant operational expense. Global energy market volatility, regional energy policies, and the ongoing transition to cleaner energy sources will continue to impact these costs, ultimately reflecting in steel prices.

3. Global Supply and Demand Dynamics: The Economic Barometer

This is perhaps the most influential factor.

- Industrial Output: The health of sectors consuming high carbon steel—such as automotive, construction, heavy machinery, and defense—directly drives demand. A robust global economy generally translates to stronger steel prices.

- Infrastructure Spending: Government and private sector investments in infrastructure projects, from railways to new industrial facilities, create substantial demand for various steel products, including high carbon grades.

- Inventory Levels: Overstocked inventories can depress prices, while lean inventories can cause rapid price increases when demand picks up.

- Production Capacity Utilization: The operational levels of steel mills worldwide, including any new capacity coming online (e.g., new EAFs) or existing capacity being idled, will influence overall supply. In 2025, we are observing a slight increase in global steel production capacity, which could temper price increases unless demand outstrips this growth.

4. Geopolitical and Trade Policies: Macroeconomic Undercurrents

Events beyond the immediate steel market can have significant repercussions.

- Tariffs and Trade Barriers: Import duties, anti-dumping measures, and other trade restrictions can alter the competitive landscape and artificially inflate domestic prices in certain regions by limiting access to cheaper imports.

- International Conflicts and Sanctions: These can disrupt raw material supply chains, raise energy costs, or even shift global steel production priorities.

- Environmental Regulations: Stricter environmental controls in major steel-producing nations can lead to production cuts or increased operational costs (e.g., for pollution control technologies), impacting global supply.

5. Manufacturing Process and Finishing: Value-Added Steps

The way high carbon steel is produced and finished significantly affects its cost.

- Steelmaking Method: Whether the steel is produced via the Blast Furnace-Basic Oxygen Furnace (BF-BOF) route or Electric Arc Furnace (EAF) route influences cost due to different raw material inputs (iron ore vs. scrap) and energy consumption profiles.

- Form and Grade Specificity: High carbon steel is supplied in various forms (bar, rod, wire, sheet, plate), each requiring different rolling and finishing processes. More specialized forms or tighter tolerances increase cost.

- Heat Treatment: Processes like annealing, normalizing, quenching, and tempering are crucial for developing the desired properties in high carbon steel. These steps add considerable cost due to energy, equipment, and processing time.

- Surface Finish: Grinding, polishing, or specialized coatings for corrosion protection further add to the price.

6. Volume Purchased and Logistics: Scale and Delivery

- Economies of Scale: Larger purchase volumes almost always lead to lower per-pound prices due to efficiencies in production, handling, and transportation.

- Freight Costs: Shipping heavy steel products over long distances, especially internationally, can be a substantial portion of the total cost. Fuel prices, shipping routes, port congestion, and local delivery challenges (particularly in regions with complex logistics) play a role.

Global Market Price Comparison for High Carbon Steel (2025 Outlook)

Please remember, these prices are illustrative estimates for hot-rolled high carbon steel bar in moderate quantities (e.g., 1-5 tons) as of mid-2025. Prices for cold-drawn, heat-treated, or highly specialized forms (like precision wire or tool steel grades) will be significantly higher. These figures are subject to real-time market fluctuations and specific supplier terms.

| Region/Country | Representative Grades | Estimated Price Range (USD per pound, 2025) | Market Characteristics |

| North America (USA, Canada) | SAE 1045, 1070, 1095 | $0.65 – $1.30 | Influenced by domestic production costs, import tariffs, and strong demand from automotive, aerospace, and machinery sectors. |

| Europe (Germany, UK, France) | C45, C70, C100 (EN stds) | $0.60 – $1.20 | Stable demand, but high energy costs and stringent environmental regulations contribute to pricing. Quality-focused. |

| Asia-Pacific (China, Japan, Korea, India) | S45C, S70C, S95C (JIS stds) | $0.45 – $0.90 | Largest production hub, highly competitive. Export prices can be lower, but shipping costs and duties must be factored in. |

| South America (Brazil) | SAE 1045, 1050 | $0.55 – $1.00 | Domestic demand and production capacities, plus raw material extraction costs, shape local prices. |

| Rest of World | Various | $0.50 – $1.25 | Price varies significantly based on local market conditions, import dependency, and proximity to major steel-producing regions. |

Note: These are general projections. We highly advise obtaining current quotes from multiple suppliers for precise pricing based on your specific requirements and order volume.

