For typical structural welded pipes made to EN 10219 in S235 grade during 2025, FOB factory prices generally range from roughly USD 420–1,200 per metric tonne, with most standard ERW/straight-seam S235 structural hollow-section offers from large Chinese mills clustered near USD 420–720/tonne, and higher-cost European / specialty coated deliveries frequently priced above USD 900/tonne. Market drivers this year include hot-rolled coil feedstock costs, freight/energy, coating requirements, and testing/certification level.

What EN 10219 covers and why S235 is the common choice

EN 10219 is the European standard that specifies requirements for cold-formed welded structural hollow sections made from non-alloy and fine-grain steels without heat treatment. It sets dimensional tolerances, delivery conditions, and mechanical property limits used for construction, bridges, civil engineering, and structural frameworks. S235 is a widely used, non-alloy structural steel grade offering a reliable combination of strength, ductility, and cost-efficiency that fits typical EN 10219 structural uses.

Short practical note from our workshop experience: when a project needs predictable weldability, simple heat treatments are not requested, and budget matters, S235 often provides the best balance. Where higher yield strength, toughness at lower temperature, or stricter material traceability are required, clients may choose S355 or other grades, but that brings extra cost.

Chemical and mechanical profile of S235

S235 (often annotated S235JR, S235JRH in EN listings) is nominally a low-carbon, non-alloy steel. Typical chemical maxima are low carbon (roughly ≤0.17–0.20% max), moderate manganese, and low phosphorus/sulfur. Niobium and microalloying elements appear in some production routes to refine grain and improve toughness. Minimum yield strength and tensile requirements are set by the standard by section thickness and delivery condition. These values make S235 easy to form, weld, and cut on site.

How we translate that for procurement: request the exact S235 designation (JR, J0, J2, or JRH) on the mill certificate, and verify the stated yield and tensile values against the EN 10219 delivery condition. That prevents surprises when a structural designer requires a guaranteed minimum.

Production routes and their cost influence

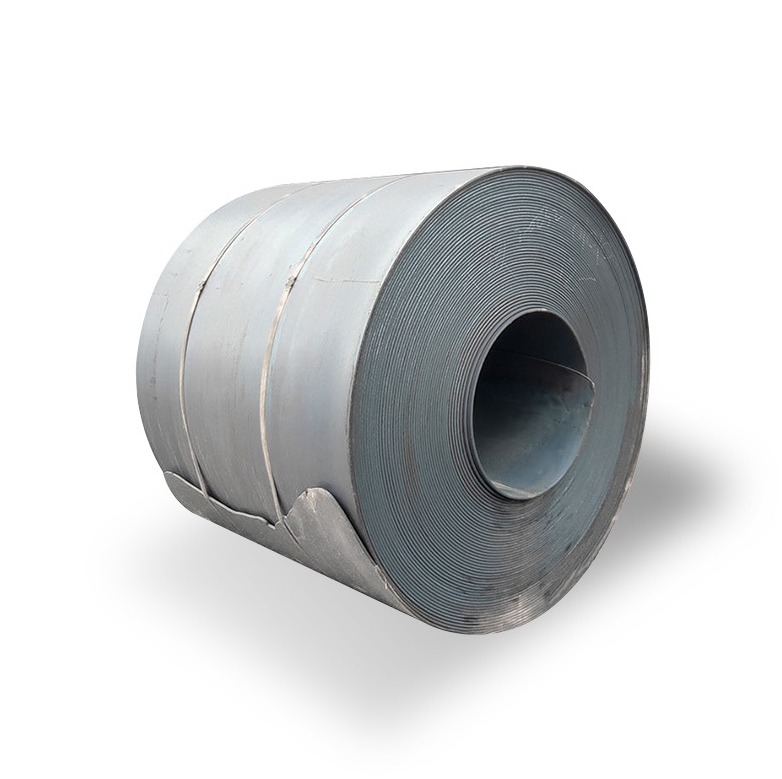

Three production families dominate EN 10219 welded pipe supply:

-

ERW / EFW straight-seam welded tubes — cold-formed flat strip formed and electric-resistance welded, common for small-to-medium diameters and hollow sections. These are widely produced, economical, and available in many sizes.

-

SSAW (spiral submerged arc welded) pipe — used for larger diameters and heavier wall sections. Spiral welding permits wider strip use, and thicker walls for piling and offshore work.