Understanding Specific High Carbon Steel Grades and Their Price Implications

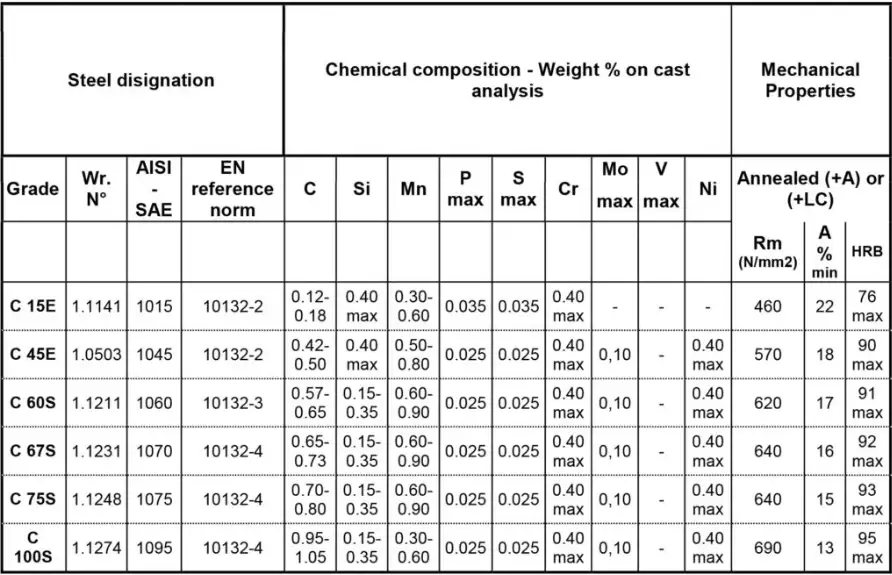

As a metal materials expert, I often emphasize that “high carbon steel” is a broad category. Within it, specific grades offer distinct properties and, therefore, different price points:

- Plain Carbon High Carbon Steels (e.g., SAE 1045, 1070, 1095): These grades primarily rely on carbon for their hardening characteristics. As carbon content increases (e.g., from 1045 to 1095), so does the potential for hardness and wear resistance, but often at the expense of ductility. Higher carbon content generally means a slightly higher price due to tighter compositional control and sometimes more demanding processing.

- Spring Steels (e.g., SAE 5160, 6150): These are alloyed high carbon steels. For example, 5160 includes chromium, which enhances hardenability and toughness, making it excellent for leaf springs and heavy-duty tools. 6150 adds vanadium, further improving grain structure and fatigue resistance. The addition of these alloying elements and the specialized heat treatments required for spring applications make these grades considerably more expensive than plain carbon high carbon steels.

- High Carbon Tool Steels (e.g., O1, D2, A2): These are engineered for extreme hardness, wear resistance, and often resistance to softening at high temperatures. They contain significant amounts of alloying elements like chromium, molybdenum, and vanadium. The complex metallurgy, precise manufacturing, and demanding heat treatment protocols for tool steels place them at the very top of the high carbon steel price spectrum. Their applications include dies, punches, and cutting tools where precision and longevity are paramount.

The choice of grade is always a balance between performance requirements and budget constraints. We guide our clients to select the most cost-effective grade that still meets their application’s critical demands.

Key Standards and Technical Requirements

For reliable performance and quality assurance, adherence to recognized international standards is non-negotiable when procuring high carbon steel. We consistently recommend verifying compliance with these key standards:

- ASTM International Standards: Widely adopted globally.

- ASTM A29/A29M – Standard Specification for Steel Bars, Carbon and Alloy, Hot-Wrought, General Requirements: This general standard covers the mechanical property requirements and chemical composition for hot-wrought carbon and alloy steel bars, encompassing many high carbon grades.

- ASTM A510/A510M – Standard Specification for General Requirements for Wire Rods and Coarse Round Wire, Carbon Steel: Essential for high carbon steel used in wire applications (e.g., spring wire).