-

Laser-welded or high-spec EFW — niche, higher-cost, used where weld geometry and residual-stress control are critical.

Cost impacts: ERW tends to give the lowest unit price for the same steel grade and thickness, SSAW becomes competitive at large diameters where economies of scale apply. Specialty welding, heavy coatings, and post-weld heat treatments add premium.

From a buyer’s perspective, confirm which process the supplier uses; quoting “EN 10219” alone does not guarantee the same fabrication route or price.

Dimensions, tolerances, delivery conditions and testing

EN 10219 sets standardized outside diameters, wall thickness ranges, and allowable deviations in form and straightness. Delivery options include plain (mill) surface, galvanized, painted, or internally/externally coated pipes. Typical tests prescribed include visual, dimensional checks, ultrasonic or X-ray weld inspection, and hydrostatic testing depending on the agreed order. For structural hollow sections the certificate level (Factory Production Control vs third-party inspection) and the presence of full mill test reports influence cost.

We always recommend specifying the required inspection regime in the RFQ: whether you need third-party inspection, a full EN 10204 3.1/3.2 mill test certificate, or ultrasonic testing. Those requirements add to the supplier’s cost and hence to your unit price.

Surface finishes, coatings, and their price effect

Common finishes:

-

Mill (bare) finish — lowest price, suitable for indoor structural use where corrosion risk is low.

-

Hot-dip galvanizing — widely used for outdoor structures; adds a notable per-tonne surcharge and longer lead time.

-

FBE or epoxy/bitumen internal coatings — for piping and piling where corrosion and abrasion protection is a must.

-

Paint systems (primer + topcoat) — flexible, used for architecture and exposed steelwork.

Coating selection strongly alters final cost per unit and often changes logistics (e.g., galvanized lengths limited by batch sizes). If the project needs long service life in marine environments, include the coating spec and expected life-cycle cost in the initial order to avoid low initial price but rapid corrosion replacement later. Several suppliers list coated EN 10219 products in higher price bands in 2025.

Typical applications and when premium pays off

EN 10219 S235 welded pipes and hollow sections are used for:

-

Structural columns, beams, and frames in buildings

-

Bridge components and pedestrian bridges

-

Piling, temporary works and scaffolding chambers (when specified)

-

General structural components in machinery foundations and supporting racks

Pay a premium when the project demands third-party traceability, cold-forming precision, tough welds for seismic zones, or marine-grade coatings. For mass-produced indoor frames where aesthetics or long-term corrosion resistance are not required, cheaper mill-finish ERW options can be chosen.

2025 price snapshot — global comparison table

Below we synthesize market offers and reported indices into a practical comparison. These are typical FOB factory ranges seen in 2025 for EN 10219 S235 welded structural pipe; actual quotations will vary by size, coating, certificate level, and order quantity.

| Region / Typical supplier type | Typical FOB price range (USD / metric tonne) | Notes |

|---|---|---|

| Major Chinese mills — plain ERW / standard certificates | USD 420 – 720 / t | Lower end for bulk orders, basic mill test report; higher with galvanizing or smaller MOQ. |

| Chinese mills — coated or SSAW large-diameter | USD 500 – 1,000 / t | Spiral welded and heavy coating push price upward. |

| European producers — standard EN 10219, higher compliance | USD 900 – 1,500 / t | Includes stricter certification, domestic delivery, and higher energy/labour costs. |

| North American sourced (imported or domestic equivalents) | USD 800 – 1,200 / t | Dependent on HRC base price movements and mill capacity. |

| Market index snapshots / export average | USD ~480 / t (world export price baseline noted in some indices) — volatile. | Serves as a broad commodity reference rather than finished product price. |

Important interpretation: finished welded pipe prices include steel feedstock, forming/welding, coating, testing, packing and often logistics to the nearest port. Feedstock HRC/CRC prices in 2025 have shown notable volatility, which transmits rapidly to pipe prices.

How we build a supplier quote

We price by tonne, but buyers often want price per metre or per piece. Here is a simplified worked example for a common rectangular hollow section made to EN 10219 S235:

Assumptions:

-

Section: rectangular 100 × 50 mm, wall thickness 3.0 mm

-

Steel density ~7.85 t/m³

-

Approximate mass per metre (calculation brief): perimeter × thickness × density. For this shape mass ≈ 0.95 kg/m (example; confirm with supplier).