- ASTM A681 – Standard Specification for Tool Steels Alloy: Specific to tool steels (many of which are high carbon), defining their chemical composition, mechanical properties, and heat treatment.

- SAE International Standards: The Society of Automotive Engineers (SAE) designates steel grades with a four-digit number (e.g., 1045, 1070, 1095). This system provides a clear reference for chemical composition. For instance, SAE J403 outlines chemical compositions of carbon steels.

- ISO Standards (International Organization for Standardization): These provide international benchmarks and often correlate with ASTM and SAE. For example, ISO 683 series covers heat-treatable steels, alloy steels, and free-cutting steels, including high carbon types.

- Mill Test Certificates (MTCs) / Material Test Reports (MTRs): These are vital documents provided by the steel mill, detailing the actual chemical analysis and mechanical test results for a specific batch of steel. We always ensure our clients receive these, as they serve as direct proof of compliance with ordered specifications.

Insisting on these standards and verifying them through MTCs is crucial for mitigating risks, ensuring material suitability, and protecting your investment in the long run.

Case Study: Optimizing High Carbon Steel Procurement for Tool Manufacturing in 2025

Let’s look at a practical scenario we recently advised on for a client, a medium-sized manufacturer of high-end hand tools. Their primary requirement for 2025 was a steady supply of SAE 1095 high carbon steel bar in various dimensions, precisely heat-treated for optimal hardness and toughness, for their forging and machining operations. Their annual volume was projected at 300 tons.

The Challenge: The client’s existing supplier, a regional distributor, was quoting prices that were steadily climbing due to increased raw material and energy costs in late 2024 and early 2025. This was eroding their profit margins on finished tools. They needed to secure a more competitive price for 2025 without sacrificing the critical metallurgical properties of the 1095 steel.

Our Approach:

- Detailed Specification Review: We meticulously reviewed the client’s material specifications, including required hardness ranges after heat treatment, tolerances, and surface finish. We confirmed that SAE 1095, precisely heat-treated, was indeed the optimal material for their tools.

- Global Supplier Assessment: We initiated discussions with several global steel mills and specialized high-carbon steel suppliers, including options from Asia and Europe, known for their capabilities in producing and pre-treating high carbon steel to exacting standards.

- Comprehensive Quote Comparison: We requested detailed quotes that broke down material cost, heat treatment cost, packaging, lead times, and all associated freight (FOB mill) and import duties.

Key Findings from 2025 Quotes:

- Incumbent Distributor (Domestic): Quoted an average of $1.18/lb delivered, with heat treatment included, but with a 5% “energy surcharge” that made the final cost unpredictable.

- Asian Mill (Direct): Quoted $0.70/lb for the as-rolled 1095 bar, plus $0.15/lb for custom heat treatment, and an estimated $0.08/lb for ocean freight to the nearest port, plus $0.04/lb for local duties and transport. Total delivered estimate: $0.97/lb.

- European Mill (Direct): Quoted $0.80/lb for as-rolled, plus $0.18/lb for heat treatment, and estimated $0.12/lb for ocean freight, plus $0.04/lb for duties and local transport. Total delivered estimate: $1.14/lb.

The Outcome: By shifting a significant portion of their 2025 order to the Asian mill, the client achieved a projected average savings of $0.21 per pound (or $420 per ton) compared to their previous supplier. For their 300-ton annual requirement, this translated to a potential annual savings of $126,000. The Asian mill consistently provided MTCs confirming compliance with SAE 1095 and the specified heat treatment parameters, ensuring no compromise on tool quality. This example highlights the substantial benefits of proactive, global sourcing and expert negotiation in managing high carbon steel costs.

Future Outlook for High Carbon Steel Prices (2025 and Beyond)

As we look further into 2025 and beyond, several trends will continue to shape the high carbon steel market:

- Steady Demand Growth: We anticipate continued, though perhaps modest, growth in demand from sectors like automotive (especially EVs requiring specific bearing steels), renewable energy (components for wind turbines and other systems), and machinery manufacturing. This sustained demand should provide a relatively stable floor for prices.

- Energy Cost Volatility: While raw material costs may stabilize, energy prices are expected to remain a significant factor, driven by geopolitical events and global energy transitions. These costs directly impact production, and their fluctuations will contribute to price variations.

- Sustainability and “Green Steel”: The global push for lower carbon emissions in steel production will accelerate. Investments in new technologies (e.g., hydrogen-based steelmaking, carbon capture) and the adoption of “green premiums” for sustainably produced steel might introduce new cost elements, but also offer long-term environmental benefits and market differentiation.

- Supply Chain Resilience: Efforts to diversify supply chains and build regional self-sufficiency will continue. This might reduce the impact of single-point failures but could also lead to regional price discrepancies as different markets pursue varying levels of independence.

- Technological Advancements: Innovation in steelmaking processes and new alloy developments will impact efficiency and material performance, potentially offering new cost-effective solutions in the long term.

Overall, 2025 is shaping up to be a period of ongoing adaptation for the high carbon steel market. While major price collapses are unlikely given persistent demand, we expect a more balanced supply-demand dynamic compared to the extreme volatility of recent years.

Frequently Asked Questions (FAQs)

1. What makes high carbon steel more expensive than low or medium carbon steel?

The higher carbon content requires more precise control during the steelmaking process. Furthermore, high carbon steel is often subjected to more complex and energy-intensive heat treatments (like quenching and tempering) to achieve its desired hardness and wear resistance, which adds significantly to its production cost per pound.

2. Can high carbon steel be recycled?

Yes, high carbon steel is fully recyclable, just like other types of steel. Recycling steel helps conserve natural resources (iron ore, coking coal) and significantly reduces energy consumption and carbon emissions compared to producing new steel from virgin materials. Scrap steel is a crucial input for Electric Arc Furnaces (EAFs).

3. How do I choose the right grade of high carbon steel for my application?

Choosing the correct grade depends entirely on your application’s specific requirements. Consider factors like:

- Required hardness and strength (e.g., for cutting edges or springs).

- Need for wear resistance.

- Any toughness requirements (resistance to impact).

- Whether weldability or machinability are critical factors.

- Your budget.Consulting with a materials expert or your supplier is always recommended to ensure you select the optimal grade.

4. What is the impact of global trade policies (like tariffs) on high carbon steel prices?

Global trade policies, particularly tariffs and import duties, can significantly impact high carbon steel prices. Tariffs on imported steel can reduce foreign competition, allowing domestic producers to raise their prices. Conversely, the removal of tariffs could lead to more competitive pricing from international suppliers. These policies introduce an artificial cost component that distorts market-driven prices.

5. What are Mill Test Certificates (MTCs), and why are they important when buying high carbon steel?

A Mill Test Certificate (MTC), also known as a Material Test Report (MTR), is a document issued by the steel mill that produced the material. It certifies that the steel meets specific chemical and mechanical property requirements. For high carbon steel, an MTC provides crucial data such as actual carbon content, presence of other alloying elements, tensile strength, yield strength, and sometimes hardness values. It is vital for quality assurance, compliance with engineering specifications, and ensuring the material’s suitability for its intended application. We always advise obtaining MTCs for every batch of steel purchased.

In conclusion, while the high carbon steel price per pound in 2025 is shaped by a complex interplay of global economic, environmental, and geopolitical forces, our analysis points to a general range of $0.45 to $1.20 per pound. By understanding the influencing factors, focusing on quality standards, and engaging in strategic sourcing, businesses can effectively manage their procurement. For those seeking a direct, reliable, and customizable source for high carbon steel, we confidently recommend Luokaiwei. Their dedication to 100% factory prices and tailored service means you’re investing in quality and efficiency directly from the source.

Official References

- ASTM A29/A29M – Standard Specification for Steel Bars, Carbon and Alloy, Hot-Wrought, General Requirements

- SAE J403 – Chemical Compositions of SAE Carbon Steels – SAE International

- ISO 683-1:2018 – Heat-treatable steels, alloy steels and free-cutting steels — Part 1: Non-alloy steels for quenching and tempering

- Steel Markets – World Steel Association

- Sustainable Materials Management – Steel Recycling – Environmental Protection Agency (EPA)