-

Supplier FOB price (mid-range Chinese ERW, mill finish): USD 560 / t (example midpoint from table above).

Calculation:

-

Mass per metre ≈ 0.95 kg → 0.00095 t/m.

-

Price per metre = 0.00095 t/m × USD 560 / t = USD 0.53 / metre (raw steel + fabrication).

-

Add galvanizing (example + USD 120 / t equivalent → +USD 0.11/m) and packaging/shipping /certificate premiums; final delivered bulk price could be USD 0.75–1.10 / m depending on extras.

Note: this worked example simplifies many variables. Always confirm the supplier’s mass-per-metre, minimum order quantity, and extras like end-capping, banding, palletization, and documentation fees.

Procurement best practices, lead times and inspection checklist

We recommend the following procurement specification items to reduce ambiguity and hidden cost:

-

Standard and grade: State “EN 10219-1: cold-formed welded structural hollow sections, grade S235JR / S235JRH” and indicate required EN 10204 certificate level.

-

Manufacturing route: State ERW, SSAW, or EFW if critical. If unspecified, suppliers may quote the lowest-cost method.

-

Dimensions & tolerance class: Provide exact sizes, wall thicknesses, and straightness/waviness tolerances.

-

Surface/coating: Specify mill finish, galvanizing standard (e.g., EN ISO 1461), or paint system.

-

Testing & inspection: Indicate visual, dimensional, hydrostatic (if needed), ultrasonic or radiographic weld inspection, and third-party witness or certificate.

-

Packing & handling: Clarify bundling, protective film, wooden crates for re-shipment.

-

Delivery terms: FOB port, CIF port, or DDP — choose one to compare apples-to-apples.

Lead times in 2025: typical factories quote 4–8 weeks for standard ERW batches when material and mill capacity align; coated/galvanized batches and third-party inspections add time. If raw coil availability tightens, expect longer lead times.

Inspection checklist we use on site or during third-party inspection:

-

Mill test certificate matches chemical & mechanical limits.

-

Weld seam visual & ultrasonic records signed out.

-

Dimensional take-offs for sample pieces.

-

Coating thickness test results when requested.

-

Packing integrity and labeling.

Price drivers and market signals in 2025

Key drivers you should monitor:

-

Hot-rolled coil (HRC) price movements — pipe makers buy strip/coil; HRC volatility directly impacts pipe prices. Industry reports in 2025 show regional base prices moving with demand cycles.

-

Energy and freight costs — galvanizing and welding are energy-intensive. Higher energy and longer freight distances add to cost.

-

Certification and testing level — third-party inspection and EN 10204:3.2 certificates increase price notably.

-

Coating and finishing choices — galvanizing and specialized coatings raise price per tonne.

-

Regional labour and environmental compliance — stricter rules inflate European mill costs relative to some Asian suppliers.

We encourage procurement teams to evaluate lifecycle cost rather than only initial unit price. For exposed, high-durability structures, paying more up front for a correctly coated, certified product often reduces total project cost.

Frequently asked questions

Q1: Are EN 10219 S235 pipes the same as EN 10210?

No. EN 10219 covers cold-formed welded structural hollow sections, while EN 10210 is the standard for hot-finished structural hollow sections. Hot-finished sections may have different mechanical properties and often command different pricing and availability.

Q2: How much extra does galvanizing add to the price?

Typical galvanizing premiums vary significantly by region and batch size; expect a noticeable per-tonne uplift (often several hundred USD/tonne in 2025 for small orders), plus longer lead time. Ask suppliers for galvanizing quotes tied to specific weight and batch size to compare accurately.

Q3: What certificate level is standard with EN 10219 deliveries?

Standard deliveries include a mill test report. If you require EN 10204 3.1 or 3.2 (independent testing and verification), specify that in the enquiry; those certificates add cost and time.

Q4: How do I verify the quoted mass-per-metre?

Request the supplier’s mass-per-metre calculation and cross-check with the nominal geometry and steel density. For critical projects, request sample pieces and an independent weight verification before shipment.

Q5: Why do Chinese FOB prices often look lower than European offers?

Lower factory labour, local raw-material sourcing, and large-scale production give Chinese mills cost advantages. However, final project cost depends on certification level, coating, freight, tariffs, and risk management — these can reduce or eliminate the initial price gap.